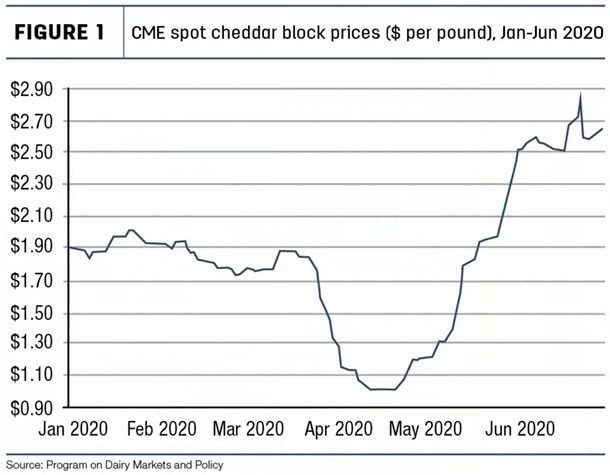

Take the case of cheddar cheese. We were rumbling along at about $1.90 per pound at the beginning of the year, feeling good about our prospects in 2020. All of a sudden, in mid-March, we were confronting a pandemic and “safer at home” orders.

Restaurant and institutional food demand collapsed and cooperatives invoked base-excess plans. Cheese prices plunged to $1 per pound by mid-April, dragging Class III sentiment with it. We hadn’t seen $1-per-pound cheese since November of 2000.

Then export opportunities grabbed some of those attractive cheese prices, the government purchased quite a bit of dairy products for food box programs, and some states began to allow restaurants to reopen with limited capacity. In the face of shrinking milk supplies, all of this new demand sent cheese prices soaring. Even in 2014, we only hit a high cheese price of $2.45 per pound; on June 23 of this crazy year, we hit $2.81 per pound (Figure 1).

Some of us may like the thrill of the ride with these highs and lows – but personally, I want guardrails along the ditches. I would gladly accept a little paint scuffed off my fenders rather than a life-threatening accident.

Risk management

We’ve had risk management tools since the Coffee, Sugar and Cocoa Exchange began trading cheese and nonfat dry milk futures in 1993. All of the dairy product contracts migrated to the Chicago Mercantile Exchange (CME) over the following years, and more were developed and refined.

The futures markets act as a clearinghouse for all kinds of information. They distill reports about weather, politics, production, inventories and even pandemics. From that, they form opinions about prices expected months from now. The futures markets are always going to be wrong about the future at any point in time, but we don’t have evidence that they are biased in their opinions – that is, either tending to be optimistic or pessimistic.

Futures markets form the basis for all of our formal risk management tools except for one: The Dairy Margin Coverage (DMC) program was outlined by Congress, and price opinions don’t matter for the cost and availability of coverage. Congress defined margin calculations, dictated the margins that can be covered and prescribed program premium costs. Let’s not agonize over this program. The Tier 1 coverage is inexpensive, and I believe that for basic risk management, producers should purchase all of the protection they can in Tier 1.

All of the other risk management programs boil down to opportunities created by the wisdom of the crowd through futures market trading. That includes contracts for hedging, options on those contracts, cash forward contracts from your handler, Livestock Gross Margin for Dairy (LGM-Dairy) and Dairy Revenue Protection (Dairy-RP). All of these programs have another factor in common – basis risk.

What is basis risk?

Basis risk is the difference between the price you can protect with risk management and the actual cash price you receive for your milk. Futures contracts can only trade effectively because the contract you are trading – for example, Class III milk – is precisely crafted and specifies volume, components, quality, etc., leaving the only thing to negotiate as the price.

But no farm actually receives the announced Class III milk price. Farm milk components will vary from the Class III standard; there are four classes of milk in Federal Milk Marketing Orders (FMMOs) with various class utilizations, Class I differentials are different across the country, and individual farms receive various premiums and deductions from their milk check. All of these factors cause variation between what a farm receives in their milk check and the futures contracts. That difference is called basis.

The general wisdom is that basis risk is less than price risk. We have seen $10-per-hundredweight (cwt) Class III price movements over the course of one or two months, while many farms may see their basis only change $1 or $2 over that same time period. Paying a small premium to exchange your $10 risk for a $2 risk is like the guardrails along the roadside. But occasionally, even basis risk can be large.

In the multiple component pricing orders (seven out of the 11 FMMOs and representing almost 90% of all milk marketed through FMMOs), farms are paid for butterfat, protein and other solids based on Class III milk values. After being paid component values, there is usually some money left in the pool from the higher class contributions – mostly Class I. This money gets paid to producers by distributing it over all hundredweights sold as pooled milk. This is called the Producer Price Differential, or PPD.

The PPD will vary every month and is one source of basis risk, but it is usually not too large. Protecting your Class III component values with risk management programs is usually very good advice.

The pandemic economy

In the third and fourth quarter of 2019, futures market opinions were optimistic about 2020 milk price prospects. Quite a lot of 2020 milk was protected with floor prices. Producers who did protect prices were comforted when much-lower-than-expected milk checks began to be seen in March and April. The risk management measures were working as expected.

In June, we saw the tremendous rebound in Class III prices. The Class III settlement price for the June contract moved from a low of $11.05 per cwt on April 22 to close at more than $21.04 per cwt on July 1. That was an unprecedented $10 price rise over a 10-week period.

June Class IV settlement prices also rose, but from a low of $10.41 per cwt to close at $12.90 per cwt. As a producer, you may be feeling good about the 40 to 50 cents you spent to put a $16-per-cwt floor under prices months ago. You didn’t need the protection because the $21-per-cwt Class III price meant you were going to get a large milk check in the cash market … or did you?

When prices rise rapidly like this, manufacturing plants can find that the minimum price they will have to pay in the FMMOs is higher than the weighted average price we call the blend price. Just as an example, in the Upper Midwest order, I estimate that the June uniform price would be about $19.70 per cwt. A cheese plant would see that their $21.04 cwt minimum price would mean that the PPD is $19.70 - $21.04 = -$1.34, or a negative PPD. That means a cheese plant that stays in the pool would have to pay their producers the $19.70-per-cwt blend and contribute another $1.34 per cwt to the pool for other class plants to take a draw from.

But manufacturing plants are allowed to depool their milk and not pay the FMMO minimum prices. If all of the Upper Midwest cheese plants depooled, then the milk left in the pool means that the blend price will then be about $12.90 per cwt, with a -$8.14 PPD. The unpooled cheese plants realize they can pay their producers the same $12.90 per cwt all other producers are receiving for their milk and not have to contribute to the pool’s equalization fund.

So the producer who put a $16-per-cwt floor under their Class III milk price won’t receive a payment for risk management because the Class III price is $21.04 per cwt. And the milk check they received didn’t reflect the expected $21.04-per-cwt payment because the PPD was so negative and plants depooled. This is the unusual time when the basis risk is larger than the price risk.

What should you do?

Don’t make the decision that risk management is bad and doesn’t work. Most of the time, these guardrails are an effective means of keeping you out of the ditch.

However, basis risk is real, and in the unusual circumstances of a pandemic economy, your carefully considered risk management program may not work as expected. ![]()

PHOTO: Getty Images.

-

Mark Stephenson

- Director of Dairy Policy Analysis

- University of Wisconsin – Madison

- Email Mark Stephenson