However, from a price perspective, the market appeared to have considered just how large these numbers were, and there has been substantial risk covering since the pre-report estimates were released mid-last week. Expectations don't stay the between when they're taken and when they're revealed.

Cattle on feed for the slaughter market in the U.S. for feedlots with capacity of 1,000 head or more head totaled 11.958 million head on Jan. 1, 2020. The inventory was 2.3% above Jan. 1, 2019. This is modestly more cattle than were anticipated prior to the report but well within the range of estimates by traders and analysts. Inventories in five of the seven states are higher, while those in Iowa are essentially level and Nebraska are down from prior years. Further, cattle on feed over 90 days and over 120 days have begun their seasonal climb that usually peaks in March. These two inventories are behind last year's numbers with the aggressive marketings through the last half of last year and cautious placements.

Marketings of fed cattle during December totaled 1.834 million head, 5.3% above the same month in the prior year. These are strong marketings. Expectations were also for an increase of 5.3% above the prior year. Placements in feedlots during December totaled 1.828 million head, 3.5% above the same month of the prior year. Pre-report expectations were for placements to be 3.3% above the prior year. Again, the actual report estimates aligned very closely to what was expected prior to the report.

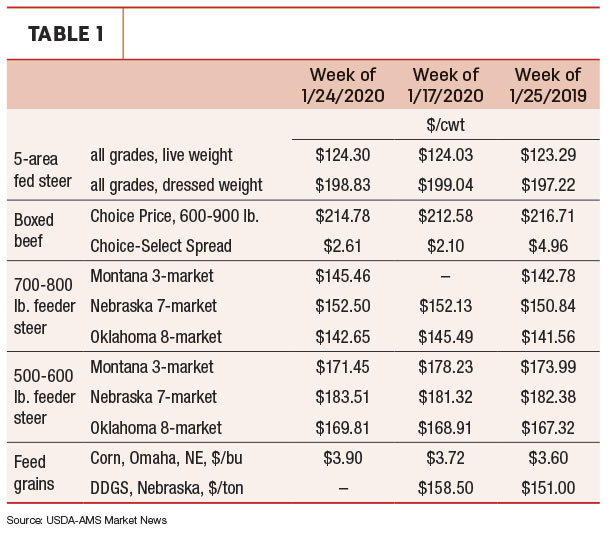

Beef supplies through the first quarter of 2020 will likely be above the prior year's quarter, and it is unlikely fed market prices will see similar strength. That appears to be what the live cattle futures market is communicating. Beef demand and beef primal cut prices were excellent through the fall. The strength of these market drivers is softening. February tends to be a tough month for downstream margins, slaughter volumes and any price improvements. The adjustment appears to have started early and just ahead of the report.

The markets

What do the technicals say? Live cattle and feeder cattle futures have been in a trading range and at resistance levels since early November. I had anticipated a breakout one way or the other: up if demand stayed strong and trade news materialized or down if the strong moves since September were not sustainable and required some form of correction. Down it is. This is a clear sell signal. The market pressed a little over $1 per hundredweight past the resistance formed last April as was not able to move any further. Local support was pressed Jan. 23 and broken Jan. 27. Trading volumes since the first full week of January have been very high, and there was substantial accumulation to open interest. High volumes imply any signal was observed, and accumulating open interest implies the change is permanent.

The technicals communicate that lots of risk protection were established. More bad news is that there is not much clear support formed during the market up-move from September to November. A 50% correction seems likely. I expect the market to think about filling today's gaps. And I also see the potential for substantial volatility until we get closer to spring. The recent Cattle on Feed report wasn't much of the surprise, but the numbers are large and point to issues in the first quarter. ![]()

Stephen R. Koontz is a professor in the department of agricultural and resource economics at Colorado State University. This originally appeared in the Jan. 27, 2020, Livestock Marketing Information Center’s In the Cattle Markets newsletter.