Items in this column are compiled from Progressive Dairy staff news sources. Send news items to Dave Natzke.

PRICE RELATIONSHIPS AND THE CLASS I FORMULA

What happened?

In recent months, Class III-IV milk prices moved closer together, and the narrow gap between the FMMO Class III-IV skim milk price factor used to calculate Federal Milk Marketing Order (FMMO) Class I prices meant producers saw net benefits from using the new “average of plus 74 cents” Class I mover pricing formula compared to the old “higher of” formula. That’s just part of dairy’s changing paradigm.

What’s next?

When November milk prices are determined, the Class IV price will likely be higher than the Class III price. Markets change, and the direction remains to be seen. Longer-term, I’m hearing a lot more about investment in cheese production capacity in the next three to four years. Without an equal investment in marketing, will cheese inventories grow and apply downward pressure on Class III prices? Will the current demand for butter (domestically) or milk powders (exports) continue to boost Class IV prices and reduce Class III skim values through the butterfat factor? And while we aren’t at a point where the old Class I formula theoretically returns a stronger net benefit to dairy farmers, it makes for some interesting discussion for anyone who wants to delve into FMMOs and potential policy reforms.

Bottom line

Class III-Class IV futures prices aren’t exact predictors of the Class III-IV skim milk price factors used to calculate FMMO Class I prices. The Class III advanced skim milk price is calculated using prices for protein, other solids derived from cheese and a butterfat factor. The Class IV advanced skim milk price incorporates prices for nonfat dry milk. You need an Excel spreadsheet to figure it out.

Class III-Class IV prices do provide an indicator of values used to drive Class I price calculations. Since they both use the same butterfat value, differences between them are due solely to the differences in their skim values. After a monthly spread of $2 to $3 per hundredweight through the first five months of 2021, more “normal” FMMO marketing returned, and the Class III-Class IV price spread averaged just 23 cents in the third quarter of 2021.

Based on quarterly average prices (using actual and futures prices as of the close of trading on Nov. 3), the Class III-Class IV spread hit 79 cents in October and will expand to $1.16 per hundredweight (cwt) in December 2021. How those spreads are created is noteworthy.

In October, the announced Class III price is $17.83 per cwt, 79 cents higher than the Class IV price of $17.04 per cwt. In a role reversal, the December 2021 Class IV futures price (on Nov. 3) was $19.13 per cwt, $1.16 more than the Class III futures price for the same month.

Longer-term, CME futures prices show the spread in Class III-Class IV futures prices remains between 27 and 91 cents through all of 2022. Unlike recent history, however, Class IV prices could be higher than Class III prices all year.

Recent USDA Cold Storage and Dairy Product reports show a slowdown in butter production and a draw on inventories. Adding to tighter butter supplies, an October fire caused major damage to a Darigold processing plant in Caldwell, Idaho. All those conditions pushed 2022 monthly Class IV milk futures prices up as much as 90 cents within a three-week period. That bucks recent historical trends: Class IV milk prices were higher than Class III prices in just two months each in 2016, 2017 and 2018, and five months in 2019.

