- ADC seeks answers on pricing concerns, hearing criteria

- Senate ag committee 2023 Farm Bill field hearing set in Arkansas

- February all-milk, mailbox price spread averaged 82 cents

ADC seeks answers on pricing concerns, hearing criteria

Members of the American Dairy Coalition (ADC) board sent a letter to U.S. Secretary of Agriculture Tom Vilsack last week, highlighting dairy policy concerns and seeking an update on a potential Federal Milk Marketing Order (FMMO) hearing.

Key points highlighted in the letter from the six-member ADC board included:

- Make allowance adjustments: The ADC board asked that any consideration of adjustments in FMMO manufacturing or “make” allowances to address higher costs for processors should also factor in the higher costs for dairy producers.

“Farmers experience the same areas of input cost increases as processors,” the ADC board stated. “We believe any move to increase the make allowance credits for processors should be linked to achieving adequate, transparent milk pricing for farmers. The linkage helps ensure farmer representation.”

-

Dairy policy consensus: Noting Vilsack’s previous comments that the dairy industry must reach a consensus on possible reforms before the USDA would consider an FMMO hearing, the ADC board sought information on “specific requirements that will meet your expectations.”

- Class I pricing formula: The ADC said there is already industry-wide consensus that the Class I milk pricing formula change made in the 2018 Farm Bill needs to be amended, although there are differences in how this should be accomplished. The change from the “higher-of” to the “average-of plus 74 cents” Class III and Class IV advance pricing factors was made through the farm bill and not through an FMMO hearing process.

“Our voice was pre-empted in the last farm bill … and our dairy farmer members paid the price for that. We do not want to see this happen again,” the letter states.

The ADC estimated the change in the formula directly resulted in a $750 million cumulative devaluation of Class I milk since May 2019, which created an environment for massive depooling and negative producer price differentials (PPDs), affecting prices for all classes of milk. Producers also saw losses through premiums paid on risk management tools that failed to protect them from the dysfunction that ensued, undermining their confidence in these tools.

“Dairy farmers share a strong consensus that ‘righting this wrong’ is a great place to start in opening an FMMO hearing,” the letter states. The letter noted that the organization had met virtually with dairy farmers across the country over the past 20 months, conducted surveys, spoke with industry experts and conducted two federal milk pricing forums in 2022.

Earlier this spring, the ADC identified policy priorities, including a return to the higher-of Class I milk pricing formula, simplification and transparency in milk price payment statements and tying higher processor make allowances with higher minimum prices paid to dairy farmers.

Senate ag committee 2023 Farm Bill field hearing set in Arkansas

The Senate Committee on Agriculture, Nutrition and Forestry will hold another field hearing on the 2023 Farm Bill, June 17. The hearing will be held at Arkansas State University in Jonesboro, Arkansas, 9-11 a.m. (Eastern time), hosted by U.S. Sen. John Boozman (D-Arkansas), ranking member of the Senate ag committee.

Witnesses will be announced prior to the hearing and will include Arkansas agricultural producers, industry stakeholders and rural community supporters. The hearing will be streamed live online at the U.S. Senate Committee on Agriculture, Nutrition and Forestry website.

The first field hearing was held April 29 in Michigan, the home state of U.S. Sen. Debbie Stabenow (D-Michigan), committee chair.

Read: Senate kicks off 2023 Farm Bill hearings.

February all-milk, mailbox price spread averaged 82 cents

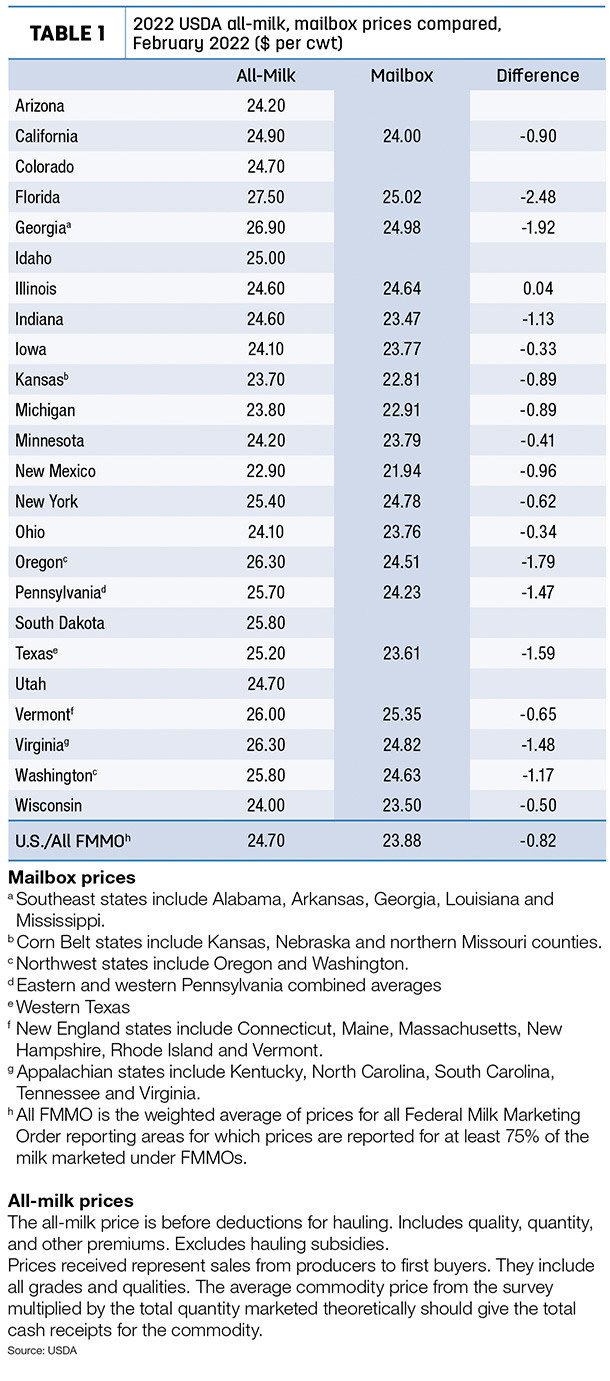

February 2022 “mailbox” prices averaged about 82 cents per hundredweight (cwt) less than announced average “all-milk” prices for the same month, based on a preliminary look at two USDA milk price announcements.

- During February, U.S. all-milk prices averaged $24.70 per cwt, up 50 cents from January 2022 and $7.60 more than February 2021.

- The February 2022 mailbox prices for selected FMMOs averaged $23.88 per cwt, up 68 cents per cwt from January 2022 and $8.18 more than February 2021, but 82 cents less than the announced all-milk price.

In Table 1, Progressive Dairy attempts to align the state-level all-milk prices and the FMMO marketing area prices as closely as possible. February’s spread between individual states or regions varied widely. Producers in two states, Illinois and Kansas, saw February 2022 mailbox prices surpass the announced all-milk prices.

The difference in the two announced prices can affect dairy risk management, since indemnity payments under the Dairy Margin Coverage (DMC), Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are all based on the all-milk price.

As Progressive Dairy notes each month, there’s a disclaimer of sorts. Comparing the all-milk price and mailbox price isn’t exactly apples to apples.

- All-milk prices: The all-milk price is the estimated gross milk price received by dairy producers for all grades and qualities of milk sold to first buyers before marketing costs and other deductions. The price includes quality, quantity and other premiums, but hauling subsidies are excluded.

Prices are reported monthly by the USDA National Ag Statistics Service (NASS).

- Mailbox prices: The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing.

Data included in all payments for milk sold are over-order premiums; quality, component, breed and volume premiums; payouts from state-run over-order pricing pools; payments from superpool organizations or marketing agencies in common; payouts from programs offering seasonal production bonuses; and monthly distributions of cooperative earnings. Annual distributions of cooperative profits/earnings or equity repayments are not included.

Included in mailbox price costs associated with marketing milk are hauling charges; cooperative dues, assessments, equity deductions/capital retains and reblends; the FMMO deduction for marketing services; and federally mandated assessments such as the dairy checkoff and budget sequestration deductions.

Mailbox prices are reported monthly by the USDA’s Agricultural Marketing Service (AMS) but generally lag all-milk price announcements by a month or more.

- Geographies may differ. The price announcements also reflect similar – but not exactly the same – geographic areas. The NASS reports monthly average all-milk prices for the 24 major dairy states. The mailbox prices reported by the USDA’s AMS cover selected FMMO marketing areas.

For example, while NASS reports an all-milk price for Georgia, the mailbox price lumps Georgia with other Southeast states: Alabama, Arkansas, Louisiana and Mississippi. Similarly, Kansas is part of the Corn Belt states, Oregon and Washington are combined in the Northwest states, Vermont is among six New England states, and Virginia is clustered with Kentucky, North Carolina, South Carolina and Tennessee among Appalachian states. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke