First-quarter 2018 was characterized by lower fed steer slaughter and a higher proportion of heifers and cows slaughtered relative to the total slaughter mix of a year earlier. Heifers and cows are typically smaller and yield lower carcass weights than steers. As a result of fewer expected fed steers slaughtered and proportionally more cows and heifers slaughtered, weights and production were reduced for the first half of 2018.

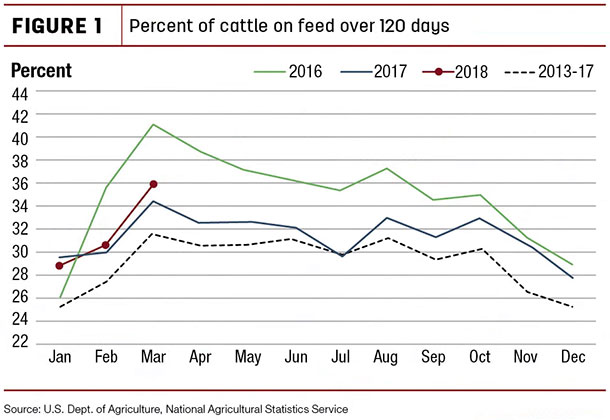

In second-half 2018, dressed weights are expected to rebound as a larger number of fed cattle marketings are expected in the third quarter. Based on the latest National Agricultural Statistics Service Cattle on Feed report, and depicted in the figure, the percent of cattle on feed over 120 days increased in March for the third consecutive month.

To the extent cattle are on feed longer, weights will likely increase and also the number of market-ready cattle. However, as the annual forecast indicates, the increase in aggregate slaughter numbers and average weights only partly offsets the lower first-half production pulling down production for the year. The expectation for increased marketings of fed cattle and increased beef supplies in the fall will likely exert downward pressure on fed cattle and beef prices.

Beef demand firm in first-quarter 2018

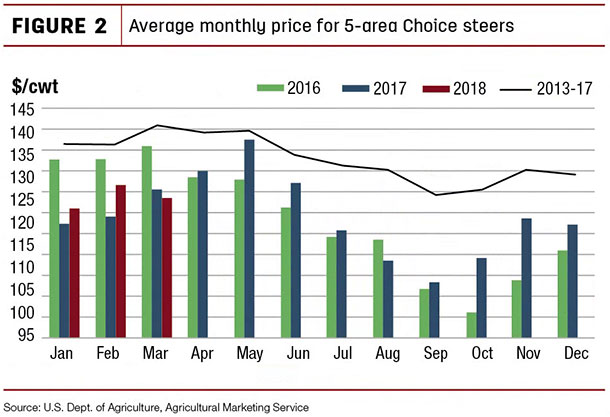

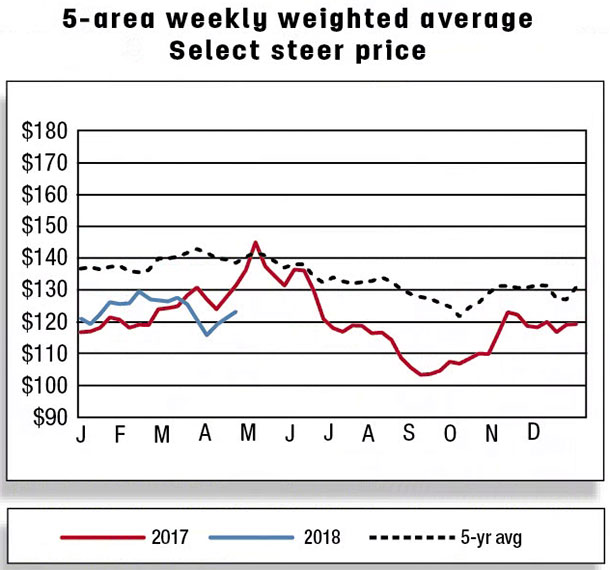

Weekly average prices for fed steers in the 5-area marketing region fell from a mid-February price of $129.93 per hundredweight (cwt) to $120.96 per cwt to close out the first quarter.

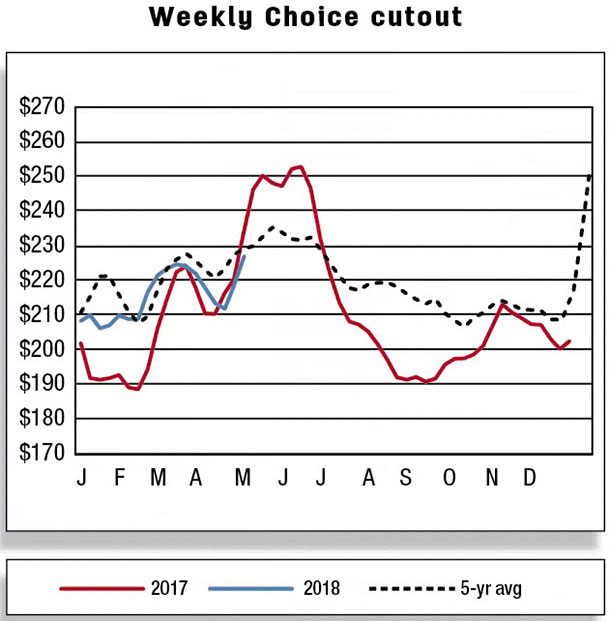

During this time, beef demand appears to have remained firm based on both higher to-date beef production and higher year-over-year wholesale prices. Strong wholesale prices and lower fed steer prices have supported packer margins at a time when they should be seasonally declining.