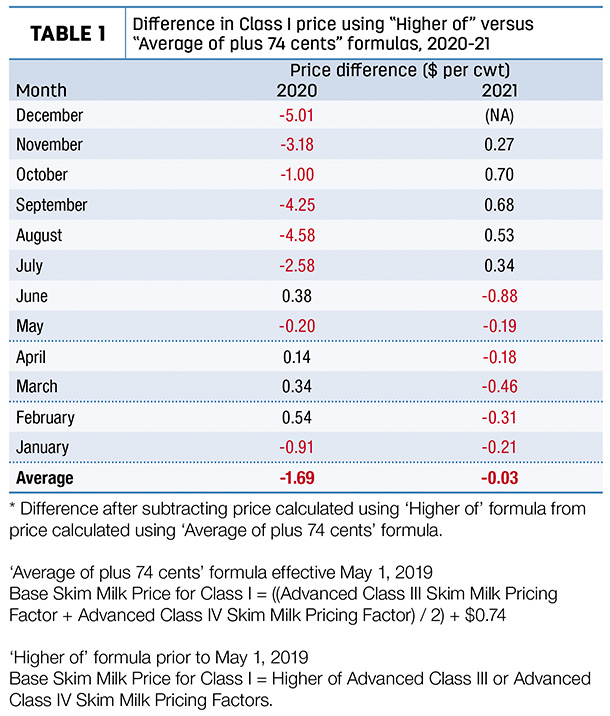

Back to the Class I mover. The new formula, created under the 2018 Farm Bill and implemented in May 2019, has been controversial ever since. Initially, the newer “average of plus 74 cents” formula provided a small net benefit during May-October 2019 and again in February-April and June 2020. Then, however, pandemic-related impacts hit milk markets in full force. Comparing the two formulas, the negative impact of the “average of” formula ranged from -$1 in October to -$4 to -$5 in August, September and December 2020, averaging about -$1.69 per cwt for the year (Table 1).

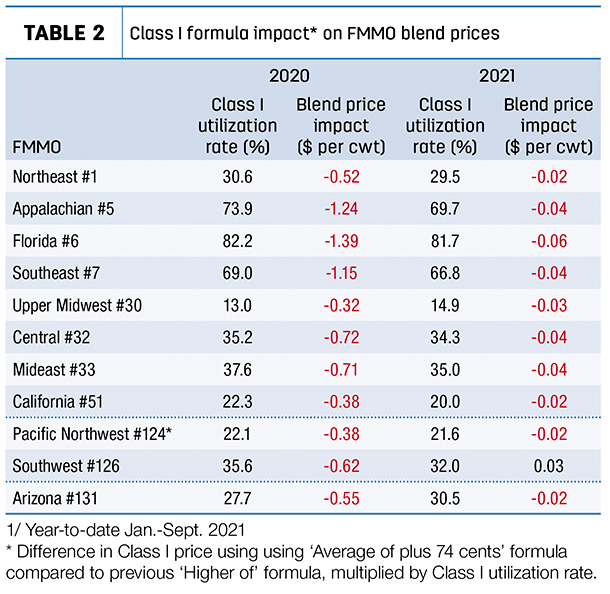

The impact on FMMO blend prices varied by Class I utilization in each FMMO (Table 2).

Based on Progressive Dairy calculations, 2020 blend or uniform prices in Appalachian, Florida and Southeast FMMOs averaged -$1.24, -$1.39 and -$1.15 per cwt under the “average of” formula, respectively. In FMMOs with lowest Class I utilization rates (Upper Midwest, California and Pacific Northwest), the impact ranged from -32 cents to -38 cents per cwt.

That eventually led to the creation of the Pandemic Market Volatility Assistance Program (PMVAP), an effort to reimburse dairy producers for losses during July-December 2020.

Moving into 2021, the “average of” formula continued to yield negative returns compared to the “higher of” formula through June (Table 1). However, the “average of” formula has now provided net benefits since July. Balancing “losses” in the first half of the year with expected “gains” in the second half of the year, it looks like the “higher of” and the “average of” formulas will be within pennies of each other when final 2021 numbers are in. As a result, the overall impact on individual FMMO blend prices will also be very small, if at all.

Looking further ahead, based on Class III-Class IV milk futures prices in early November, estimates by Erick Metzger, general manager of National All-Jersey Inc., show the “average of” formula should yield positive net benefits compared to the “higher of” formula through 2022.

As noted previously, although the Class III-Class IV milk price spread is widening from the third quarter 2021 average, we likely aren’t to a point where the “higher of” formula would return a net benefit to dairy producers over the “average of” formula. Arithmetically, the trigger point is a $1.48-per-cwt (2 x 74 cents) difference in advanced Class III-IV skim prices, regardless of which is higher. In addition, the Class III-Class IV price spread isn’t likely to cause FMMO marketing disruptions to the extent we saw during the COVID-19 pandemic, even though Class IV handlers can “depool” like their Class III handler counterparts did.

It certainly is a new paradigm. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke