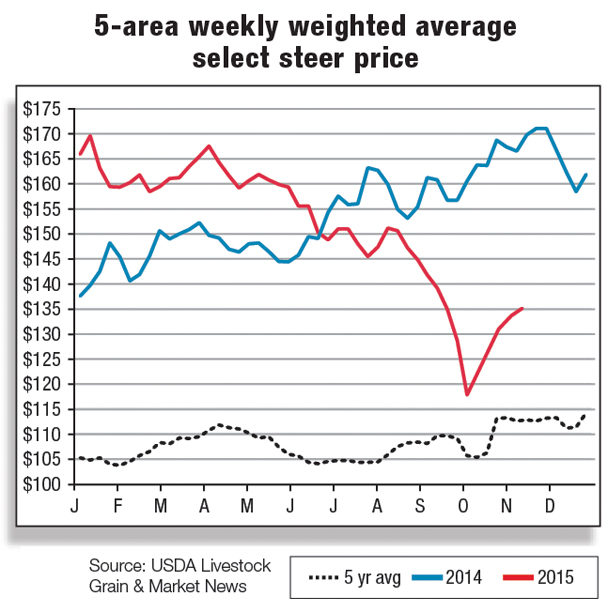

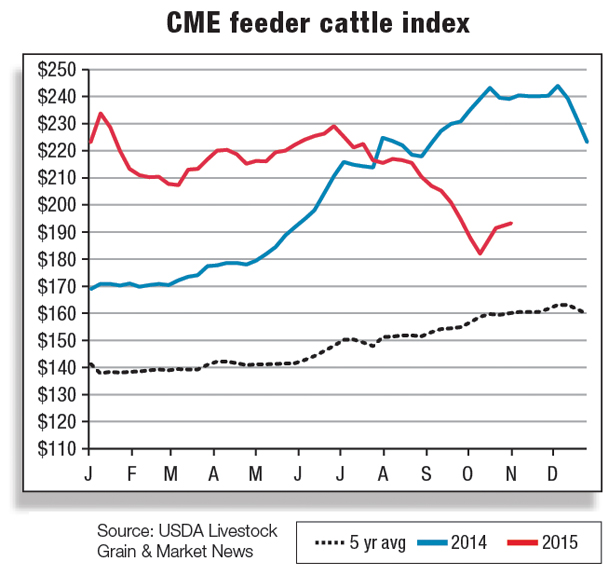

Oklahoma National Stockyards prices for medium No. 1 feeder steers weighing 750 to 800 pounds ranged between $187 and $192 per hundredweight (cwt) the week ending Oct. 5, 2015 (Oklahoma National Stockyards), down more than $20 compared with the same time last year.

Oklahoma National Stockyards prices for medium No. 1 feeder steers weighing 750 to 800 pounds ranged between $187 and $192 per hundredweight (cwt) the week ending Oct. 5, 2015 (Oklahoma National Stockyards), down more than $20 compared with the same time last year.

Reasons for the sharp declines in fed-cattle prices could include packer reluctance to pay higher prices during a time of softening beef prices and large supplies of heavyweight cattle. Mounting losses to cattle feeding are tempering demand for feeder cattle, pressuring feeder cattle prices downward. These plunging feeder calf prices will impact returns for cow-calf producers.

Reasons for the sharp declines in fed-cattle prices could include packer reluctance to pay higher prices during a time of softening beef prices and large supplies of heavyweight cattle. Mounting losses to cattle feeding are tempering demand for feeder cattle, pressuring feeder cattle prices downward. These plunging feeder calf prices will impact returns for cow-calf producers.

Pasture conditions

Drought persists in much of the West and the Southern Plains, after a respite earlier in the year (Oct. 6, 2015 U.S. Drought Monitor). The Oct. 6, 2015, U.S. Drought Monitor projected dry conditions to continue for the near term in Oklahoma and eastern Texas.

Through the week ending Oct. 11, 2015, the USDA Crop Progress reported that 23 percent of pasture and range conditions in the lower 48 were rated as poor or very poor, slightly worse than the same time the previous year.

