In the weeks following Russia’s invasion of Ukraine on Feb. 24, the prices of everything from food and gasoline to wheat, corn and other feedstuffs have reacted with extreme volatility.

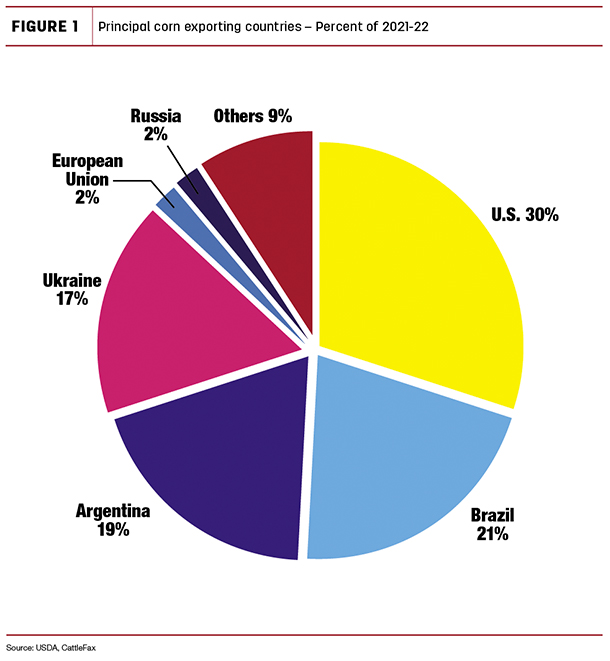

Ukraine, as the fourth-largest corn exporter in the world, is a major player in agriculture exports. The invasion prompted the halt of all shipping from its ports along the Black Sea. Ukraine’s abrupt absence on the market has caused some countries dependent on their corn supplies to scramble to find other resources.

Concerns abound that global grain supplies will be thrown out of balance with the sudden increase in demand for exported grain, leading to more worries that the U.S. domestic feed corn stocks will be depleted due to increased price competition with exported corn. “Here in the U.S., corn stocks-to-use are estimated to be 10.4 percent for the 2021-22 market year. On the tighter side, but still relatively comfortable,” Troy Bockelmann wrote in a CattleFax report. “China is the largest corn partner for Ukraine. With ports closed, it is probable that China will look for a new or expanded partner. Increased U.S. exports this year would not only tighten this year’s balance sheet but lower carryover as well.”

The report stated that the USDA Ag Outlook forum’s trendline yield for corn was estimated to be 181 bushels per acre, 4 bushels above last year’s record. “The markets are looking for certainty. With stocks-to-use on the tighter side, the market will remain well supported, not only with the U.S. crop potential but also with the current situation in Ukraine.”

With Ukraine out of the export picture for the moment, all eyes turn to the other top exporters of corn (Figure 1), primarily Brazil, Argentina and the U.S.

Potential impact on feed supplies

Dan O’Brien, agricultural economist at Kansas State University, says the biggest concern is the potential of what could happen, rather than what is happening in the current moment. According to the USDA Foreign Ag Service, export numbers did show an uptick in U.S. corn exports over the weekend of Feb. 24, up to a little over 61 million bushels. “If there’s an anticipated stress that could be coming, it’s that that export number would continue to grow and compete even more with other major domestic uses – feed use, ethanol, wet corn milling,” he says. “There’s the possibility of higher corn exports than the USDA initially projected, a tightening of ending stocks, and then we just have to see where we go in terms of the rest of the supply-demand balance sheet and the tightness of projected stocks.”

Texas A&M agricultural economist David Anderson says the effects on the cattle and other livestock markets will be indirect but unavoidable. “Russia is not a major trading partner for meat with the U.S. The impacts are going to be on grain prices – wheat and feed grains. Those feed grain prices will hit our production costs. Grain prices are already shooting higher due to expectations of near-term supplies and ability to ship to world markets and expectations for the next growing season’s crops.

2022 corn production is critical

“Higher prices should get U.S. farmers and others around the world to plant more acres,” says Anderson. “The market, in the form of high prices, is working to get more supplies produced. It will be hard to fill that gap, so higher prices will remain.”

O’Brien says all eyes will be on planting this year, since having a solid corn crop this year will be critical to maintaining the U.S. supply. “There’ll be a greater sensitivity this spring to the process of planting this crop, to looking at emergence, looking at developing crop prospects and adequacy of moisture, and there will be a lot more sensitivity to any threat to the crop this year than in the past, just because there’s so much at stake with regard to having adequate U.S. domestic supplies, much less supplies to export.”

High fertilizer prices will also have an impact on how well the harvest does this year. With fertilizer prices through the roof and outlay costs in corn planting already so high, especially with increased fuel costs, it’s highly likely that growers may run light on the fertilizer due to cost restraints, or that some producers may not be able to get a hold of anything, so the crop may well be weaker than usual.

Long-term effects

In a bigger “market basket” point of view, O’Brien says inflation is going to be a big influencer going forward. Generalized inflation in fuel costs due to the Russia-Ukraine conflict will affect the general level of inflation. “Since a lot of industries are dependent on the U.S. consumer being able to keep driving, keep buying food, buying a bunch of things, beef demand – and meat demand in general – will certainly affected by that,” he says. “The general impact on the world economy of this Russia-Ukraine conflict has been one of raising the rates and cost of energy, probably raising the cost of living for people and raising the risk of economic downturns, to the degree that consumers are affected by this in a broader sense, and to where their spending habits would be affected. There are a lot of things in the ag industry which are dealing with food and energy production, that could be affected negatively.”

“I think it’s worth mentioning some other potential impacts on Ukraine,” Anderson says. “This disaster for their country could lead to a huge humanitarian crisis. Stalin, back in the 1930s, caused a famine in Ukraine, resulting in the deaths of upwards of an estimated 3 million people who died of starvation. They feed their people through their agricultural productivity and have an excess to see on the world market. The result for them may not be just high prices.”