Milk prices declined and feed costs continued to rise in July, cutting into monthly dairy producer milk income over feed cost (IOFC) margins calculated under the Dairy Margin Coverage (DMC) program.

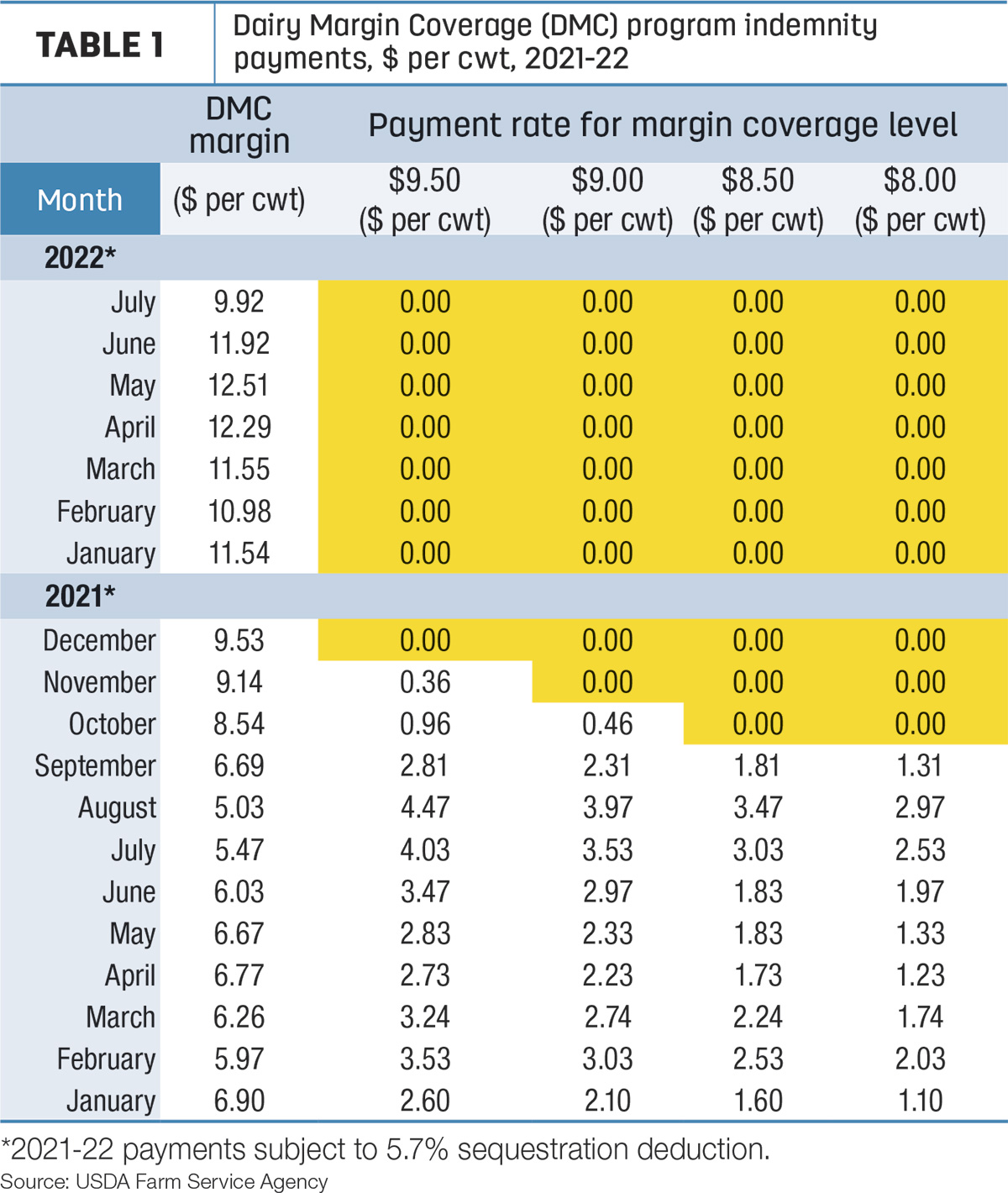

The USDA released its latest Ag Prices report on Aug. 31, including factors used to calculate July DMC margins and potential indemnity payments. The July DMC margin is $9.92 per hundredweight (cwt), down $2 from June but still above the top Tier I insurable level of $9.50 per cwt (Table 1) for an eighth consecutive month.

With the recent weakness in milk futures prices and higher feed prices, the USDA’s DMC decision tool indicates monthly margins could shrink to levels triggering indemnity payments in August and September.

