Singer and songwriter Bob Dylan said, “The times they are a-changin’.” One could argue the same idea applies to today’s U.S. dairy industry and the tastes of global consumers that demand dairy products. Domestically, consumer preference for dairy is changing. Cheese and yogurt are replacing fluid milk and ice cream as the products of choice.

Likewise, protein is getting the spotlight as supermarket space for high-protein or protein-enriched products, such as Greek-style yogurts, sports drinks and energy bars, continues to grow. Walk into any trendy metropolitan smoothie shop, athletic club or health food store and you’ll be surprised by how many low-fat, high-protein food and supplement options you find.

In the U.S., dairy products seem to be evolving from something we drink into something we chew. Protein is in and fat is out. Internationally, a growing population with greater wealth comes with an increasing demand for the dairy foods we Americans consider dietary staples.

In developing economies, consumers are looking to replace carbohydrates in their diets with protein and fat. In many instances, this requires imports of internationally produced products.

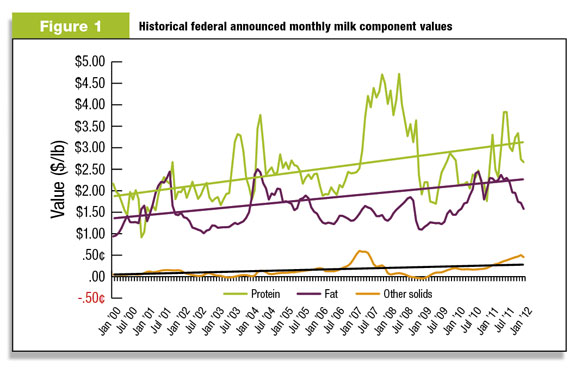

A look at historical federal announced monthly milk component values can help demonstrate some of these points ( Figure 1 ). Since January of 2000, even amongst all the volatility, the trend is for increased values in both fat and protein, while other solids have remained relatively flat.

Likewise, the rise in milk protein value has been outpacing that of milk fat (the trend line is steeper). Also, milk protein has been of greater value than milk fat more than 90 percent of the time during this period.

While the reasons for these trends are sure to be many, the 30,000-foot view suggests that, in many market segments, the advantage belongs to those who can produce and process the most components most efficiently.

So what does this mean for the U.S. dairy producer? It means that while producers “act locally,” they must also “think globally.” We used to just ask, “What does my milk processor want?” A new question that needs to be pondered is: “What are the people on my planet going to want to eat?”

Likewise, in many of our milk marketing orders, producer paychecks are determined ultimately by pounds of fat, protein and other solids sold, in addition to quality considerations. The real challenge is to increase milk component output through increases in both milk yield and milk component content.

Bringing this discussion closer to home is best done using a real-world example of one of our clients and explaining some areas we’ve focused on to achieve results. Since this client sells milk to a cheese manufacturer in the Upper Midwest marketing order, milk fat and protein are prime milk price drivers.

Therefore, one of our objectives has been to continually look for opportunities where we can profitably increase both milk output and milk component content.

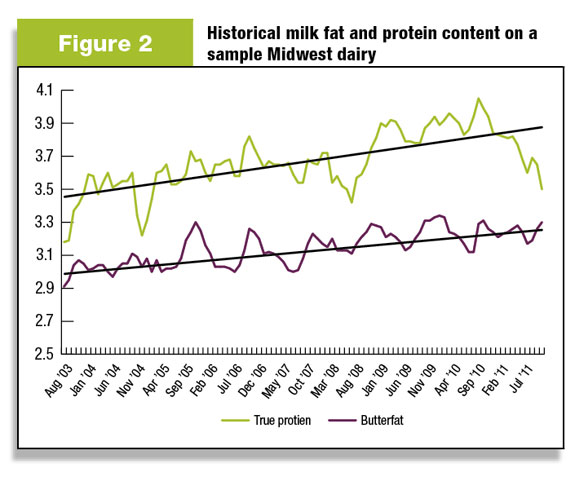

Figure 2 shows what has been achieved over the past eight years in regards to monthly average milk component content. Despite some obvious hiccups along the way, a 7 percent improvement in milk fat content and a more than 10 percent improvement in milk protein content have been realized.

Likewise, eight years ago, the rolling herd average stood close to 25,000 pounds – now we’re knocking on the door of 30,000 pounds.

So what are a few of the management and nutritional areas we focused on to achieve these results?

Forages

Quality forages that are harvested, processed, stored and properly removed from storage lay the foundation for a cost-effective, healthy and productive ration. For grass and alfalfa silages, intensely monitor plant maturity so that harvest is at the optimum balance between yield and NDF digestibility.

Over the years, yield has taken a second seat to higher digestibility. As brown-midrib corn silage harvest approaches, a yard-and-garden chipper is used to help evaluate whole-plant moisture content.

At harvest, incoming silage is monitored for proper chop length and kernel processing, and silage is covered with oxygen-excluding film, plastic and sidewall tire-to-tire coverage. A face grinder is used to remove forages from the bunker silos.

Spoilage

No matter how hard you try to prevent it, spoilage occasionally happens. Whether it’s mold at the top of the bunker, water infiltration at the bunker walls or excessively wet, butyric acid-laden haylage caused by a sudden thunderstorm, at some point in time you will have spoilage.

The rumen microbial population doesn’t like spoilage – the cows act adversely to it and your balance sheet is the worse for it. The rule is that spoilage doesn’t get fed. In commodity bays and sheds, it’s a good idea to have a “total cleanout” several times a year.

Feed only high-quality, consistent byproducts

We violated this rule in the summer of 2003. A new ethanol plant opened in the area and, due to the location and price, we thought we were getting a good value. As it turned out, this new plant had some difficulties at startup and the high-fat solubles ended up in the product.

The result was serious milk fat depression as the cows’ rumens got a good dose of unsaturated fats. Know where byproducts are coming from and test when needed.

Amino acid balancing and sugars

Much has been written on amino acid balancing, but the bottom line is that economical improvements in milk fat and protein yield are realized when rations are balanced properly. We started this strategy in the summer of 2005 and are confident we gained an additional 0.2 percent in milk protein content and a little less in regards to milk fat.

We started experimenting with feeding liquid sugar sources in the summer of 2008. After trying various options, we settled on using a byproduct from cheese manufacturing that is very high in sugars. Milk fat content gained an additional 0.2 percent.

Consistency

In all aspects of the dairy operation – from feedstuffs and feeding to milking and animal handling – consistency is paramount. Always be on the lookout for ways to reduce variation.

From the cows’ perspective, rumens are large fermentation vessels responsible for producing the majority of the energy, milk and milk component precursors the animals need to be highly productive, profitable and healthy. The more consistent the inputs and delivery are, the better the results. Having multiple deliveries of TMR to each pen helps reduce any possible mixing variation.

Conclusion

Historical prices are not always great predictors of future performance. Being mindful of both regional and global trends in consumer demands for dairy and adopting practices and technologies that allow responsiveness to these consumer demands will ensure our viability in an ever-changing global industry.