The product that all in the cattle industry are in business to produce – beef – ultimately begins with seedstock producers. The quality of genetics disseminated throughout commercial cattle herds influences all other sectors of the industry, including efficiency in the feedlot, quality on the rail and finally consumer satisfaction.

It is a significant responsibility for seedstock producers to not only produce quality genetics for their customers but also to market those genetics. Yet, they are often expected to do so with relatively limited information regarding what commercial customers are prioritizing when making their selection decisions, and what marketing tools they should be using as they market bulls each year.

With this in mind, in 2017 the Red Angus Association of America (RAAA) commercial marketing team began collecting a broad range of price and marketing data while attending bull sales across the country. With five consecutive years of price and marketing data, RAAA now houses the most comprehensive bull marketing dataset of any breed association. This unique dataset is capable of informing seedstock producers of selection priorities for their commercial customers and best practices for marketing their cattle.

Prior to evaluating the data, it’s important to understand the data collection process. The RAAA commercial marketing team, designed to serve commercial cattlemen, operates in a way which is unique to the breed association world. The role of the team at bull sales is to visit with commercial producers about RAAA’s value-added programs and marketing opportunities available through RAAA, while assisting them with bull purchases as needed. Price and marketing data for this analysis has been collected by commercial marketing personnel while attending these sales. While the dataset does not include all Red Angus bulls sold, it does comprise a representative sample.

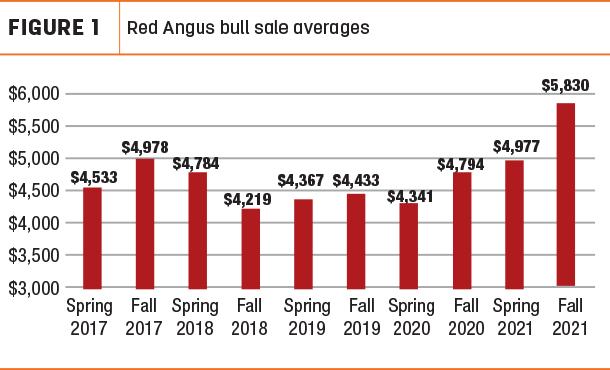

Transparent price discovery occurs in the auction setting, and the market has certainly done some unexpected things in recent years. Particularly following the turmoil caused by the COVID-19 pandemic, the bull market responded much differently than one might have expected. While bull prices took a slight hit in the second half of the spring 2020 sale season when restrictions were first implemented, Red Angus bull sale averages have increased since, achieving a record high of $5,830 in the fall 2021 sale season (see Figure 1).

In 2021, we also saw a record number of “high-selling” bulls, with 103 Red Angus bulls dropping the gavel at $15,000 or more. Another testament to the strength of the market this year, 35% of Red Angus bull sales attended by staff averaged $5,000 or more. The number of Red Angus bull sales attended by staff has increased by 18% over the past five years, which is one indicator of breed growth.

The largest volume of Red Angus bulls is marketed during the spring sale season, with 80% of bulls being sold in the spring compared to the fall. The Red Angus bull market also has regional tendencies. Over the past five years, the top five states for volume of bulls sold have been Montana, North Dakota, South Dakota, Nebraska and Kansas, with Montana consistently leading.

EPDs and indices

To understand the emphasis bull buyers place on specific expected progeny differences (EPDs) and indices, an analysis of the correlation between sale price and selection criteria has been conducted each year. The EPD with the highest average correlation to sale price is Average Daily Gain (ADG), indicating bull buyers favor high-growth bulls with a larger spread from weaning to yearling. Note, the ADG EPD was added to the RAAA EPD suite in 2019.

The trait with the next-highest correlation to sale price is the Grid Master index, RAAA’s terminal index, which places selection pressure on growth, feedyard performance, feed efficiency and carcass traits. It may be no surprise that yearling weight and weaning weight had the next-highest correlations with price, again an indicator that growth is very important to Red Angus bull buyers.

The ProS index, released in 2020, ranked in the top five for traits of importance. The ProS index is RAAA’s all-purpose index, predicting average economic differences across all segments of the beef supply chain. It is encouraging bull buyers are prioritizing this index, indicating that while growth is important, they are still selecting for a balanced set of traits.

Accurate data

Data is king, and this analysis has shown customers value data. Sales which provided ultrasound data, feed intake data and/or genomic testing on bulls averaged higher than sales which did not. Taking a closer look at the genomic testing factor, 48% of bulls (averaging $5,042) had genomic testing, and 52% (averaging $4,878) did not.

Genomic testing bulls increases EPD accuracies, giving buyers more precise data with which to make their selection decisions. For seedstock producers, genomic testing provides better information for customers and comes with a price advantage for bull sales. Thus, we’d hope to see an increase in the percentage of bulls with genomic enhanced EPDs in coming years.