Milk price slide continues

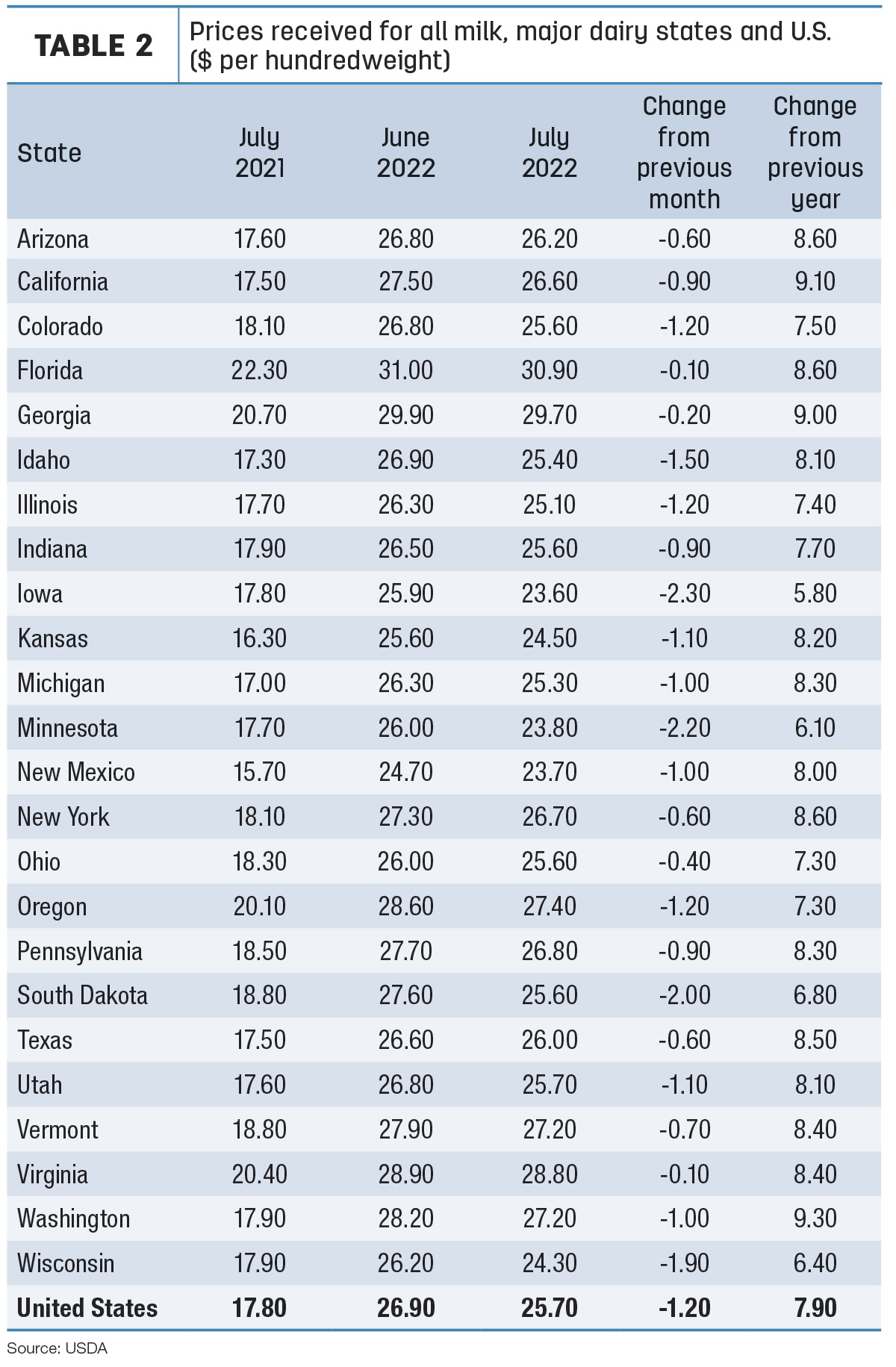

The July 2022 announced U.S. average milk price fell $1.20 from June to $25.70 per cwt, the lowest since February. Despite the decline, the average was still $7.90 above July 2021, leaving the year-to-date average at $25.97 per cwt, the highest January-July average on record.

July milk prices were lower than the month before in all 24 major dairy states (Table 2). Largest month-to-month declines were in Iowa (-$2.30), Minnesota (-$2.20), South Dakota (-$2.00) and Wisconsin (-$1.90). Smallest declines were in Georgia (-20 cents) and Florida and Virginia (both -10 cents).

Compared to a year earlier, July 2022’s U.S. average milk price was up $8 per cwt or more in 15 states, led by California, Georgia and Washington.