With the pending increase in fed cattle slaughter, steer prices are expected to trend even lower in the second quarter to $114 to $118 per cwt. The price forecast for fed steers was also lowered to $106 to $114 per cwt in the third quarter and to $108 to $118 per cwt in the fourth quarter.

Feedlot operations, on the other hand, will likely push to keep fed steer prices from dropping further, but the growing volume of cattle on feed may make it a struggle. However, feedlots will likely have to accept lower prices if they want packers to buy more cattle.

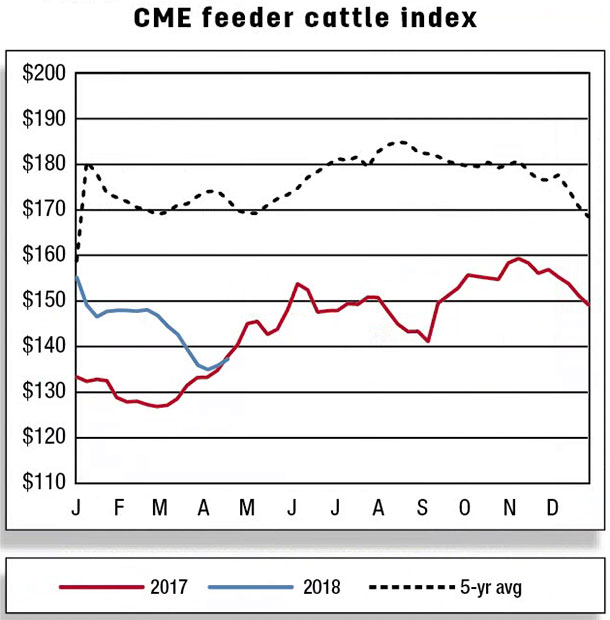

On the input side of the equation, lower fed cattle prices and higher feed prices expected for the current marketing year will likely encourage feedlots to bid lower for feeder calves. However, many calves are already on feed due to poor winter forage availability, which likely limits the availability of feeder calves to be placed on feed.

Producer decisions concerning heifer breeding in the spring will likely affect supplies. Second-quarter feeder calf prices were lowered within the range of $138 to $144 per cwt, and third-quarter prices were reduced to $133 to $143 per cwt.

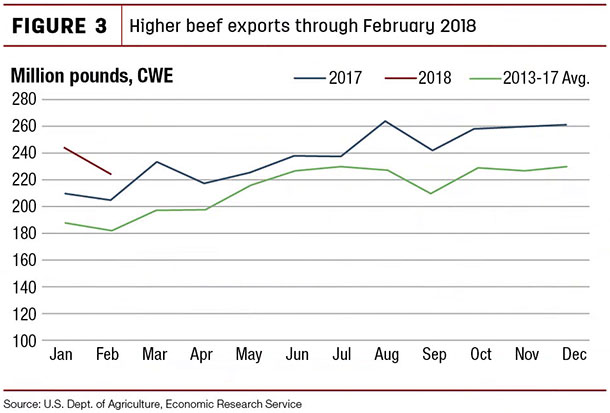

U.S. beef exports off to fast start in early 2018

In February 2018, beef exports were reported at 225.8 million pounds, up 9.9 percent from year-earlier levels. Among major destinations, increases in volume were greatest to Hong Kong (+44.5 percent), Taiwan (+36 percent), South Korea (+27.6 percent) and Mexico (+14 percent). The increased volume overshadowed declines to Japan (-12.7 percent) and Canada (-13.5 percent).

Moderate increases in Canada’s beef production and slowing demand in Japan likely contributed to the slower pace of shipments. The 2018 forecast is unchanged at 3.025 billion pounds as gains in key markets will likely be offset by softer demand in outlying quarters.

Beef imports in February 2018 were 9.7 percent higher year-over-year, to 220.01 million pounds. On volume basis, imports rose by the greatest percentage from Nicaragua (+68.9 percent), Brazil (+63.6 percent), Australia (+10.3 percent) and Canada (+9.5 percent). Steady demand for imported processing beef is expected to continue through 2018. The import forecast was left unchanged from the previous month at 3.04 billion pounds.

Despite strong February sales, cattle exports revised lower for 2018

U.S. cattle exports in February were 14,893 head, nearly 80 percent more than a year ago. Canada was the major destination for U.S. live cattle shipments, which consisted mainly of feeder cattle. Exports through February 2018 are 6.4 percent above year-earlier levels.

However, based on expected weaker cattle imports by Canada, driven in part by lower expected Alberta feeder calf prices compared to fourth-quarter 2017, the U.S. cattle export forecast was revised downward by 40,000 head to 160,000 head.

U.S. cattle imports in February fell 8.6 percent year-over-year to 153,951 head. Imports from Canada declined by 14.2 percent to 43,214 head, and imports from Mexico declined by 6.3 percent to 110,737 head. Fewer imports were likely affected by increased slaughter cattle demand in Canada and moderate drought conditions in northern Mexico that have encouraged Mexican farmers to finish cattle in feedlots. The import forecast for 2018 was left unchanged from the previous month at 1.905 million head. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.