Best foot forward

In addition to genetic components, phenotypic soundness is, and should be, a high priority for commercial customers. The RAAA commercial marketing team assigned a subjective foot score to each sale offering, ranking the offering below, at or above average for feet. Bulls in the “below average” category averaged $4,272, offerings with an “average” foot score garnered $4,961, and bull offerings with “above average” feet averaged $5,934. Clearly, not only does selecting for soundness better serve commercial customers as bulls go to work for them, but it also heavily impacts sale averages.

Larger variety

Volume of bulls offered had a consistently significant effect on sale average, with the price advantage for sales offering 100 or more bulls ranging from $924 to $1,069 on average compared to sales offering fewer bulls. This is likely because larger offerings attract more customers, and larger sales are often hosted by reputable producers who have been in the seedstock business longer. We have seen an increase in the percentage of smaller offerings over the past five years as new players enter the bull business during Red Angus breed expansion.

The online bidding ring

The increased adoption of technology for bull sales has been interesting to observe. In 2021, bull sale averages for sales offering online bidding was $1,135 higher than sales that did not. The number of sales utilizing an online bidding service has jumped from 90% to 98% since 2017. Every year of data collection, bull sale averages have been higher for sales which display bulls on video during the auction rather than run them through the ring.

The price advantage is likely due to the faster pace of the sale and mitigated risk of a bull blowing up in the ring. Customers also favor sales held directly on the ranch, the advantage ranging between $497 and $947. Perhaps as a result, we have seen more Red Angus bull sales held onsite in 2021 than any other year.

Consumer services

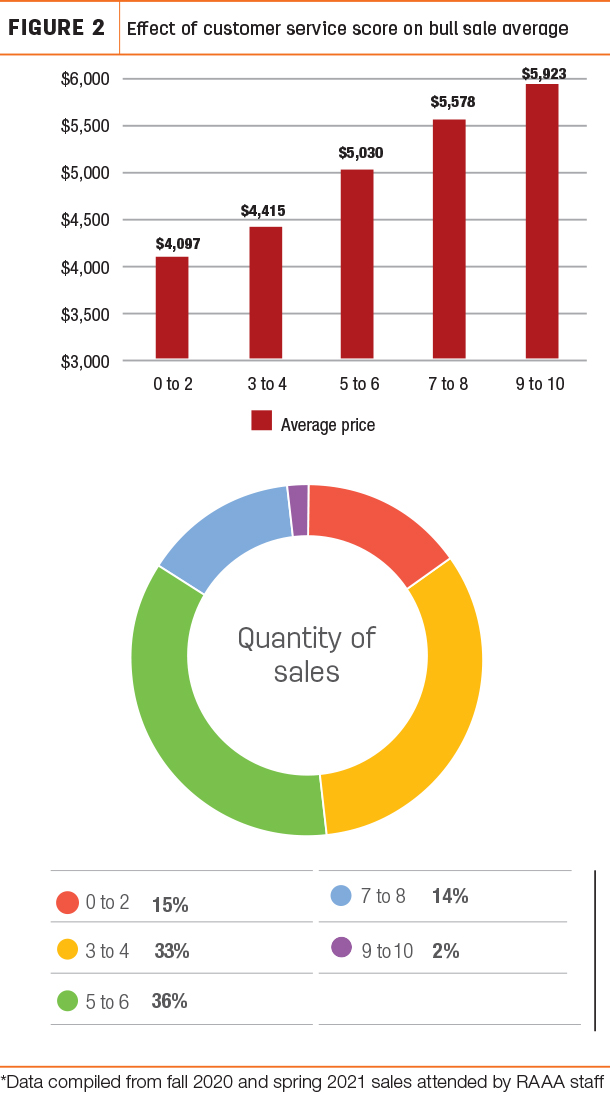

An analysis of customer service practices has also been evaluated for effect on sale price. The following 10 factors have been found to positively impact bull sale averages:

- Hosting a pre- or post-sale event

- Offering insurance

- Volume discounts

- Discounting bulls hauled home the day of sale

- Free delivery

- First breeding season guarantee

- Health guarantee

- Top Dollar Angus seedstock partnership

- Offering cost share for Feeder Calf Certification Program enrollment

- “Other” customer service as determined by the RAAA commercial marketing team

The number of customer support services offered by the seller positively correlates with sale average (see Figure 2) and are additive in most situations.

Much can be learned through bull price data analysis of this type. It is RAAA’s goal that seedstock producers gain valuable knowledge from these efforts to improve their production sales and better serve their customers.

To see the complete data analysis, visit Red Angus - educational-resources.