The investigation, sparked by the tumult stemming from the August 2019 Tyson plant fire, is exploring reasons behind the rapidly rising price spread – or difference between boxed beef cutout values and dressed fed cattle prices – that occurred after the fire. The investigation was recently broadened to include the impact of the COVID-19 pandemic on cattle markets.

This report, prepared by the Agricultural Marketing Service (AMS) in coordination with USDA’s Office of the Chief Economist, summarizes market conditions, fed cattle prices, boxed beef values, and the spread before and after the fire and plant closure at the Tyson Holcomb plant. The report then summarizes market conditions, fed cattle prices, boxed beef values and the spread before and during the COVID-19 pandemic.

The report does not examine potential violations of the Packers and Stockyards Act, since the investigation into potential violations is ongoing. Therefore, AMS has limited ability to publicly report the full scope and status of the investigation.

“The closure of the Tyson beef packing plant in Holcomb, Kansas, after a fire at the facility and the COVID-19 pandemic clearly disrupted the markets and processing systems responsible for the production and sale of U.S. beef,” said U.S. Secretary of Agriculture Sonny Perdue. “The report examines these economic disruptions and the significant increase in the spread between boxed beef and fed cattle prices that resulted from them. While we’re pleased to provide this update, we assure producers that our work continues in order to determine if there are any violations of the Packers and Stockyards Act. If any unfair practices are detected, we will take quick enforcement action.”

Impact of Tyson fire

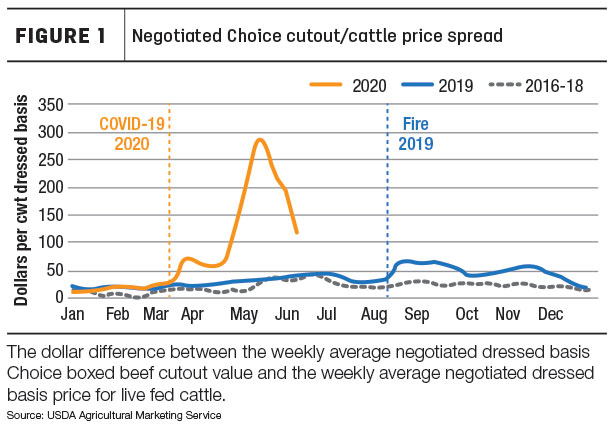

The closure of the Tyson beef packing plant in Holcomb, Kansas, following the Aug. 9, 2019, fire at the facility caused widespread disruption in the markets and processing systems responsible for the production and sale of U.S. beef. The plant accounted for approximately 5%-6% of the nation’s beef processing capacity. The spread between the dressed fed cattle price and the Choice boxed beef cutout value peaked at a then-record high of $67.17 per hundredweight (cwt) the week ending Aug. 24, while the same week in 2016-18 averaged a spread of $27.66 per cwt, leaving a difference of $39.51 per cwt, or 143%. That record was later exceeded following the COVID-19 pandemic (Figure 1).

Impact of COVID-19

By the last week of April, disruptions in beef production peaked when nearly 40% of the nation’s beef processing capacity was idled due to COVID-19 illnesses among packing plant employees. The market reactions to the pandemic during the month of March were characterized by sudden changes in beef demand. Consumers increased purchases of fresh beef at grocery stores, and food service demand declined as restaurants ceased on-site dining.

An additional surge in consumer retail demand occurred in April when consumers appeared to react to the possibility of beef shortages in grocery stores. The supply disruptions and additional surge in demand may have contributed to a sharp increase in beef values. At the same time, packers purchased fewer cattle as plant closures and slowdowns increased. From early April until the second week of May, the spread grew from $66 per cwt to over $279 per cwt, a 323% increase.

In May, as restaurants and other sectors of the economy opened, beef demand started moving back to a more normal balance between retail grocery and food service. Processing plant closures and shutdowns also eased, and production began climbing back to normal levels. Boxed beef cutout values peaked in the second week of May at $459 per cwt but declined to $298 per cwt by the first week of June. Fed cattle prices rose from a 2020 low of $154 per cwt in late April to $179 per cwt during the first week of June. The spread narrowed from $279 per cwt in the middle of May to $119 per cwt by the beginning of June. It is too early to determine if spread will continue to narrow.

Continued vigilance

Findings thus far do not preclude the possibility that individual entities or groups of entities violated the Packers and Stockyards Act during the aftermath of the Tyson Holcomb fire and the COVID-19 pandemic. The investigation into potential violations under the Packers and Stockyards Act is continuing. The USDA does not solely own investigatory authority over anti-competitive practices in the meat packing industry and has been engaged in discussions with the Department of Justice (DOJ) regarding allegations of anti-competitive practices in the meat packing industry. Should the USDA find a violation of the Packers and Stockyards Act, it is authorized to report the violation to DOJ for prosecution. ![]()

-

Carrie Veselka

- Editor

- Progressive Cattle

- Email Carrie Veselka