When someone hears “estate plan” they generally think “will.” In many cases, a will gets the job done.

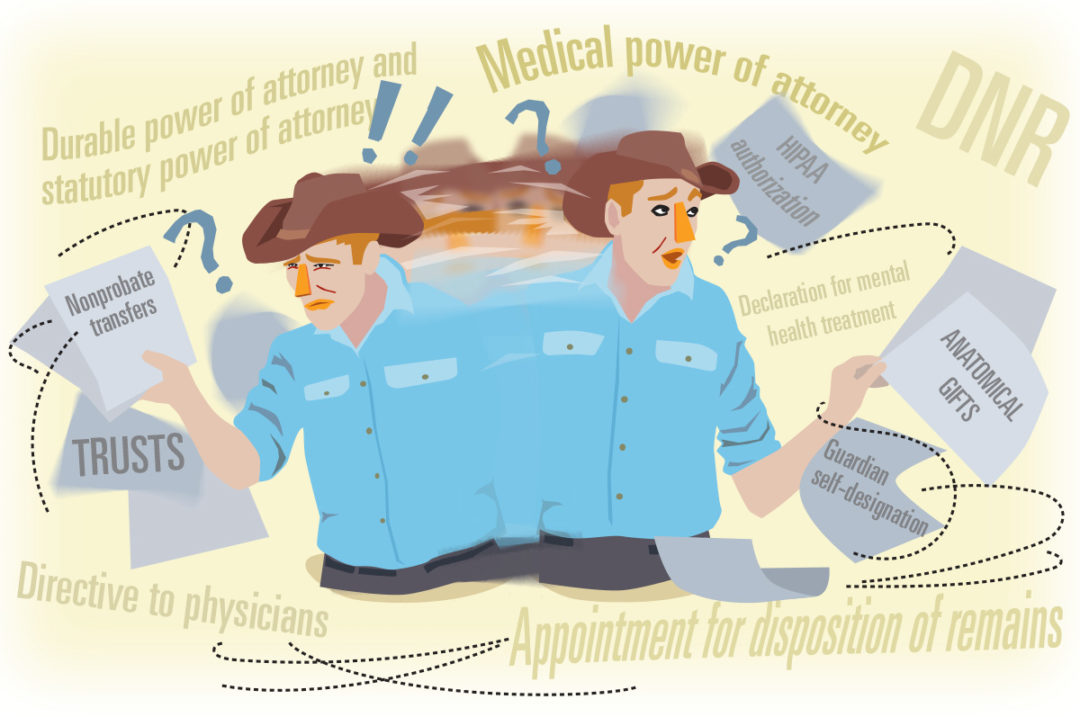

However, for today, I want to focus on the other estate documents beyond a will – there are many! A comprehensive estate plan considers not only your assets after your passing but also your health, living, business and financial circumstances for the remainder of your lifetime. To keep things brief, I have provided summaries of some common estate-planning tools you may consider.

1. Trusts

There are many types of trusts: testamentary (created by a will), inter vivos (created during your life), specialty trusts (those created for special purposes under the law – such as special needs/disability care, pet trusts, charitable trusts, land trusts, management trusts, etc.) and many more. Each of these trusts has unique laws that apply and should be drafted by an attorney. In general, trusts split title to property into two pieces – legal title and equitable title.

- The trustee holds the legal title, is the record owner of the property (for the benefit of the trust), is subject to fiduciary duties (legal obligations to another) and generally does not receive any benefits from the property but may be paid a fee.

- The beneficiaries hold the equitable title, are entitled to the benefits of the property under the terms of the trust, generally do not have any fiduciary duties and, unless the trust states otherwise, generally have little or no control over the property until the trust is terminated.

2. Durable power of attorney and statutory power of attorney

A power of attorney (POA) can be limited or very broad. A POA is used by an individual to appoint another to act on their behalf, usually in business or property matters but not medical or health care matters. Generally, special provisions must be included to make the POA durable – meaning the POA remains effective even after the principal becomes incapacitated or incompetent. The death of the principal or the appointment of a guardian of the estate generally terminates the POA. Most POAs take effect immediately. However, in many states, it is possible to create a “springing” POA, which only becomes effective when the principal becomes incompetent or incapacitated.

3. Medical power of attorney

A medical power of attorney (MPOA) allows the principal to appoint an agent to make medical or health care decisions when the principal is unable to make those decisions. Some states have mandatory forms for MPOAs. Religious or personal beliefs must be considered when drafting an MPOA to ensure the principal only receives medical care they would approve of if they were capable of communicating with their doctor at the time of treatment.

4. HIPAA authorization

Under the federal Health Insurance Portability and Accountability Act (HIPPA), most health information is private and cannot be disclosed. For example, think of Grandma getting run over by a reindeer in a classic Hallmark Christmas movie. The charming small-town doctor usually comes out and tells the entire town that Grandma will make it and she’s doing just fine. Generally, HIPAA would prevent a doctor from doing so – or at least prevent him from disclosing details about Grandma’s condition. This HIPAA authorization is used to appoint an agent(s) (personal representative), grant the agent access to your health records and information and authorize the agent to speak with your medical providers, if needed.

5. Guardian self-designation

If you become incapacitated or incompetent, it may be necessary to appoint a guardian of the person and/or estate. In many states, you may designate in writing the person to serve as guardian. Additionally, and perhaps more importantly, you may also disqualify persons from serving as guardians.

- Guardian of the person means a guardian responsible for taking care of someone who is incapable of caring for themself because of infancy, incapacity or disability.

- Guardian of the estate means a guardian responsible for taking care of the property of someone who is incapable of caring for their own property because of infancy, incapacity or disability.

6. Directive to physicians (living will)

This document allows you to state your intentions regarding life support or artificial means of life. Many states have mandatory forms for directives or living wills. Additionally, many religious or personal beliefs may impact your decision regarding life support.

7. DNR – Do not resuscitate

DNRs are state-specific, but in general, they are an express statement that you do not want resuscitation measures. Those measures may include the following: cardiopulmonary resuscitation (CPR), transcutaneous cardiac pacing, defibrillation, advanced airway management and artificial ventilation. Many states have mandatory forms for DNRs, and some states differentiate between in-hospital DNR care and out-of-hospital DNR care. Generally, if you execute a written DNR, you can wear a DNR device – bracelet, necklace, etc. – with the DNR medical symbol, which informs EMS that you should not receive resuscitation.

8. Appointment for disposition of remains

This document allows you to designate an agent with the authority to determine how your remains will be managed – burial, cremation, etc. – subject to laws and regulations. Additionally, you may limit the authority granted to this agent and provide details of your wishes. There are many nontraditional options that may require specific instructions, including the following: cremation and being made into jewelry, being planted with a tree sapling, being buried at a specific or special location, the type of ceremony to be conducted and religious considerations. I have had clients all over the spectrum. Some care greatly about the remains themselves, while others just want to ensure there is a good party, food and music.

9. Declaration for mental health treatment

This document allows you to express specific wishes regarding mental health treatments should you become incapable of giving or withholding informed consent. Generally, I find this document useful for clients with a family history of mental illnesses or a high risk of such illnesses – such as dementia or Alzheimer’s disease. Additionally, in some states, this document supersedes an MPOA or guardian and acts as conclusive proof of your mental health treatment preferences.

10. Anatomical gifts (organ donations)

Anatomical gifts, such as organ donations, can be a difficult subject. In many states, registering as a donor is very simple (can be done at a driver’s license renewal, etc.), but the law regarding what that registration means is very complex. Additionally, removing yourself from a donor registration can be quite challenging. For example, in Texas, if you have registered on the state organ donor list, simply removing it from your license does not remove you from the list. Finally, religious or personal beliefs must be considered when drafting or registering for an organ donation. Many of the state or public registries have little or no limitations on what your body/organs can be used for. If your faith places limitations on those uses, you will need to consider a custom organ donation to ensure those wishes are followed.

11. Nonprobate transfers

Estate plans should also consider utilizing nonprobate transfers to prevent a property from entering the estate at all. Nonprobate transfers can include, among other things, the following: (some) trusts; joint accounts with “rights-of-survivorship,” pay-on-death bank accounts and other financial accounts with designated beneficiaries; life insurance policies and other policies with designated beneficiaries; and transfer-on-death deeds, lady-bird enhanced life-estate deeds or other specialty deeds for the transfer of real property (generally land, minerals, water rights, wind rights, etc.).

All of these items are state-specific and vary widely from state to state. You should consult your legal counsel when considering these options.

Disclaimer of legal advice: This information is made for educational purposes only and is not intended to be legal advice for any particular reader. Reading this article does not create an attorney-client relationship. Readers are encouraged to consult a licensed attorney for their legal needs. The information is primarily based upon laws of the United States of America and the state of Texas. Laws generally vary by state.