The major element of change that stands to impact this environment is the market access under recently negotiated trade agreements and the Canada-U.S.-Mexico Agreement (CUSMA).

The CUSMA (also referred to as the U.S.-Mexico-Canada Agreement or USMCA in the U.S.) was signed by member countries on Nov. 30.

Under the CUSMA, Canada provided the U.S. access to the Canadian market in the form of tariff rate quotas (TRQs) for dairy products. The quota (butterfat) equivalent of this access is approximately 3.9%.

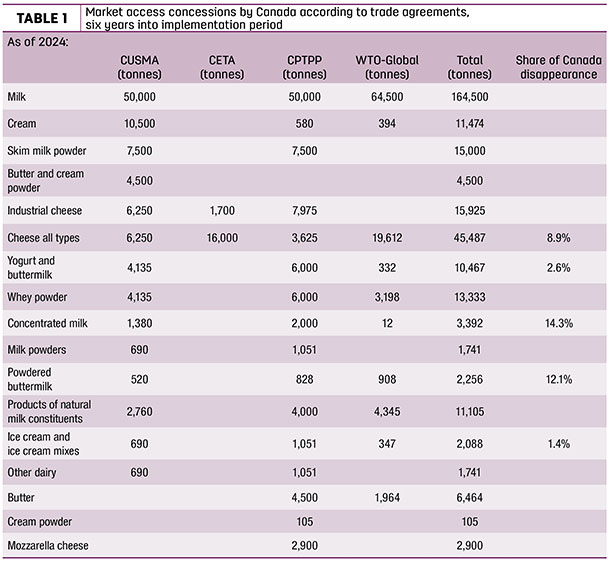

The dairy market access levels conceded in CUSMA stack up with access conceded in the Comprehensive Economic and Trade Agreement with the EU (CETA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

These are summarized in Table 1, which is formatted mostly using the categories from the CUSMA – but with some redundancy to accommodate categories in previous trade agreements – and benchmarked to year six of each agreement.

For selected products, the approximate share of consumption allocated to imports through TRQs is estimated. Table 1 shows, for the most part, the CUSMA access is similar to that under the CPTPP.

When the access allowed under each of the trade agreements is combined and taken as a share of Canadian consumption, the estimated significance of the market access allowed can be seen; for example, the combined access allowed for cheese under CUSMA, CPTPP, CETA and existing market access arrangements under the World Trade Organization is estimated at about 9% of consumption.

It is reasonable to expect the access granted to the U.S. under the CUSMA will be filled; however, this is not as clear under CPTPP.

For example, the access granted for fluid milk would need to be filled by New Zealand, Australia, Mexico or another of the Asian or South American CPTPP members; this seems unlikely.

The significant volume of bulk cream granted to the U.S. in CUSMA is consistent with Canada’s structural surplus of cream.

Due to the structural surplus in skim milk, Canada has the incentive to offer access on products that represent the highest levels of embodied butterfat and relatively less embodied skim.

Canada was also given TRQ access to the U.S. dairy market under CUSMA. However, Canada faces constraints in accessing it.

First, Canadian exports to the U.S. face a relatively high price point on raw milk in Canada versus that in the U.S. Second, Canada’s dairy exports are deemed subsidized according to the resolution of the WTO dairy export decision in 2003; under the Canada-U.S. Trade Agreement of 1989 and succeeding agreements, there are no subsidized exports between member countries.

Finally, many U.S. dairy products fall under the Pasteurized Milk Ordinance (PMO), requiring compliance with U.S. Grade A milk standards. The U.S. has not established equivalency agreements with others to satisfy the PMO.

The experience of Canada and other countries is: Compliance with the U.S. PMO is costly and practically difficult for the Canadian dairy supply chain to comply with and, as such, the PMO represents a non-tariff trade barrier to the U.S. dairy market.

CUSMA and Class 7

The Canadian dairy industry has struggled with surplus skim milk; meeting butterfat demand generates a structural surplus of skim, which has only worsened as milk quotas expanded in recent years to meet growing butterfat demand.

In resolving the WTO dairy export dispute in 2003, Canada agreed to the WTO panel criteria defining its dairy exports as subsidized and agreed to limit these exports to WTO caps.

Under the WTO Nairobi Declaration of December 2015, subsidized exports must be completely eliminated as of 2021.

