West Texas A&M meat scientist Dr. Ty Lawrence said developing relationships, understanding the grid in your market, knowing your cattle and the value of a good sort are important because in the “fine print” of the grid is the fact that the producer pays for mistakes.

As a marketing method, the grid is best judged by how a seller does over time, and it is a good way to pass value information back through the production chain.

Optimizing value was top-of-mind for 160 cattle feeders attending a recent seminar in southeast Pennsylvania, where Lawrence touched on the branded program premiums but focused his discussion on current trends, emerging labels and a behind-the-scenes understanding of the grid, which he said is the method used to sell 90 percent of the 3 million cattle on-feed in 125 Texas Panhandle feedlots.

When marketing fat cattle to the big four (JBS, Cargill, Tyson, National), the carcass beef value is a straight pass, or trade, from the cattleman through the fabrication floor to the consumer.

“The drop credit – the hide, head, heart, lungs, all the offal – that is what is running the plant,” Lawrence explained. “Some weeks in 2014, packers paid more to fabricate cattle than they were worth. There’s a whole lot of labor involved in the middle of that equation.”

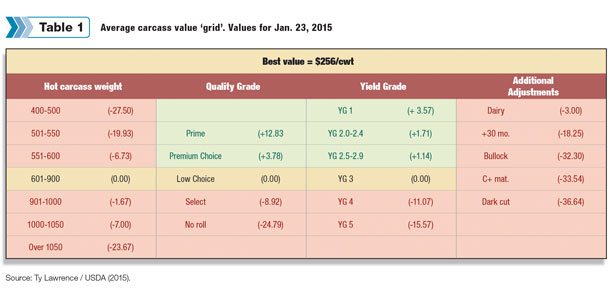

In grid marketing, it is important to know what the cattle are worth in the areas that influence value. These are defined as premiums and discounts (a.k.a. rewards and risks) after a base value is first established.

“The base price is what you negotiate,” said Lawrence. “The grid then applies quality discounts or premiums, yield discounts or premiums and weight discounts.”

Selling on the grid is where both the risk and reward are transferred from the buyer to the seller in three key areas: hanging carcass weight, quality grade and yield grade.

The negotiated base price covers the target low choice YG 3, 600- to 900-pound steer, and then the grid assigns premiums or discounts on anything falling outside of that (Table 1).

Click here or on the image above to view it at full size in a new window. (PDF, 1.6MB )

Selling on the grid forces producers to be more in touch with the market-readiness of their cattle, what they buy as feeders and when they sell their fats.

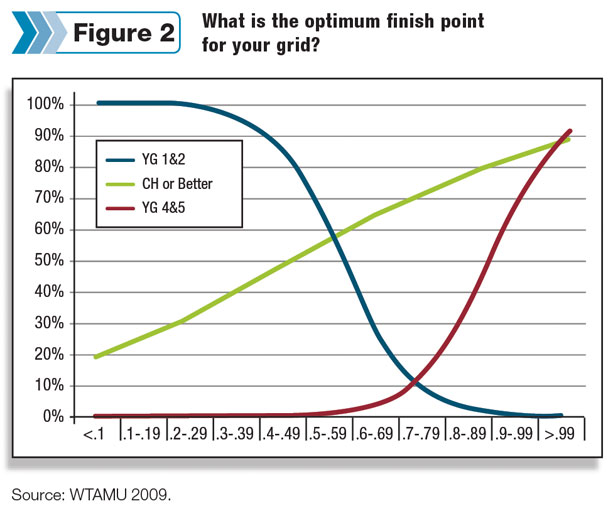

Using the 2011 National Beef Quality Audit distribution of quality grade, yield grade and weights, Lawrence said producers should watch how the three line up to find the optimum point of sale for “your market’s grid” (Figure 2).

On average, the negotiated base price accounts for 98 percent of the value. The weight and yield grade discounts or premiums together account for 0.3 percent and the quality grade premiums or discounts 0.8 percent.

“Other” discounts, combined, account for 0.8 percent of the carcass value. But there is nothing “average” about getting hit with a no-roll or a dark cutter, for example, taking a $25- to $40-per-hundredweight chunk of change off the table – at current base price levels.

In addition to managing the yield grade in association with higher-quality grade and to watch the spread between select and choice as it varies according to market conditions, Lawrence highlighted some grid marketing pitfalls and trends to be aware of in any market.

Shrink is underestimated. The examples shown by Lawrence from his weight studies indicate the typical 3 to 5 percent estimated shrink that is figured into most cattle buying equations is actually low.

“The reality is two or three times that,” said Lawrence, explaining that from both U.S. and Canadian feedlots, he found mud on the hide can weigh as much as 100 to 200 pounds.

