Investment in equipment is expensive, and knowing how that will impact your annual costs is a big factor in that decision. There is a lot to consider when deciding on the best option for accessing equipment from purchasing, leasing, renting or custom hiring, but costs are at the forefront with increasing equipment and machinery operating prices.

A good place to start is looking at what it would cost to purchase the equipment. Working out expected costs for new equipment can be a challenge since you don’t have costs from your own records to draw from. Machinery costs can be separated into two main categories: operating (fuel, repairs and labour) and ownership (depreciation, interest, insurance and housing).

Working through the operating and ownership costs, here are some guidelines on estimating costs.

Fuel

Average diesel consumption (litres per hour) = 0.244 x maximum PTO hp per hour. For example, a 300-hp diesel tractor will consume approximately 73 litres per hour (0.244 x 300 hp). Diesel units will use less fuel than gasoline units. Multiply the diesel fuel consumption rate by 1.37 to estimate gasoline fuel consumption. Average gasoline fuel consumption (litres per hour) = (0.244 x 1.37) x maximum PTO hp per hour or = (0.334) x maximum PTO hp.

Repairs

Repair costs are relatively low early in the life of a machine, but repair costs rise quickly as a machine’s hours of use increase. Averaging these repair costs over the machine’s life can provide a reasonable estimate of annual repair costs. Repair rates will vary by equipment and by your maintenance schedule, typically ranging from 1.5% to 4.5% of the purchase price.

Labour

This will be an estimate of the work rate of hours per acre or acres per hour based on the size of the machine and traveling speed. Several provinces and U.S. extension services have publications and calculators to estimate work rates.

Depreciation

Depreciation is a non-cash cost but recognizes that the machinery loses value over time and you need to plan for its replacement. Annual depreciation rates will vary based on the equipment and the annual usage; with typical annual hour usage, the rates range between 3% and 8% of the purchase price.

Interest

If the machinery is partially financed by a lender and partially your own capital, use the weighted average of the two rates. The owned capital investment interest rate used should reflect conservative rates of return for money that could be obtained in the current market, e.g., T-Bill rate, GIC rate. For example, your manure spreader is 80% financed at 6%, and 20% is your own equity through either a down payment or trade-in. The interest rate is (80% x 6%) + [20% x 3.5% (GIC rate)] = 5.5% weighted average interest rate. Annual interest cost is the average value of the machine over its life multiplied by the interest rate.

Insurance and housing

Insurance and housing make up a small part of the ownership costs of a machine. Talk to your insurance company to get an estimate of the insurance rate, and current building storage rates can estimate housing. One percent of the purchase price is also commonly used to estimate annual insurance and housing costs.

Ownership costs per unit of work done drop as the hours or acres of use per year increase. One of the fundamental rules of machinery ownership is to "use it." This approach for budgeting machinery costs is available in more detail in the OMAFRA factsheet Budgeting Farm Machinery Costs.

With your total estimated cost of purchasing the machinery in hand, you can compare it to other alternatives.

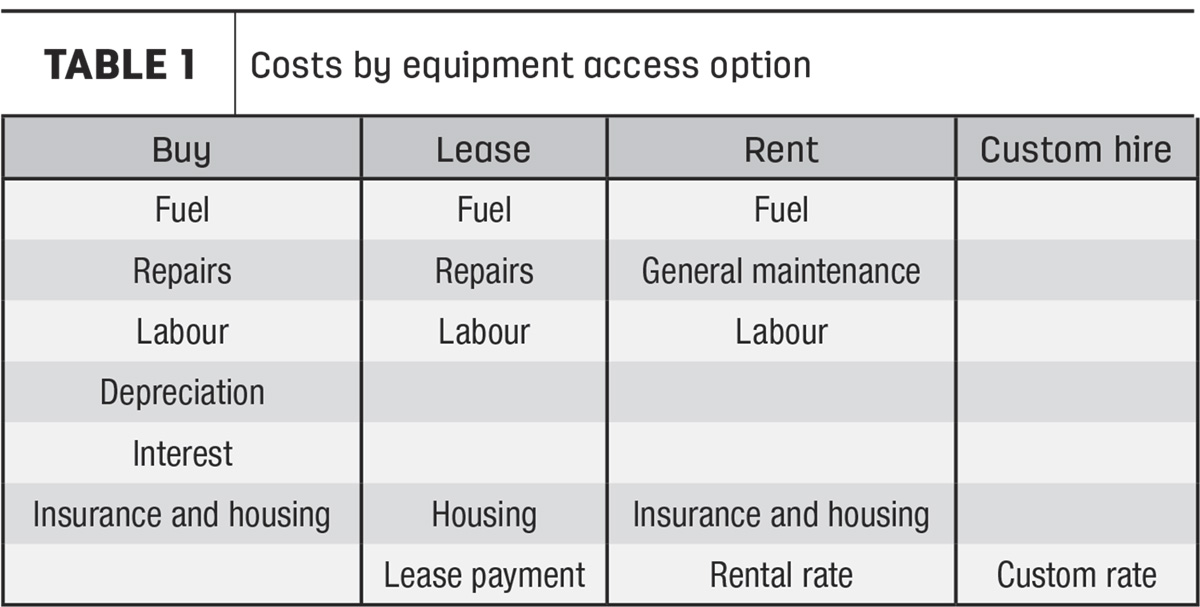

Table 1 looks at the common ways to access equipment and the costs involved. To compare the costs and make decisions, you need to consider all the costs and where they are included. Ultimately, it will be you, as the machinery user, covering the costs. Knowing what is included in the rental rate or lease payment, for example, and what you will be covering is important in making an "apples to apples" comparison to the other options. A lease payment may or may not have insurance included, so be sure to ask. A custom rate will include all machinery costs in one cost line. General maintenance over the rental period is the responsibility of the renter, but major repairs would be factored into the rental rate.

If you look at manure application as an example, the challenge is getting a "clean" comparison across the options. It is not just one piece of equipment involved in the operation. Loaders, spreaders, tractors, transfer trucks, pit agitators and pumps can all be part of the operation. Renting is likely a mix of owned and rented equipment. The custom rate for manure spreading can include loading, trucking and spreading operations.

Being aware of all the costs and isolating the equipment you are considering is important to make the best option choice.

Custom hire rates can be quoted in dollar per hour and rental rates on a per eight-hour day or 40-hour week basis. Looking solely on a per-hour basis may be misleading if the time it takes you to complete an operation like spreading manure is much different than the hours it would take a custom operator. If the custom operator comes in with a team and can complete in 12 hours what takes you 36 hours, the total cost to custom hire may be less, even if their per-hour rates are higher than your ownership estimates. Knowing the per-hour rate is helpful in planning, but total cost of the job is also important.

Costs are not the only consideration in machinery equipment decisions, but no machinery decision should be made without them. It will take some effort, but with machinery prices on the rise, it will be time well spent.