In cow-calf operations, reproductive rate is the foundational productive function of the enterprise. Obviously, if cows do not become pregnant, then no calves are produced for revenue generation the following year. Revenue from culled cows is not a result of production; it is the liquidation of an asset that must be replaced (usually at a higher price), if production is to continue. Pregnant cows must successfully produce a live calf, and live calves must be weaned and sold before production revenue is generated. It is intuitive that improvements in reproductive success, or the prevention of reproductive failure, drive cow-calf enterprise productivity.

Profitability, however, is not solely driven by gross revenue or productivity. The incremental costs of increasing production must be considered if managers are to successfully allocate resources to increase profitability. In other words, improving reproductive rate at all costs is not likely to be a solution. The optimum level of additional investment to support improved reproductive rate (or mitigate loss) depends on many factors, and the relationship of expenditure to improved production may be complex. However, identifying the potential value of improved reproductive success is an important benchmark by which management decisions can be evaluated for feasibility. In this article, we describe one method of evaluating the value of reproduction to facilitate decision-making.

Change in expected revenue

A straightforward way to estimate the value of increasing the pregnancy rate is to project the value of additional calves produced. Increasing pregnancy rate by one unit doesn’t result in one more calf weaned and sold, due to expected losses between pregnancy determination and weaning. Average values of gestational loss and pre-weaning losses are 3% to 4% each, although these will vary considerably among operations. So for every cow pregnant, we may expect to wean 0.93 calves. A 1% change in pregnancy rate (one more cow bred out of 100) therefore results in a 0.93% increase in the number of calves weaned. If each calf weaned has an average value of $700, then increasing pregnancy rate 1% results in a $6.51-per-cow-exposed increase in expected production revenue ($700 per calf times 0.93 calves weaned per 100 cows).

