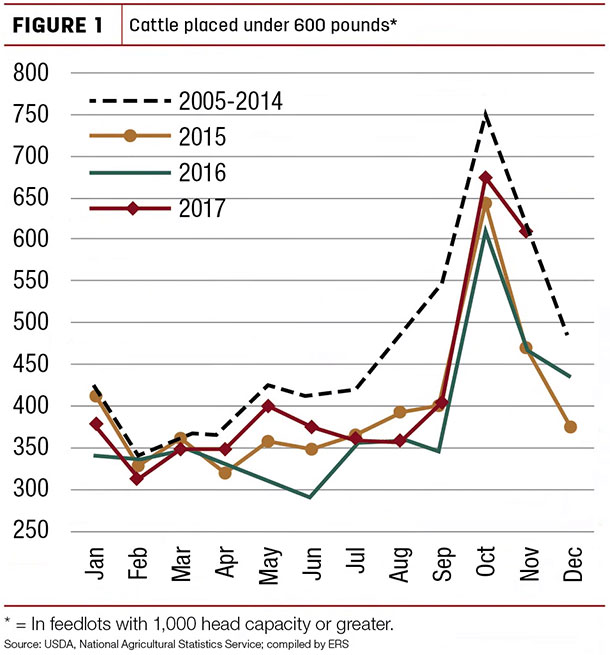

The seasonality of cattle placed in feedlots is historically characterized by peak placements of the lightest weight cattle during the fall for longer-term feeding, as summer forage supplies tighten during the fall weaning period.

According to the NASS Cattle on Feed report, net placements of cattle in feedlots (with 1,000 head capacity or greater) in November were 2.03 million head, which is 14.3 percent higher year-over-year. Based on that report, placements as a percent of cattle weighing under 600 pounds reached 29 percent.

Further, 140,000 more head (30 percent) of cattle in this category were placed than in November 2016 (see Figure 1).

The Cattle on Feed report could suggest a shift in 2017 back to a more seasonal placement pattern of lightweight calves into feedlots in the fourth quarter.

Larger expected marketings to boost beef production in 2018

Greater year-over-year placements in October and November 2017 suggest that the number of cattle outside feedlots available for placement remains large. NASS released the semiannual Cattle report on Jan. 31, providing estimates of heifers held for breeding and an insight into the number of cattle available for placement during 2018.

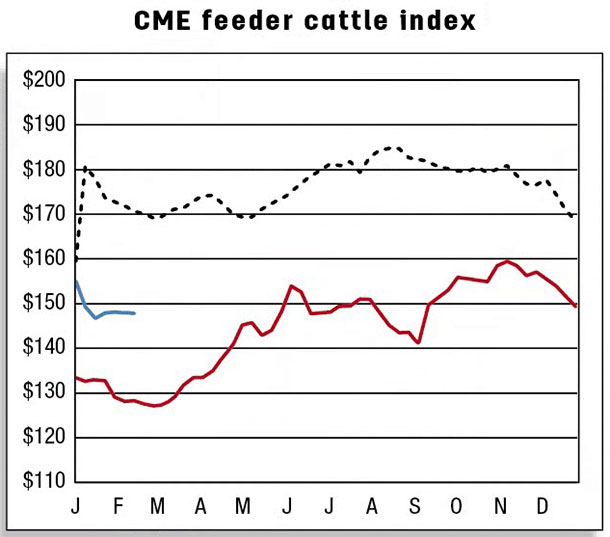

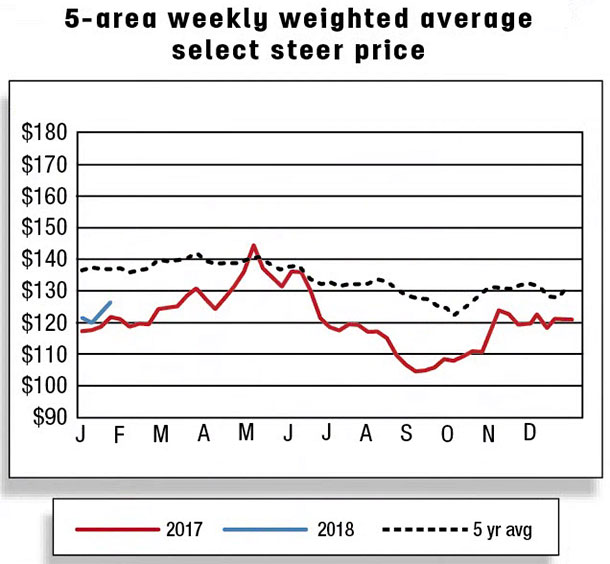

The 2018 beef production forecast was raised from last month by 170 million pounds to 27.8 billion pounds on greater expected marketings and slaughter. Although cattle prices have been stronger than previously expected given higher anticipated marketings, fed steer prices will likely remain below levels of the first half of 2017.

The 5-area fed steer price forecast for the first quarter of 2018 was adjusted higher to $120 to $124 per hundredweight (cwt), as well as for the second quarter, to $115 to $123 per cwt. The forecast for 2018 feeder steer prices was left unchanged from last month.

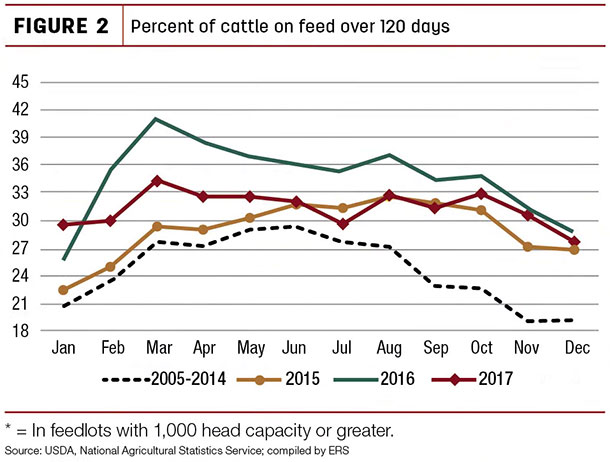

In the last quarter of 2017, although increasing relative to 2016, the percentage of cattle on feed over 120 days remained below the prior year (Figure 2).

Given expected pressure on fed cattle prices from larger placements in second-half 2017, feedlot operators will likely have incentives to continue to aggressively market finished cattle in 2018. As feedlots are expected to maintain a rapid pace of marketings in the first half of 2018, the percent of cattle on feed beyond 120 days should stay relatively low.

U.S. beef imports revised upward for 2017

The 2017 U.S. beef import estimate has been revised upward by 10 million pounds to 2.98 billion pounds from the previous month’s forecast. This is largely due to continued strength in imports from Australia and Canada. Imports from Australia picked up in recent months, increasing by 46 percent, 67 percent and 35 percent year-over-year, in September, October and November 2017.

Imports from Canada have also been stronger, increasing 23 percent year-over-year in November. AMS weekly reports, Imported Meat Passed for Entry in the U.S. by Country (LSWIMPE), also indicate stronger imports at the end of 2017. Forecasts for 2018 are unchanged from last month. November 2017 U.S. beef imports were fractionally lower than year-earlier levels, totaling 212 million pounds.

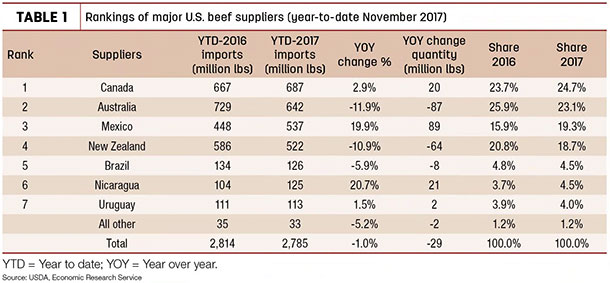

Imports were higher from Australia (+13.2 million pounds) and Canada (+12.1 million pounds), but imports from other major sources such as Mexico (-10.9 million pounds), Brazil (-9.4 million pounds), Uruguay (-6.2 million pounds) and New Zealand (-1.6 million pounds) were lower. Year-to-date November imports were 2.78 billion pounds, about a 1 percent decline from the same period last year. Table 1 shows the year-to-date rankings of countries based on 2017 imports from major suppliers.

Year-to-date November U.S. beef exports up

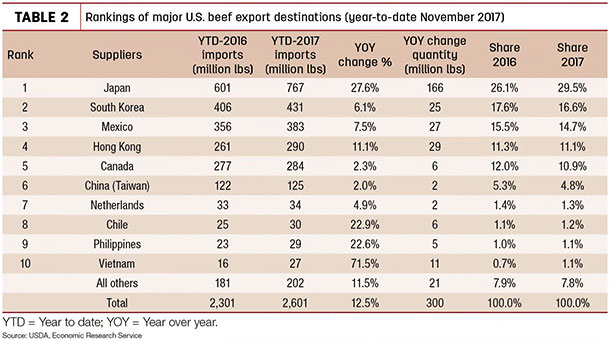

November 2017 U.S. beef exports increased 2.6 percent from 2016 to 261 million pounds. November was the lowest growth month thus far in 2017. After several months of strong growth, the pace of exports to Japan and Mexico slowed and exports declined to Canada, South Korea, Netherlands, Indonesia and Taiwan.

Through November 2017, exports were 13 percent higher (+320 million pounds). Most of the increased exports were to the higher-income Asian countries, including Japan, South Korea, Hong Kong and Taiwan. Increased supplies in the U.S. and higher export demand are likely drivers of the increase in exports during this period. Table 2 shows U.S. beef exports through November to major destinations.

Cattle imports and exports revised upward

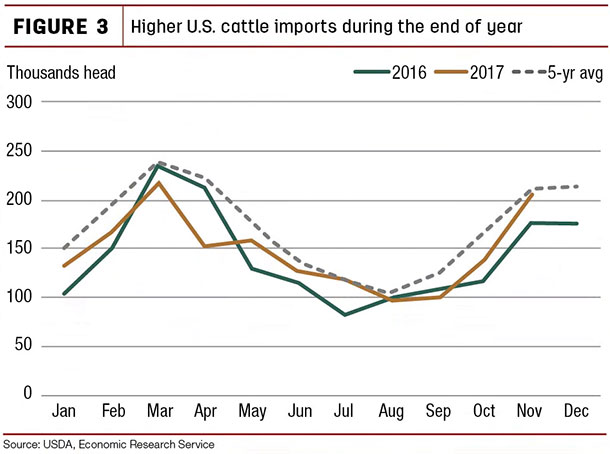

Live cattle imports were strong in November 2017, recording 29,325 head above year-earlier levels, totaling 206,296 head. Increased imports from Mexico more than offset declines from Canada. Year-to-date through November, 1.62 million head of cattle were imported, 89,565 head above a year ago. The AMS weekly reports (ALLS625, WALS637) also indicate stronger December imports.

Based on stronger year-to-date growth, higher imports during the end of the year (see Figure 3) and AMS weekly report preliminary December data, 2017 cattle imports have been revised upward by 10,000 head to 1.82 million head.

In November, U.S. cattle exports topped 36,469 head, the highest monthly export volume to date for 2017, and 23,358 head (178.2 percent) above the previous year. Further, successively higher year-over-year monthly exports from January through November totaled 168,814 head, which is three times more cattle than was exported in 2016. Most of these cattle were shipped to Canada.

A significant proportion of the increased exports fell into the “other than purebred breeding animals” category, either for feeder or slaughter purposes. Higher feeder cattle prices in Canada compared to the U.S. during October and November 2017 partially supported this cattle movement. Recently, Canadian feeder cattle prices have softened while U.S. prices have strengthened, dampening potential movements.

Historically, December cattle exports are roughly equal to shipments in November. As a result, 2017 U.S. cattle exports have been revised upward by 20,000 head to 185,000 head. The cattle export forecast for 2018 has also been revised upward by 15,000 head to 190,000 head. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.