This limited export market access situation has generated problems clearing the Canadian skim market. The structural surplus and sharply limited export market access has eroded the incentive to invest in skim processing capacity, even as skim availability has grown.

This has pushed Canada towards other means of skim surplus removal within the domestic market, such as the marketing of skim milk into the feed market in Class 4m (at exceptionally low prices) and periodic waste dumping of surplus product with no market.

Class 7 was established as a mechanism to allow the Canadian skim market to clear by providing for pricing at a competitive world price in either domestic or export markets.

Consistent with the WTO definition of export subsidies, exports based on Class 7 are not notified to WTO as subsidized.

With Class 7 priced competitively for domestic use or in export, it provides an incentive for renewal of skim processing investments, and investment in dairy processing in Canada has recently occurred.

The CUSMA singled out Class 7; however, its provisions present a challenge of interpretation. CUSMA provides for the following:

- Canada agreed to eliminate Class 7 within six months of ratification and to reclassify components in their appropriate end-use class.

- Canada agreed to a price mechanism for skim milk powder (SMP), milk protein concentrate (MPC) and infant formula using solely the U.S. wholesale price as a reference, with adjustments for Canadian product yields and manufacturing costs.

- Canada agreed to export volume thresholds for SMP and MPC (55,000 tonnes in year one, 35,000 tonnes in year two and then increasing by 1% per year). Beyond the export thresholds, a surcharge of $540 per tonne will apply. Analogous thresholds will apply to infant formula (13,333 tonnes in year one, 40,000 tonnes in year two and then increasing by 1% per year) with a surcharge over the threshold volume of $4,250 per tonne.

- CUSMA commits Canada (and the U.S.) to enhanced notification, information disclosure and consultation on any changes to milk classification and pricing.

The potential implications of these elements can only be inferred because the CUSMA text itself does not provide a statement of intent, and there are implied inconsistencies.

Canada agreed to eliminate Class 7; however, the agreement contains threshold volumes for SMP and MPC that exceed Canada’s subsidized export caps. This, in turn, implies acknowledgement by the U.S. that Canada can have non-contingent price classes, such as Class 7.

The implication would seem to be that Canada can have non-subsidized exports of SMP, MPC and infant formula. The agreement will require a new price class to replace Class 7 that incorporates or facilitates the volume surcharges, but many of the specifics around the surcharge are unclear.

CUSMA timing

The U.S. International Trade Commission published its study of CUSMA/USMCA in April 2019 and found the effects of the agreement on Canada-U.S. dairy trade were a 0.1% increase in U.S. dairy output.

With the publication of this study, the way is cleared for the process of formal review by Congress, culminating in an up-or-down vote regarding ratification. It remains unclear when this will actually occur. Early this summer, there has been a push by the U.S. administration towards ratification.

Previously, U.S. ratification had seemed far off – perhaps late 2019 or early 2020 – whether it can occur earlier, even in the coming weeks, is a matter of U.S. politics. Mexico has already approved CUSMA, and the approval process in Canada is underway.

From the time of ratification, Canada has six months before it must eliminate Class 7 and go through whatever process of policy adjustments that may entail.

Under swift U.S. ratification, this could bring these adjustments mid- or late in the 2019-20 dairy year; more deferred approval could push this forward towards the 2020-21 dairy year.

Conclusions

Slowing quota growth in Canada is consistent with increased penetration of cheese imports under CETA and the beginning of dairy imports under CPTPP.

The market access granted by Canada to the U.S. piles on top of this, and it can be expected the access established under CUSMA will certainly be filled.

A renewal of recent growth in the Canadian dairy market would blunt some of the increased market access, but nonetheless it will hurt.

The compensation for supply-managed industries announced by the federal government in the spring of 2019 is consistent with this.

The CUSMA provisions dealing with Class 7 are ambiguous and subject to interpretation. However, what does appear clear is that through the CUSMA, the U.S. confirmed Canada can have some non-subsidized dairy exports, presumably through non-contingent milk price classes.

This is a key victory for Canada in the CUSMA and, with this in place, the fundamentals of milk supply management can be retained. With some new limits, Canada will create a new non-contingent price to replace Class 7. ![]()

References omitted but are available upon request. Click here to email an editor.

Al Mussell is the Research Lead and Founder at Agri-Food Economic Systems. Email Al Mussell.