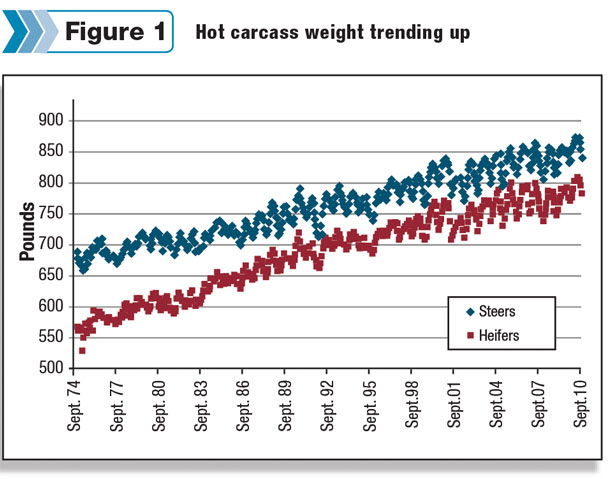

More discount pressure on lighter-weight carcasses is evident in the current market, according to Lawrence. He explained that with fewer cattle available, heavier weights have become a “market equalizer for packers.”

Carcasses are getting heavier with less discount pressure. As the heavyweight discounts are smaller today, “the threshold for getting hit with them is moving higher on the weight scale,” said Lawrence.

One reason is packers are looking to dilute the fixed costs of running the plant – particularly the significant labor costs – by producing more salable beef for roughly the same effort and expense.

“Carcasses are steadily getting heavier (Figure 1), and the 900- to 1,000-pound carcass could fast become average,” said Lawrence. “Fewer cattle and larger carcasses are the trend.”

Fast calculating – beef graders have roughly 10 seconds per carcass to click through a list of visual observations and mental math to determine preliminary quality and yield grades.

In-house plant graders have a vested interest in the outcome, and the decision to re-rail for a longer chill and second look depends on many factors.

“Graders do this every day, all day, and they have correlations with other graders once a month to improve consistency,” Lawrence explained. Automation is beginning to assist plant grading for improved accuracy at today’s faster line speeds.

Livers and lungs, hides and tongues – Lawrence noted that cattle tongue is the number one export in value – second only to the hides, which make up the largest part of the packer drop credit.

Liver and lung condition also affect the packer’s bottom line. Beef producers can reduce liver abnormalities with good bunk management and increase both value and performance by treating and preventing respiratory problems that can permanently scar the lungs.

Studies show the losses from liver and lung damage can range 23 to 54 pounds in carcass weight. “Those trims cost real dollars,” he said.

Zero-tolerance on food safety and humane slaughter concerns are changing the dynamics of beef processing and value. Large packers implement the latest technologies, spreading the cost over more cattle.

On the kill floor, centralized restrainers and pneumatics improve the speed and accuracy of the stunning process in a timed progression.

Plants are also implementing sanitation strategies for preventing the transfer of bacteria from the gut to the meat during evisceration and hide-pulling.

Some examples at the plant level are hide-on carcass washing, steam vacuuming and organic acid sprays, while at the feedlot level, vaccines and probiotics deter the growth of certain E. coli strains.

Plant workmanship issues that result in excessive trim losses, down-puller carcasses, busted guts and bloodsplash result in discounts to the producer on the grid, and any improper handling during transport and processing can lead to costly bruises and dark cutters.

On the horizon: USDA Tender. Cattle feeders learned that separate from the USDA quality grades on official age and marbling, the emerging USDA Tender and Ultra-Tender labels can qualify cattle outside the A-maturity range that have youthful meat color and meet the standard for mechanized shear-force testing.

This can open markets for beef from carcasses that would otherwise be costly no-rolls.

With all of the variables in mind, Lawrence stressed his “Top five rules of engagement” to optimize value from the grid (see sidebar below). ![]()

Sherry Bunting is a freelance writer based in Pennsylvania.

PHOTO 1: Dr. Ty Lawrence is director of the West Texas A&M Meat Laboratory and Beef Carcass Research Center.

PHOTO 2: As a marketing method, the grid is best judged by how a seller does over time. It also allows the passage of more beef value information back through the production chain as trends change. Photos courtesy of Sherry Bunting.

Top 5 rules of engagement

1. Develop an “other than adversarial relationship” with one or more packers.

Lawrence urged producers to learn and understand the packer’s business. “Ask what they need from you as a supplier, and understand what their customers are asking from them,” he said. Therein lay the eye-opener.

Cattle feeders learned that packers get constant requests from retailers looking for a unique labeled beef item they can call their own.

Having a relationship with more than one packer allows the cattle supplier to see cattle perform in different plants. This, plus No. 2 below, helps the seller have that important conversation with the buyer (and vice versa) on how to avoid those cattle management discounts from farm to plant.

2. Know your cattle.

Know with some confidence how they may perform in the grading cooler. Lawrence urged producers to build up and keep their cattle history.

“Unknown cattle are a big risk,” he said. “If you have no idea how they will perform, don’t sell them all on the grid.”

3. Sorting is key.

Lawrence urged sorting cattle at opportune times such as when they are received as feeders, at re-implant and a few weeks prior to harvest. “You have to do No. 3 in order to accomplish No. 2,” he said.

4. Crunch the numbers and know the grid.

By managing the distribution and number of cattle types in the feedlot, the operator knows where they are, when to move them and how to market them. “Pen riders are very important.”

“Also know your grids,” said Lawrence. “Make sure you know how the YG 4 discount affects the net value of a high choice or prime premium on the grid.”

5. Understand the market.

Knowing the historical trends and the market fuels the producer’s ability to “buy cattle with the sell in mind,” said Lawrence. In some of his examples, the seller reaped a reward from the grid, and in some cases the seller would have been better off selling an outlier in the pen average.