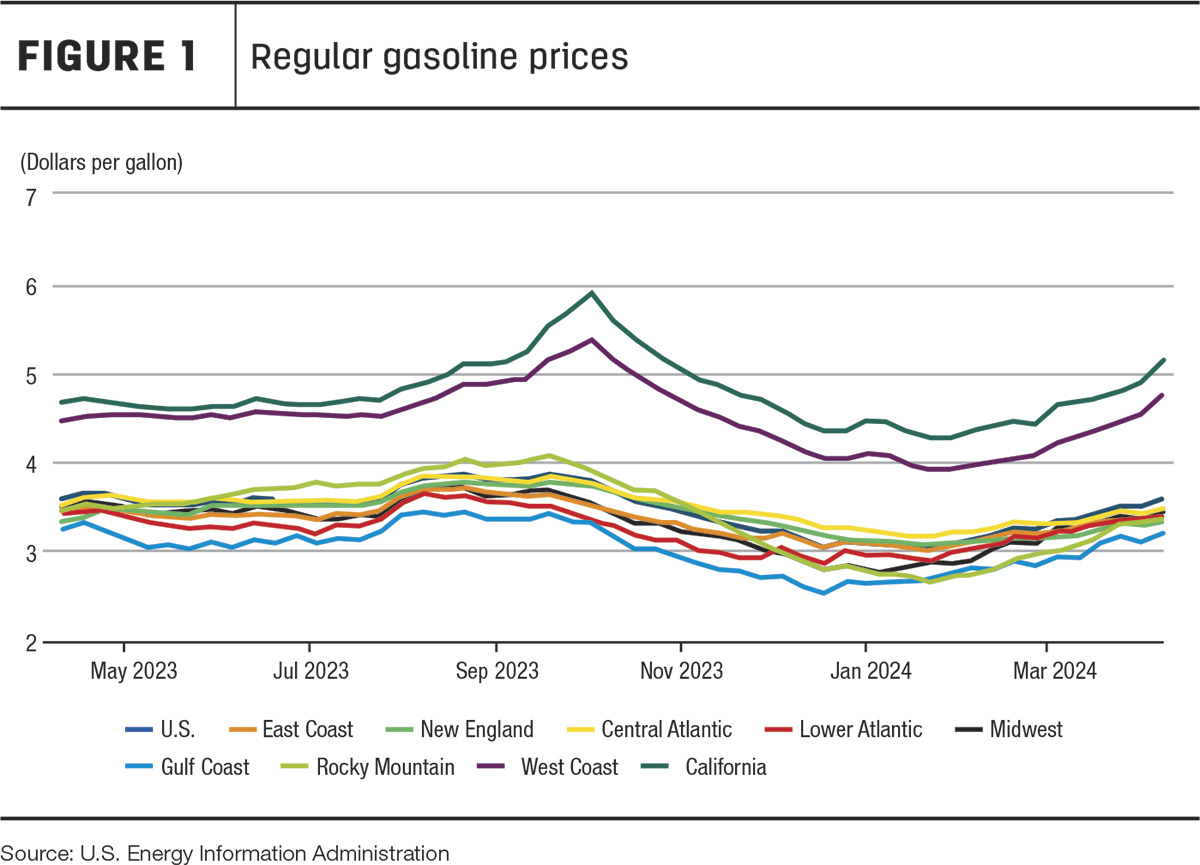

U.S. gas and diesel fuel prices stretched into a third consecutive month of spikes, as the weekly regular average price hit $3.591 per gallon on April 9, up more than 50 cents from the $2.944 conventional price on Jan. 15, 2024.

Inflation index reports on April 10 showed the U.S. still facing a consumer price index (CPI) of 3.5%, and gasoline prices with housing costs are major factors.

The retail price average was $3.591 per gallon on April 8, an increase of 7.4 cents the week prior but still below gas prices from a year ago.

onsumers’ pain at the pump feels especially frustrating after what appeared to be a season of relief between October and December 2023 when average prices swung to the $3 level. And the price increase is even more puzzling considering that the U.S. has boosted crude oil production from 12.9 million barrels per day in 2023 to 13.2 million per day.

