Editor's note: USDA announced the sign-up period for the 2018 Margin Protection Program for Dairy will be open from April 9 to June 1. On the back of falling milk prices and increasing feed costs, February 2018’s Margin Protection Program for Dairy (MPP-Dairy) national average margin fell to the lowest level since June 2016, at $6.88 per hundredweight (cwt).

The February 2018 margin is down 15 percent from January and down 35 percent from February 2017, according to John Newton, director of the American Farm Bureau Federation’s Market Intelligence.

The Bipartisan Budget Act of 2018, signed into law in February, made several changes to MPP-Dairy, but those provisions – and the ability for farmers to sign up for the program – have not yet been announced by the USDA.

The changes include calculating margins monthly, increasing the catastrophic coverage level to $5 per cwt for some farmers and significantly reducing the buy-up premium rates. Dairy producers are expected to be given an opportunity to re-enroll in MPP-Dairy retroactively for the 2018 coverage year following these congressional modifications.

Once the 2018 MPP-Dairy enrollment period is reopened, Tier I farms (covering production of 5 million pounds of milk or less per year) purchasing MPP-Dairy margin coverage at $7, $7.50 and $8 per cwt coverage options will be eligible for indemnity payments of 12 cents, 62 cents and $1.12 per cwt, respectively. For a farm covering 5 million pounds of milk, the MPP payments represents $500 for $7 per coverage to nearly $4,700 for $8 per cwt coverage.

As of April 2, the USDA Farm Service Agency (FSA) was still finalizing details before reopening the 2018 enrollment period for MPP-Dairy. The sign-up period will be for 90 days, but exact dates have not yet been announced.

With lower MPP-Dairy premiums, “the realities are, when the program comes out, farms with a base of 5 million pounds [of milk] or less are going to want to sign up for $8 [per cwt] coverage,” said Alan Zepp, risk management program manager at Pennsylvania's Center for Dairy Excellence (CDE). “I think that will be a no-brainer.”

At 14.2 cents per cwt, the annual premium would be about $1,420 per 1 million pounds of milk. Based on Zepp’s calculations on current price conditions, MPP-Dairy indemnity payments would return $3,500-$4,000 per million pounds.

“Projected MPP-Dairy margins are under $8 through July,” Zepp said. “Although futures markets indicate margins will recover after that, but if they don’t, the payments could be even higher.”

February milk prices fall

February milk prices weakened, although it will likely be the low point of the year. On March 28, the USDA National Ag Statistics Service (NASS) released its monthly Ag Prices report, showing the February 2018 U.S. average milk price was $15.30 per cwt, down 40 cents from January 2018, $2.80 less than February 2017 and the lowest since June 2016.

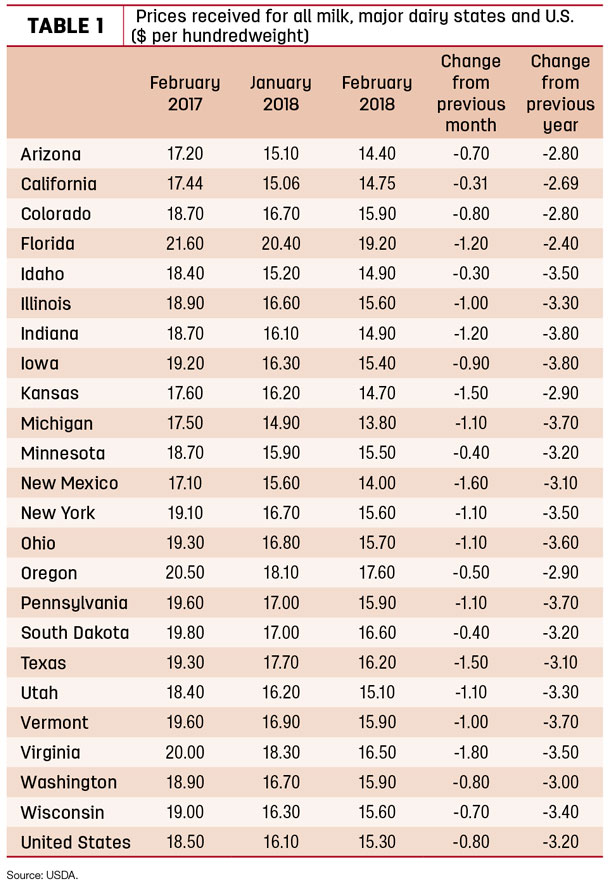

Among the 23 major dairy states (Table 1), February prices compared to a month earlier were down $1 or more in 13 states, led by a $1.80 decline in Virginia and drops of $1.50-$1.60 per cwt in Kansas, New Mexico and Texas. The average price dipped below $15 per cwt in seven states, with Michigan again coming at the bottom, with an average of $13.80 per cwt. Florida’s average of $19.20 per cwt remained the nation’s high.

Compared to a year earlier, February 2018 milk prices were down $3 or more in 17 states.

MPP-Dairy margin payment kicks in

The higher feed costs and the lower milk price reduced margins substantially.