California, Oregon and Washington each reported roughly 60 percent of their pasture and range conditions as poor or very poor. Ongoing drought could continue to adversely impact grazing in this region.

Despite abundant rainfall early in 2015, the recent lack of precipitation in the Southern Plains area may have an adverse impact on potential wheat pasture.

For the first week of October, Oklahoma made the least progress in its winter wheat plantings, but has caught up according to the Crop Progress report for the week ending Oct. 11, 2015. It was reported that 65 percent of winter wheat was planted in Oklahoma, down 12 percent compared with the same time last year and 1 percent below the 2010-2014 average.

Texas reported 48 percent of its winter wheat planted, down 14 percent year-over-year and down 10 percent compared with the four-year average. Many stocker operations depend on winter wheat grazing, but the current lack of rain has significantly delayed winter wheat emergence in the Southern Plains.

Placements and marketings

The early portion of 2015 had favorable pasture conditions and good precipitation levels, allowing producers to graze cattle for longer than typical periods. Many of the cattle grazing in 2015 reached the feedlot at significantly higher weights.

However, delayed winter wheat emergence could limit winter grazing availability for cattle located in the Southern Plains. This could reduce weights of feeder cattle placed in feedlots as absence of wheat pasture forces cattle into feedlots at younger ages and lighter weights. These lighter placements could also lead to lighter fed cattle and dressed weights being marketed in 2016.

However, delayed winter wheat emergence could limit winter grazing availability for cattle located in the Southern Plains. This could reduce weights of feeder cattle placed in feedlots as absence of wheat pasture forces cattle into feedlots at younger ages and lighter weights. These lighter placements could also lead to lighter fed cattle and dressed weights being marketed in 2016.

Recent placements of feeder cattle in feedlots of 1,000-plus-head capacity in 2015 have been record lows for the series that began in 1996.

August 2015 placements were 5 percent lower than August 2014, the lowest for August since the series began. Placements were low because producers kept cattle on pasture longer and generally to heavier weights, and feedlot operators have been resistant to paying high prices for feeders given their losses.

The August 2015 category of 800-plus pounds for feeder cattle placements on feed were about 4 percent above August 2014. Because of relatively cheap corn prices, cattle feeders have had the opportunity to keep cattle on feed longer, which has resulted in increased cattle-on-feed inventories year-over-year.

Like August placements, August marketings of fed cattle were the lowest for August since the series began in 1996. Marketings of fed cattle during August totaled 1.59 million head, or 6 percent below 2014. Cattle feeders have little incentive to sell their animals at current price levels and may be holding on to fed cattle, hoping for better market prices.

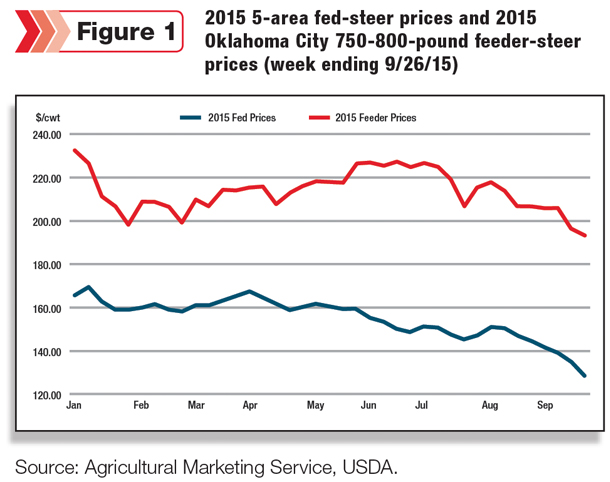

Cattle in these increased cattle-on-feed inventories have also been marketed at atypically heavy weights, dampening cattle feeding margins. For example, the estimated breakeven price for October 2015 is $174.22 per cwt (Cattle Feeder Simulator, meat statistics).

With current prices, cattle feeders could lose as much as $50 per cwt or more. Because of the recent collapse in fed cattle prices (Figure 1), the USDA’s third-quarter prices were reduced to $144.22 per cwt – down $14 from this time last year. The USDA revised fourth-quarter 2015 steer prices to $129 to $135 per cwt. Lower prices into early 2016 are expected to average $131 to $141 per cwt.

Weekly beef production surpasses year-prior levels

Cattle weights will continue to be an important factor to watch in the months ahead. Cattle are remaining on feed longer and are currently being marketed at record weights.

This is being heightened by the increase in the proportion of heavier-weight steers versus heifers and cows, resulting in near-term year-over-year increases in beef production despite the continuing constraint of cattle supplies. As of the week ending Oct. 3, federally inspected cattle carcass weights were reported at 850 pounds, and weights are expected to remain at relatively high levels in the fourth quarter.

In light of the factors mentioned above, the pace of marketings and heavy carcass weights, USDA revised third- and fourth-quarter beef production forecasts higher by 95 and 150 million pounds, respectively.

USDA projects 2015 beef production will reach about 23.8 billion pounds. Higher cattle slaughter levels, in conjunction with heavy carcass weights, are expected to increase beef production in 2016. The USDA’s current forecast for total beef production next year is nearly 25 billion pounds, up 5 percent relative to 2015.

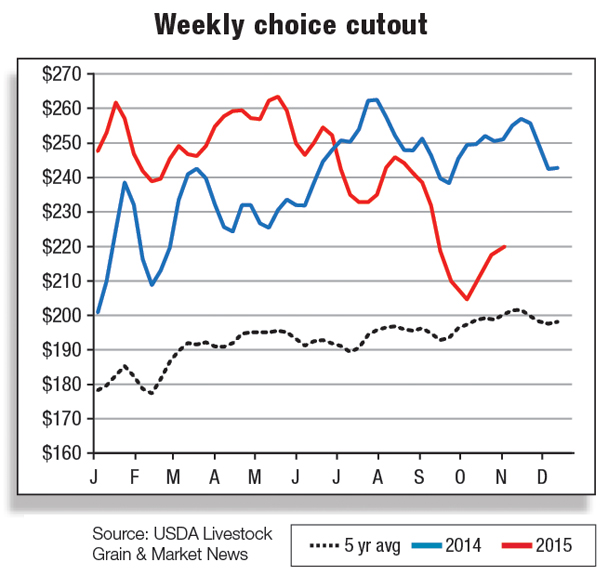

Wholesale prices plummet, choice-select spread narrows

The cattle and beef complex remains under immense pressure as a result of current supply and demand fundamentals. The abrupt decline in live cattle prices continues to support positive packer margins despite the simultaneous downturn in wholesale beef prices.

The recent increase in year-over-year weekly beef production has been a drag on beef cutout values, but another factor helping to explain the decline in wholesale prices is weaker-than-expected beef demand.

Beef primal values have declined sharply over the last month, some of which can be attributed to the seasonal transition from grilling items to roasting items.

Record-heavy steer and heifer weights continue to pressure the 50 percent lean beef (50CL) market. The expected seasonal uptick in cow slaughter in the fourth quarter, brisk imports of lean processing beef and large volumes of boneless beef in cold storage could result in further declines in the 90 percent lean beef (90CL) market.

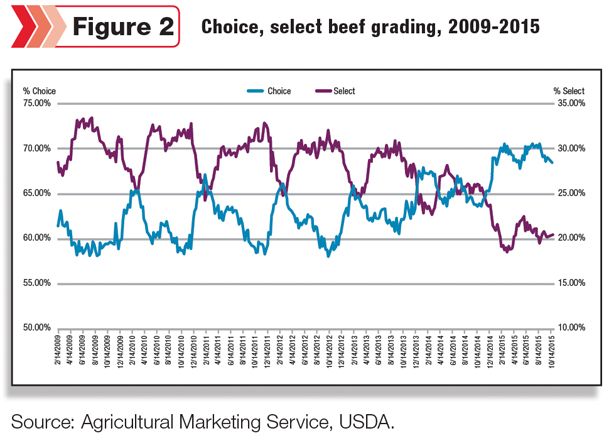

Choice and select beef cutout values have declined steadily since late August, and the spread between the two has narrowed (approximately $5.51 per cwt as of Oct. 9). Supportive of this squeeze is the current relationship between the percent of beef grading choice or select and the choice-select spread (Figure 2).

The narrowing spread between the choice-select cutouts is logical due to the large amounts of choice beef in the supply chain. Thus far in 2015, the percent of beef grading choice has ranged between 68 and 70 percent – and select between 19 and 22 percent, whereas for the same period in 2014, choice beef ranged between 64 and 68 percent – and select between 23 and 28 percent.

Limited global demand for U.S. beef constrains exports; beef imports remain robust

Year-to-date U.S. beef exports through August are about 12 percent lower than the previous year. Lackluster demand from key trading partners continues to hamper U.S. beef exports. Exports to Japan, Hong Kong and Mexico continue to experience strong declines year-over-year.

Beef exports to Japan have declined approximately 12 percent (January-August 2015) from the previous year due to increased competition from Australian beef exports and the overall high price for U.S. beef.

Exports to Mexico and Hong Kong are also lower by double-digit amounts. The USDA revised third-quarter exports 25 million pounds lower on weaker-than-expected global demand from key trading partners, in part a function of the negative effect of the strong U.S. dollar and bearish global economic pressures.

Total U.S. beef exports are forecast near 2.3 billion pounds in 2015, down 11 percent relative to 2014. However, exports are expected to improve in 2016 as U.S. beef supplies expand and domestic prices subside, spurring renewed global demand for U.S. beef.

It is also expected that Australian beef exports will slow as producers begin to rebuild herds after an extended period of herd liquidation. Beef exports in 2016 are forecast at just more than 2.4 billion pounds, up 6 percent over 2015.

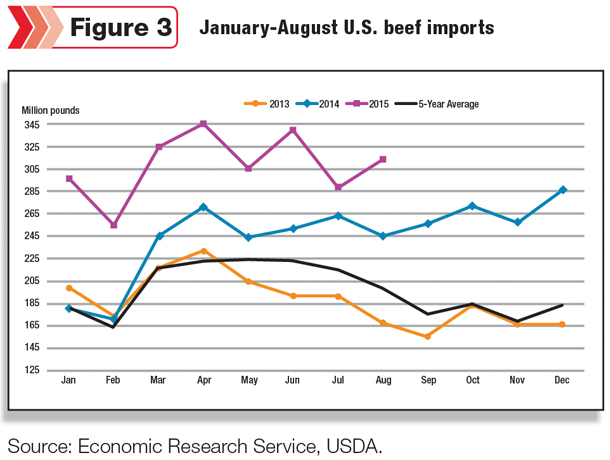

U.S. beef imports for 2015 are forecast at 3.4 billion pounds, increasing nearly 17 percent year-over-year. Robust shipments of lean processing beef from Australia and New Zealand have propelled beef imports to historic levels (Figure 3).

January-August 2015 beef imports from Australia and New Zealand are up 53 and 17 percent, respectively.

January-August 2015 beef imports from Australia and New Zealand are up 53 and 17 percent, respectively.

In addition, beef imports from Canada, Mexico, Brazil and Uruguay are noticeably higher year-to-date. However, the brisk pace of U.S. beef imports is expected to slow substantially in 2016 as a result of sharp reductions in processing beef imports from Australia.

Australia has experienced massive herd liquidation due to extreme drought conditions that began in 2012 and, as a result, is faced with shrinking beef cattle inventories. Smaller cattle inventory levels will translate into decreased slaughter and beef production next year, with subsequent lower exports for Australia.

In addition, expanding domestic U.S. beef supplies are expected to limit beef import demand in 2016. Beef imports for 2016 are projected to reach 3 billion pounds, down 11 percent relative to 2015.

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.