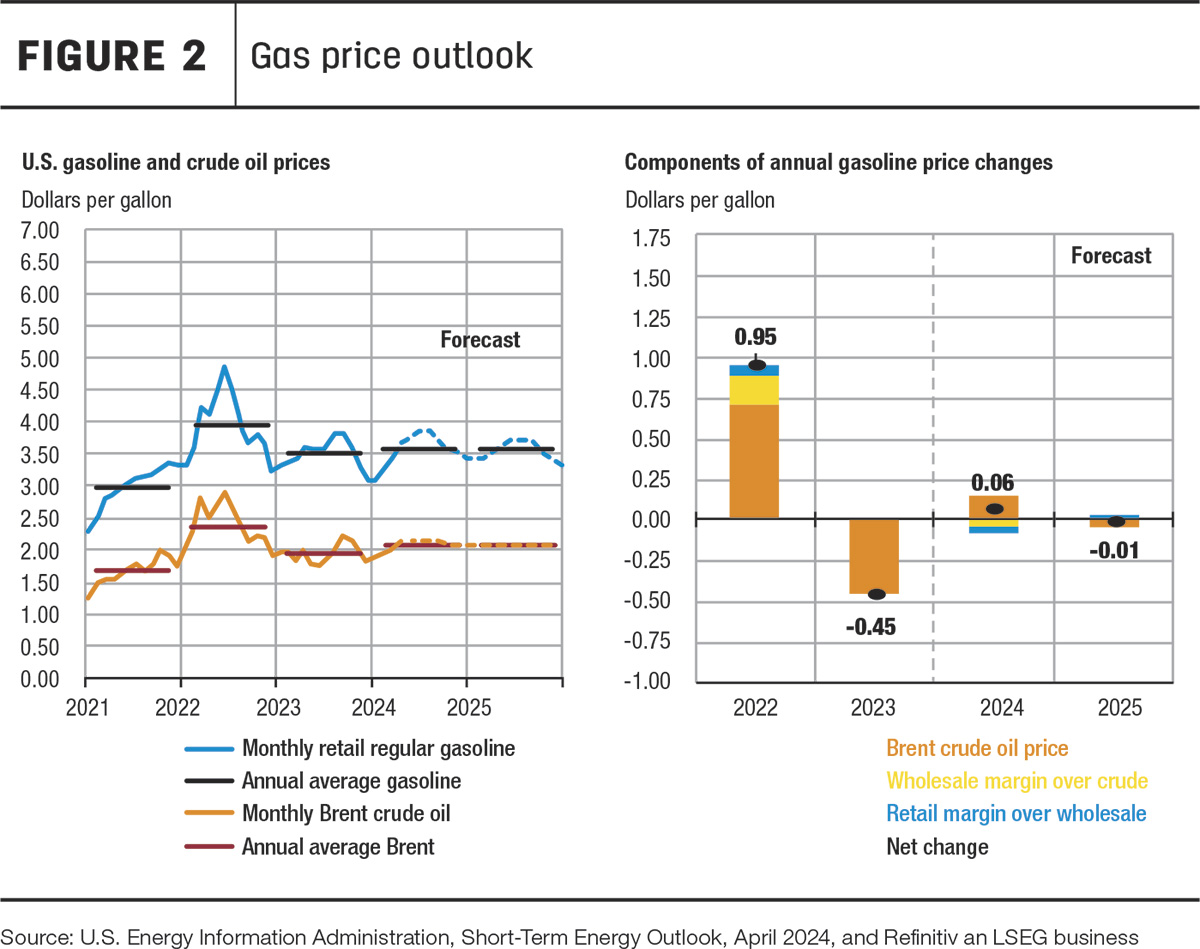

In its April 9 forecast overview, the U.S. Energy Information Administration (EIA) predicted that “crude oil spot price will average 90 dollars per barrel in the second quarter of 2024, 2 dollars per barrel more than our March short-term energy outlook, and average 89 dollars per barrel in 2024. This increase reflects our expectation of strong global oil inventory draws during this quarter and ongoing geopolitical risks.”

On-highway diesel fuel prices, meanwhile, have increased slightly but kept relatively stable since December and into the new year. U.S. average diesel per gallon was at $4.061 on April 8, down 3.7 cents since 2023 but up 6.5 cents in the past month.

The U.S. EIA short-term energy outlook sees monthly retail regular gasoline blends staying between $3.40 and $3.80 through much of 2024 and lower in 2025 (see Figure 2), with annual average gasoline holding steady just above $3.50 in the next two years.

For external factors affecting gasoline, the U.S., which remains the top crude oil producer in the world, sees shipment challenges ahead with combat hitting two fronts. Marcus Brix, energy analyst for CattleFax, in an April 5 report noted risk affecting markets after Israel struck an Iranian consulate building in Syria and Ukrainian attacks on Russia’s refineries pushed higher global energy prices. Even though the assets were used to fuel Russia’s ongoing invasion of Ukraine, U.S. opposition to the strikes appears convoluted.

“Perceived disruptions to global oil output become materialized in prices, adding risk and expanding volatility,” Brix wrote. “On [April 4], Brent crude oil recorded its first close above 90 dollars per barrel since late October, establishing a floor around 88 dollars and testing resistance around 94 dollars. Beyond 94 dollars lies 99 dollars per barrel resistance defined in November ’22.

“As the situation escalates, the risk environment will change quickly, and futures are guaranteed to quickly price it in. Consider using risk management tools, which provide price protection but are less impacted by daily volatility and are not subject to margin calls.”