The February U.S. average margin over feed costs slipped to $6.88 per cwt. Under the older MPP-Dairy calculations, that would result in a January-February combined average of $7.50 per cwt (Table 2).

However, in changes made earlier this year in a federal budget bill, 2018 margins are now calculated monthly, instead of the two-month average, so any producer enrolled at $7, $7.50 or $8 per cwt levels should see an indemnity payment for February.

National average prices for all feeds included in the MPP-Dairy ration were higher in February. Soybean meal took the biggest jump, to $362.85 per ton, up more than $40 per ton from January and the highest since July 2016. Corn, at $3.38 per bushel, was up 9 cents from January and the highest since July 2017. Alfalfa hay was up $3 from January, to $155 per ton, and the highest since May 2017. Together, total February feed costs of $8.42 per cwt of milk sold were up 44 cents from January and the highest since July 2016.

Based on milk and feed futures prices as of March 27, the Program on Dairy Markets and Policy projects monthly MPP-Dairy margins will hover around $7 per cwt through June.

‘Protecting Your Profits’ call

Zepp reviewed MPP-Dairy, the Livestock Gross Margin-Dairy (LGM-Dairy) program and puts and options on the Chicago Mercantile Exchange (CME) futures market during his monthly “Protecting Your Profits” conference call on March 28.

Looking at market fundamentals, U.S. cow numbers have plateaued, but milk production per cow continues to grow. Cow slaughter is up slightly compared to a year ago, but there’s no rush to the slaughterhouse. U.S. dairy product inventories continue to grow.

There are positive signs for both domestic and export demand. U.S. consumer confidence remains high, and unemployment is the lowest level since the 1990s. The U.S. Dollar index is the lowest since 2014, although still at the high end of 2004-14 period. The U.S. is exporting more volumes of dairy products, but with lower product prices, total export values are stable.

U.S. dairy product prices are very competitive on the world market. The current CME cash cheddar price of $1.55 per pound was less than the latest Global Dairy Trade (GDT) auction price of $1.64 per pound and the European Union (EU) price of $1.82 per pound. CME butter was trading about $2.19 per pound, below the GDT average of $2.83 per pound, and the price in Germany of $2.72 per pound. Finally, the CME nonfat dry milk powder was trading at about 69 cents per pound, compared to the GDT average of 86 cents per pound and 74 cents per pound in Germany.

EU milk powder inventories are dropping slightly, but still very large. Questions remain over whether the aging inventories will go toward food consumption or animal feed.

Looking at world milk production, EU milk production has been declining recently, and New Zealand production has also been running lower than a year ago.

Margin protection options

Zepp summarized various risk management options:

• At the time of the call, CME Class III futures contracts for the remainder of 2018 averaged just over $15.24 per cwt, well below the five-year average. The Class IV futures projected average was $14.15 per cwt. A September 2018 Class III futures contract was trading at $15.93 per cwt. A $16 per cwt at-the-money put cost 70 cents per cwt; a $15 put option, similar to a $1 deductible LGM-Dairy policy, cost 28 cents per cwt.

• As of late March, the LGM-Dairy insurable margin for the 10-month period (June 2018 through March 2019) averaged $6.53 per cwt. Cost for coverage for the entire period was estimated at 55 cents per cwt for a $0 deductible policy; 15 cents for a $1 deductible policy.

• The current estimated MPP-Dairy margin for the remainder of 2018 is about $7.73 per cwt. Based on milk and feed futures prices as of March 27, the Program on Dairy Markets and Policy projects monthly MPP-Dairy margins will hover around $7 per cwt through June.

Zepp’s next Protecting Your Profits call will be April 25, preceding the April LGM-Dairy sales period. All calls are recorded and archived.

Organic dairy challenges abound

Like their conventional dairy counterparts, organic dairy producers are facing lower pay prices and loss of marketing contracts, according to Ed Maltby, executive director of the Northeast Organic Dairy Producers Alliance (NODPA).

Lower base prices and little power in negotiating contracts are resulting from poor supply management, increases in sales of nonbovine juices (marketed as milks), shortages of available processing facilities and the increase in large-scale dairies supplying private-label buyers with large milk volumes at low prices.

There is some good news: Researchers found cows fed a “100 percent organic grass and legume-based diet” produce milk with elevated levels of omega-3 and conjugated linoleic acid.

February dairy cow slaughter highest in six years

The number of U.S. dairy cows culled during February was the highest for the month dating back to 2012 (a leap year), according to USDA records.

For February 2018, federally inspected milk cow slaughter was estimated at 260,700 head, 7,500 more than February 2017. Through the first two months of 2018, the culling total is 550,500 head, about 28,300 head more than the same period a year ago.

The USDA’s latest milk production report indicated there were 9.41 million cows in U.S. dairy herd in February 2018. Based on the slaughter estimates, about 2.8 percent of the herd was culled in February 2018, compared to 3.1 percent in January 2018.

February cull cow prices rise

Despite the high culling rate, U.S. average cull cow prices rose in February. Cull cow prices (beef and dairy combined) averaged $65.60 per cwt, up $2.30 from January, and 70 cents more than February 2017. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke