High demand for ground beef, along with low supplies of lean cuts and the ongoing decline in the national cattle numbers are all contributing factors that could enable a comeback for the lean ground beef product within the next few years. The product is simply too valuable to consumer demands to be shelved.

But for that comeback to happen, Rabobank International says the product needs to be changed and its production method transparent to the public. The media backlash that led to LFTB plants being closed must be studied closely and avoided in the future, or else consumer will not have trust in the product.

But for that comeback to happen, Rabobank International says the product needs to be changed and its production method transparent to the public. The media backlash that led to LFTB plants being closed must be studied closely and avoided in the future, or else consumer will not have trust in the product.

Titled “LFTB: Beef’s Latest Battleground for Survival,” the report says the beef product is too valuable to be ignored in today’s economy.

The report says the sequence of events that led to the demise of LFTB “presents a cautionary tale for the global animal protein industry,” especially due to how the product’s defenders were unprepared for the social backlash against it.

When media reporting hit the product hard in March 2012, after previous coverage as early as 2008, a “social media frenzy ensued that saw the product removed from a number of restaurant chain menus and retailer shelves,” the report said.

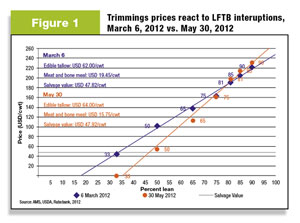

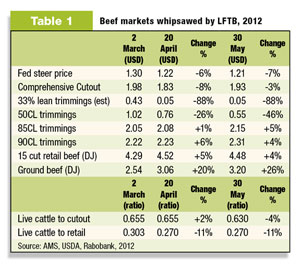

As a result of the industry’s mass exodus from LFTB uses, the report cites wholesale prices or 85 percent chemical lean and 90 percent lean beef trimmings shot upward, as demand grew for non-LFTB grinds. Prices for 50 percent beef with higher fat contents and lower trimmings “collapsed to well below salvage values” as the industry was hit with a flood of new products coming into the by-product market.

Impact on price

With those price revolts, the report says the decision to take LFTB off the markets has cut total U.S. beef supplies by an additional 2 percent, right when supplies are already low and may be reduced further due to the ongoing drought.

Other impacts:

- Retailers will pay more for beef and “lose access to what is a very safe (treated) meat product” with lower E. coli and salmonella risk.

- Lower efficiency among beef packers and processors, who have less of a product that enhances value of low revenue salvage cuts.

- Reduced demand for cattle feeders, who went from modest profits in February “before collapsing to moderate and severe losses” after the mid-March media crisis.

- Cow-calf producers also figure to be hit with higher replacement heifer prices, as reduced efficiency “will ultimately be passed o to the cow, calf and stocker operators.”

The report notes that the combined drop in value of beef trimmings amounted to a loss of $78.34 per head, or $6 per hundredweight on a 1,300-pound live weight animal. “Given that cattle prices declined $9 per cwt and $6 per cwt is directly attributable to the decline in trimmings values that leaves $3 per cwt in lost live price that is attributable to other lost value, presumably softer overall beef demand.”

Return to net imports

Return to net imports

While the U.S. successfully became a net exporter of beef in 2011, after a lengthy effort to rebuild trade destinations, that trend will probably be reversed this year – due in large part to LFTB, Rabobank said.

A decline in available lean beef will probably require more importing of beef. Over half of the beef consumed in the U.S. is in the form of ground beef. The poor economy also means more buyers turn to ground beef instead of pricier muscle cuts, which will push demand and prices up further this year as a result.

Imports of lean beef for grinds will largely come from Canada and Mexico, the report predicts, and possibly also from Australia and New Zealand. And as U.S. national herd numbers continue to decline, that means fewer cull cows that are used for lean beef.

“The combined effect of growing demand for ground products and fewer and fewer cows and bulls slaughtered annually was cause for the increased pace of imported lean beef as well as creating the need for LFTB.”

Staged for return

But even with more imported lean beef, retailers will prefer non-frozen beef for fresh retail sales. With time, the report says, the structural supply and higher prices will force retailers to reexamine LFTB as an option, “with some important modifications to both the process and the way in which it is presented at retail, including clearer labeling” along with more consumer education.

Yet the report also notes that the attention and emotion given to LFTB will mean its return is still two or three years away. Labeling the product will be one way to soften harsh criticism of the product’s use. Education efforts will be necessary to boost consumer acceptance. And a repackaging process may include renaming, improved regulatory approval, and possibly ending the use of ammonia gas on the product, may be necessary.

The report says Cargill’s use of citric acid instead of ammonia gas has effectively increased pH levels to prevent E. coli and salmonella, and a similar strategy could make LFTB’s reintroduction more palatable to the public.

Public acceptance

To bring back LFTB, the report makes it clear that the industry must change its approach on the product and others like it, so that consumers have transparency into production methods. This is especially necessary if LFTB is to be used again in USDA school lunch programs.

To win consumers’ hearts and minds, the industry should utilize social media and consumer campaigns to mobilize buyers toward the product. Beef production allies need to be more open, especially given how in some cases animal agricultural opponents have “become the trusted source of information for consumers through repeated messaging and the lack of response from industry,” the report suggested.

“The consumer and the end users will determine the fate of LFTB, not the industry,” the report summarized. “It will require a sustained effort to educate consumers and inform them of the benefits of the product, to dispel the myths and concerns that have grown through the LFTB crisis and to regain the trust of consumers, regulators and retailers that they can bring the product back into the market with confidence.” ![]()