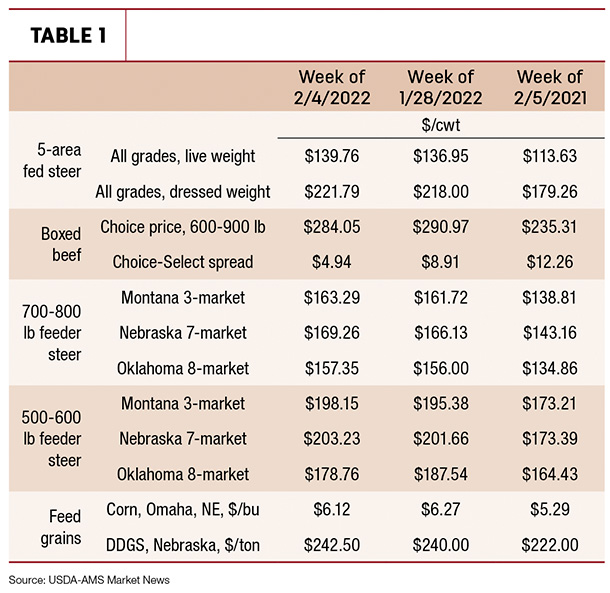

The USDA does not report feeder cattle supplies directly, but it is easy to calculate using other categories in the report. The last row in Table 1 estimates feeder cattle supplies outside feedlots for U.S., Arkansas, Mississippi and Kentucky, respectively.

Using data from the table, adding other heifers, steers 500 pounds and over, and calves under 500 pounds (steers, heifers and bulls) gives the total feeder cattle supply. Subtracting cattle on feed gives feeder cattle supplies outside feedlots. As of Jan. 1, 2022, there were 25.5 million head of feeder cattle outside feedlots, a 2.6% decline from last year. Arkansas had a significant decrease in feeder cattle supplies, down 9% year over year. In Mississippi, feeder cattle supplies were about even with the year prior, while Kentucky had a 5% decline.

Why did feeder cattle supplies decline so dramatically? Strong fourth-quarter prices, coupled with drought, likely resulted in producers selling cattle that they would have otherwise kept through the winter.

For example, Arkansas prices for 500- to 600-pound steers averaged $163 per hundredweight (cwt) for November-December 2021, or 13% higher year over year. These high prices provided adequate incentives for producers to sell some cattle earlier. Cattle on feed data showed that cumulative November-December feedlot placements were 5% higher than 2020 placements for the same months.

January cattle on feed inventories are close to even with last year. It will take time for feedlots to work through these inventories. In the next couple of months, we should start to see tighter feeder cattle supplies show up in the placement data. Tighter feeder cattle supplies will translate to higher prices. ![]()

James L. Mitchell is an assistant professor and extension economist in the department of agricultural economics and agribusiness at the University of Arkansas.