But pushing that buying power forward will include more inflationary pressure on those goods, and it may not be a temporary thing. “Some would think of inflation and think back to the 1970s, and today may not need seem bad,” Murphy said. “But, looking over the past 10 years, we have a really strong inflation in front of us today. And, when we look at the inflationary price pressure we see at the retail price level, it’s looking like it’s here to stay. We’re starting to see it already.”

Murphy pointed to two key factors that have built inflationary price pressure as the U.S. economy has climbed out of the pandemic slowdown. One is unemployment and its push to higher wages. Murphy mentioned reports from Goldman Sachs saying today’s 5.4% unemployment rate could dip to 3.5% in 2022, setting a 50-year low. “That is good news for those who are seeking employment or better work. That is awesome, because those are the people that are going to be our consumers for our product in the beef industry.”

Average annual wage increases were 2.7% from 2009 to 2019, and it’s getting stronger in 2021. “That’s more dollars the consumer can spend back on certain items. We can expect this kind of growth to continue as we go to 2022.”

The other factor was government payments, something usually categorized as Social Security payments. But, from 2020-21 that largely meant government stimulus, child tax credits or unemployment benefits from federal or state programs.

“Some of those subsidies to the consumer had a huge impact as far as stabilizing the economy,” Murphy said. “There might certainly be an argument to be made [that] the government went overboard with this kind of payment structure. But, that liquidity that was injected directly to the consumer has certainly created a lot of this inflation that we have today.”

“We all have already incurred higher costs, and we’re already experiencing that in fertilizer and freight rates, whether it be trucking, ocean or rail freight.”

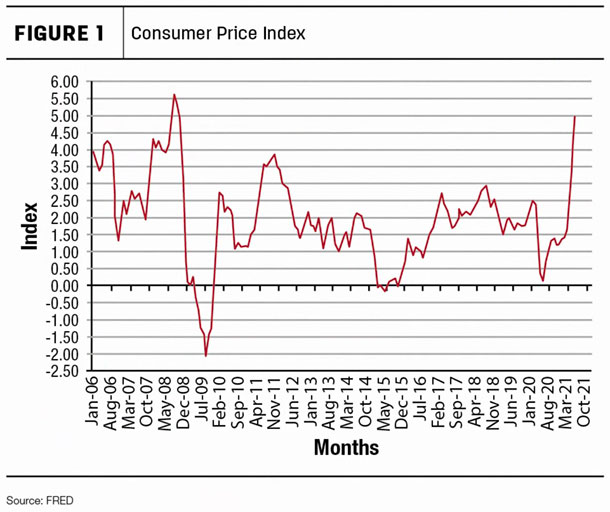

Outlining charts on the Consumer Price Index (see Figure 1), Murphy said that when the bottom fell out at the outset of COVID-19, once government checks came to Americans, inflation started to show strength. And, the most intense spike has occurred in the past seven months.

Fuel cost inflation

No commodity registers pain during inflation quite like gasoline, and Murphy charted how consumption and production were tightly connected during pandemic months. “Go back to spring 2020: We got into this situation with total consumption of world fuel production, and we can see that fell off. Most of us in this crowd were probably not as influenced as those in cities. But, once things started to recover and began to open up, we wanted to get outside the home, and consumption started to come back quickly.”

But, productivity did not keep up in the pandemic, as markets slowed down to match lower demand. “Production was a little slow to come back. So, we started to draw down on the stocks. Consumption was starting to outpace production. And, when you start to look at forecast[s] until the end of this year, we’re going to continue in a marketing hold standpoint, to where we see production start to match consumption.”

The pinch is also being felt with tight oil supply as international buyers are demanding U.S. oil exports. “We continue to see growth in the global market for our products. We expect to see that where a higher percentage of our product will be going for global consumption.”

Corn production

At the start of the pandemic, the projected stocks-to-use (SU) for corn had a range of 22% for May 2020. But, as demand went down for ethanol – and plantings and crop estimate results were drastically overstated, leading to a shortfall – the picture began to change for fall and early 2021. Prices for corn began to soar from $4.50 a bushel up to $7 during the 2021 season.

Foreign demand also played a role in that demand picture. The Phase One trade agreement signed between the Trump administration and China caused exports to pick up. “Phase One has had such a positive impact on our ability to trade corn to China,” Murphy said. “We drew down those stocks to use significantly.” Today, the U.S. has its smallest SU estimate in years, with a 10% estimate for May of 2021. That will create a realistic floor for average corn prices staying between $4.25 and $6.50 per bushel in 2021. ![]()

PHOTO: CattleFax Analyst Mike Murphy in his presentation at the NCBA's outlook seminar. Photo by Carrie Veselka.

-

David Cooper

- Managing Editor

- Progressive Cattle

- Email David Cooper