Applying the value

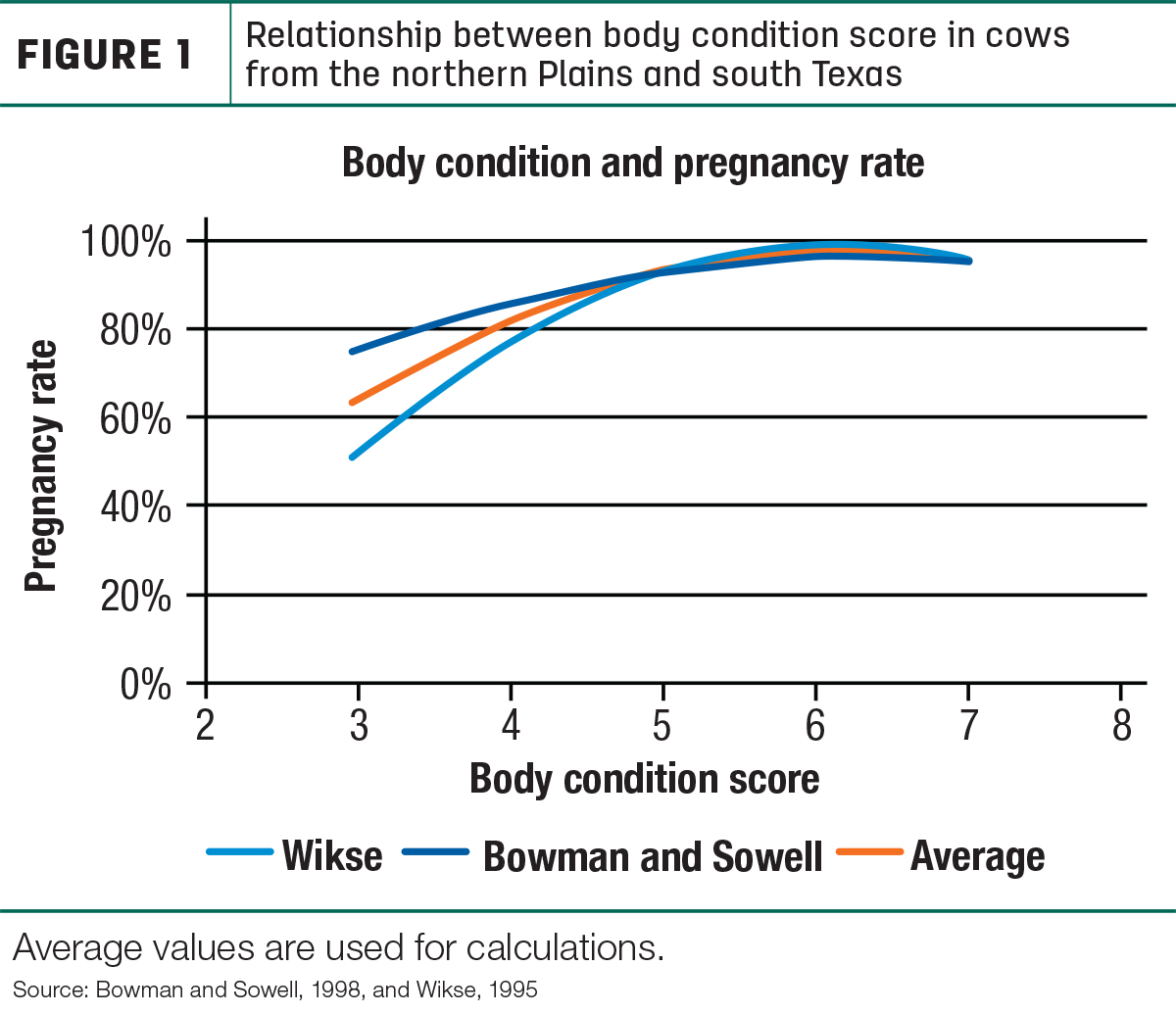

When considering strategies to increase pregnancy rate (or prevent losses), managers make projections about the effect of the strategy on pregnancy rate (the production function) and its cost. For example, a nutritional strategy to increase the body condition score (BCS) of cows might be applied to improve pregnancy rate. Using data from Figure 1, increasing BCS from 3 to 4 results in a 17.5% increase in pregnancy, increasing from 4 to 5 results in a 12% improvement and from 5 to 6 only a 5% improvement.

Based on the estimate before, each 1% unit change is worth $6.51; therefore, the value of changing body condition score from 3 to 4 is $6.51 times 17.5, or $114 per cow. Increasing from 4 to 5 is worth $78 per cow, but from 5 to 6 is only worth $32 per cow. If a strategic feeding program is available to achieve these changes in cow condition at a cost per cow lower than the expected value, it is likely to be a profitable decision.

Preventing loss of body condition prior to or during the breeding season can be valued similarly. A strategy to prevent cows that are marginal from losing body condition has the same value as improving condition in thin cows, assuming the same effects on pregnancy rate.

Another example is the prevention of pregnancy losses – what is it worth to prevent a loss in pregnancy rate, perhaps due to a disease outbreak? In this case, managers should consider the magnitude of impact of the disease on pregnancy rates, coupled with the risk of such an outbreak occurring. Let’s suppose pregnancy rates might be reduced by 40% due to a reproductive disease. However, based on local or historical occurrence rates, this might only happen once every 40 years. This suggests a risk of 2.5%: The impact (-40% pregnancy) is only 2.5% likely. The combined rate is -1%. Using the value of reproduction derived before, this is an expected annual loss of $6.51 per cow. Preventive measures such as vaccines that cost less than this amount are considered a good investment.

Other considerations

The expected revenue model provides a reasonable frame for decision-making and is relatively easy to estimate. Other factors should be considered when holding these projections up to actual accounting data. First, as pregnancy rate decreases, current year cash flow from cull cows increases while cash flow from calves is not affected but may be affected the following year. If all open females are culled and subsequently replaced, calf revenue the following year may not be decreased, although expenditure for replacements will be increased.

While the method of revenue estimation is a reasonable approach, it may not match directly with cash flows. Additionally, due to the often negative swap on cull cows (book value higher than market value), using cash accounting only does not fully reflect the true impact of lowered production rates. A full managerial accounting analysis can be conducted to derive the true total cost/benefit of changing reproduction rate, but it relies on accurate managerial accounting frameworks. The estimated revenue method can be used in the absence of this information.

Summary

Managers are often motivated (rightly so) to cut cash expense, but due to lags in cash flows, they may not realize the potential benefits of investing in inputs that improve pregnancy rate. Reproduction is the primary driver of productivity, and a method to estimate its value to the business can enhance decision-making and improve the bottom line.