Hay prices jump

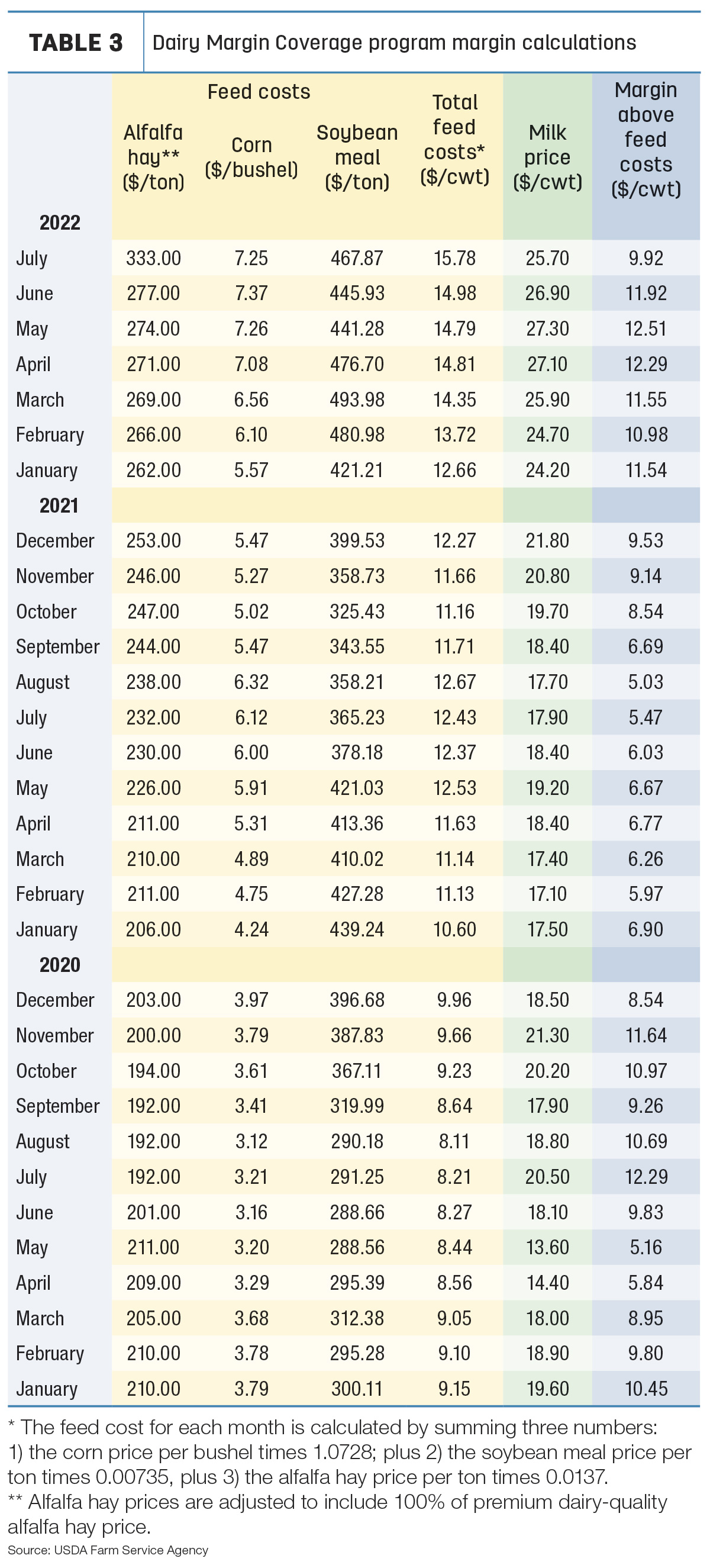

In addition to the lower average milk prices, the bigger margin impact came from higher overall feed costs (Table 3):

The average price for corn dipped 12 cents from June to $7.25 per bushel, the third-highest on record since the inception of the DMC program or its predecessor, the Margin Protection Program for Dairy (MPP-Dairy).

- With the DMC change to include the price of dairy-quality alfalfa hay in feed cost calculations, the July average price for hay was $333 per ton, up $56 (20%) from June and easily the highest on record.

- The average cost of soybean meal rose to $467.87 per ton, up $21.94 from June.

July feedstuff prices yielded an average DMC total feed cost of $15.78 per cwt of milk sold, another all-time record high during the DMC or MPP-Dairy era dating back to March 2014.

Other costs mostly higher

Outside of feed – and not factored into DMC margins – other costs were mostly higher. The July index of prices paid for commodities and services, interest, taxes and farm wages was up 0.5% from June 2022 and up 13% from July 2021. Machinery costs rose 1% from June and were up 20% from July 2021. The July fuel cost index was down more than 5% from June but 51% more than July 2021. Higher prices in July for hay and forages, feeder cattle, other services and herbicides more than offset lower prices for nitrogen, diesel, mixed fertilizer and feed grains.

Cull cow prices rise

Prices for market cows rose for a seventh consecutive month. U.S. prices received for cull cows (beef and dairy, combined) averaged $90.60 per cwt in July, up 40 cents from June and the highest monthly average since September 2015.