Improving conditions on both the income and cost side mean dairy farmers will be getting more money from markets and less from the new Dairy Margin Coverage (DMC) program.

We already know January-February 2019 indemnity payments for producers covering their first 5 million pounds of milk production at the 95 percent level in 2019 will surpass premium costs for the full year. Read: February margin ensures DMC payments will surpass 2019 premium costs.

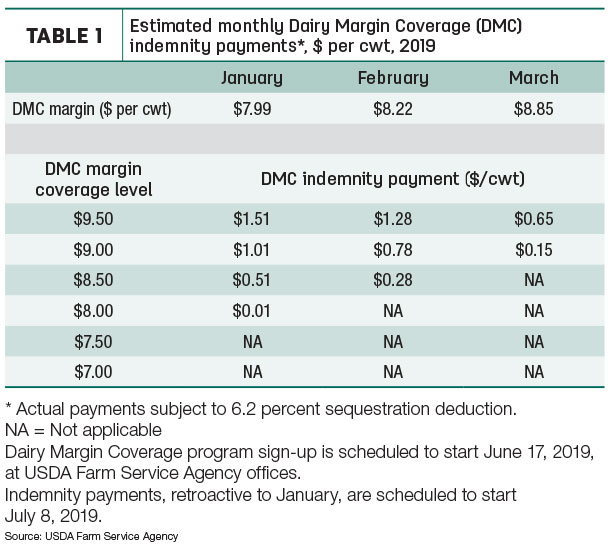

However, the March 2019 margin was estimated at $8.85 per hundredweight (cwt), thanks to higher milk prices and steady feed prices (Table 1). That will yield a DMC indemnity payment of 65 cents per cwt on March milk production for those selecting the top coverage level at $9.50 per cwt, and just 15 cents per cwt at the $9 per cwt coverage level. The payments are also subject to a 6.2 percent sequestration deduction.

The USDA previously estimated the milk income over feed cost margin of $8.22 per cwt for February 2019, ensuring an indemnity payment of about $1.28 per cwt on the monthly milk marketings for producers who select the $9.50 coverage level. The January 2019 margin of $7.99 per cwt will yield an indemnity payment of about $1.51 per cwt for the same producers.

As we’ve seen in recent weeks, markets are changing. Earlier this year, DMC payments had been projected to extend into October. However, the increases in milk futures prices and declines in corn and soybean meal futures now push the forecasted monthly margin to $9.50 per cwt by June or July, halting monthly indemnity payments.

Enrollment in the DMC program will begin June 17 at the USDA Farm Service Agency offices. The April DMC margin will be announced May 31, so dairy producers will know expected payments for January-April 2019 before they sign up for the program. Distribution of indemnity payments, retroactive to January 2019, is scheduled to begin about July 8.

March milk prices higher

The March 2019 U.S. average milk price rose 70 cents per cwt from February to $17.50 per cwt and was $1.80 higher than March 2018 (Table 2) and the highest average since November 2017. Florida’s average of $20.80 per cwt remained the nation’s high; the low was $15.90 per cwt in New Mexico.

Compared to a month earlier, average milk prices jumped $1 per cwt or more in Minnesota, Oregon and Wisconsin. Compared to a year earlier, March 2019 milk prices were up at least $2 per cwt or more in Arizona, California, Florida, Indiana, Michigan, New York, Ohio, Pennsylvania, Vermont, Virginia and Washington.

What if? New ‘dairy hay’ information

Beginning in February, the USDA began reporting average “dairy-quality” Premium and Supreme alfalfa hay prices in an effort to more accurately calculate dairy farmer feed costs under federal dairy safety net programs. The report lists hay prices in eight states and averages prices from the top five milk-producing states: California, Idaho, New York, Texas and Wisconsin.

March 2019 dairy quality hay prices in those states averaged $213 per ton, down $12 from February, but $29 per ton more than the all alfalfa hay average of $184.

It’s only a “what if?” scenario, but if that average was incorporated into the DMC formula, the margin would have been 40 cents lower, or about $8.45 per cwt. That would have yielded a March 2019 DMC margin of $1.05 per cwt at the top margin coverage level of $9.50 per cwt. However, the new dairy-quality hay prices are not part of the DMC calculations.

New DMC calculator available

The USDA has made a new web-based tool to help dairy producers evaluate coverage levels through DMC program by combining operation data and other key variables to calculate coverage needs based on price projections.

The decision tool assists producers with calculating total premiums costs and administrative fees associated with participation in DMC. It also forecasts payments that will be made during the coverage year.

DMC, Dairy-RP webinar scheduled

A webinar, hosted by I-29 Moo University, will highlight DMC and another risk management program, the Dairy Revenue Protection (Dairy-RP) program, on May 17 beginning at noon (Central).

Presenters will included Marin Bozic, University of Minnesota, and Josh Newton and Cassandra Monger, Compeer.

Bozic will outline developments in the Dairy-RP program and provide forecasts for the next year.

Compeer’s Newton, a crop insurance team leader, and Monger, a dairy industry specialist, will focus on Dairy-RP from a lender’s perspective. They’ll provide program results from the first quarter of 2019 and discuss how Dairy-RP can fit into an overall dairy risk management plan.

There is no registration. Access the webinar, or contact Jim Salfer (320) 203-6093 or Fred Hall (712) 737-4230 for more details. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke