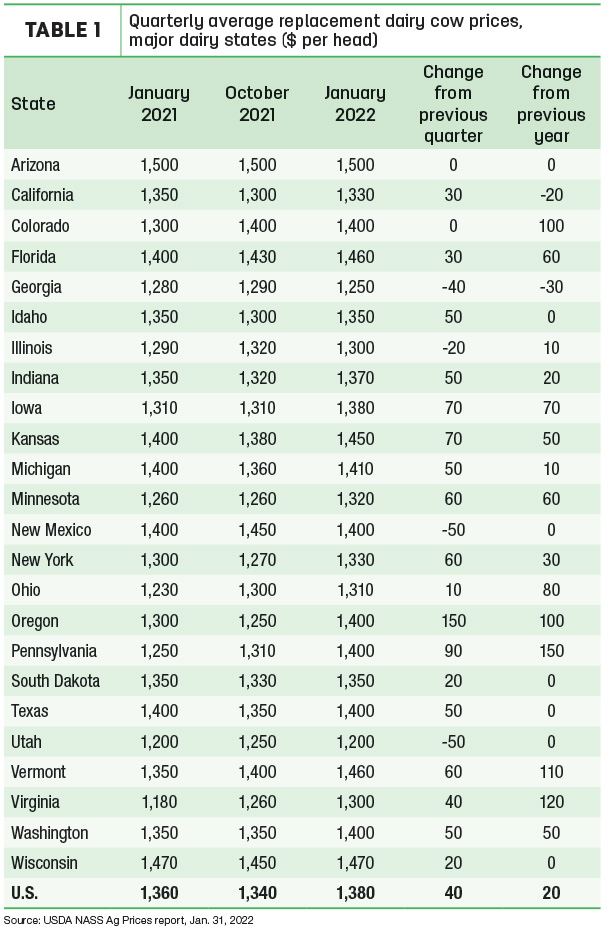

U.S. replacement dairy cow prices averaged $1,380 per head in January 2022, up $40 from October 2021 and $20 more than January 2021. The U.S. average price was still 35% per head less than the latest high of $2,120 per head in October 2014.

The USDA estimates are based on quarterly surveys (January, April, July and October) of dairy farmers in 24 major dairy states, as well as an annual survey (February) in all states. The prices reflect those paid or received for cows that have had at least one calf and are sold for replacement purposes, not as cull cows. The report does not summarize auction market prices.

Compared to the previous quarter, average replacement cow prices were up in 18 of 24 major dairy states tracked by the USDA (Table 1). Prices were down in four states and unchanged in two others. The largest quarterly increases were in Oregon, up $150 per head, and Pennsylvania, up $90 per head. In contrast, average prices were down $50 in New Mexico and Utah.

Compared to a year earlier, January 2022 replacement cow prices were up $100 or more in Colorado, Oregon, Pennsylvania, Vermont and Virginia, but $20-$30 lower in California and Georgia.

When overlaid on USDA Milk Production reports, changes in average replacement prices were again weakly correlated with trends in cow numbers in indidual states. The major states saw dairy cow numbers drop by about 42,000 between December 2020 and 2021 (the latest estimates available), with largest declines in New Mexico and Washington. As of December, U.S. cow numbers were down 132,000 head since peaking in May 2021 and were the lowest since December 2020.

Progressive Dairy’s Cattle Market Watch tracks dairy heifer prices from about 20 auction markets throughout the U.S., with price summaries updated about every two weeks. The listings cover top and medium springers, shortbred and open heifers, and heifer calves.

2022 starts with fewer cows, fewer heifers

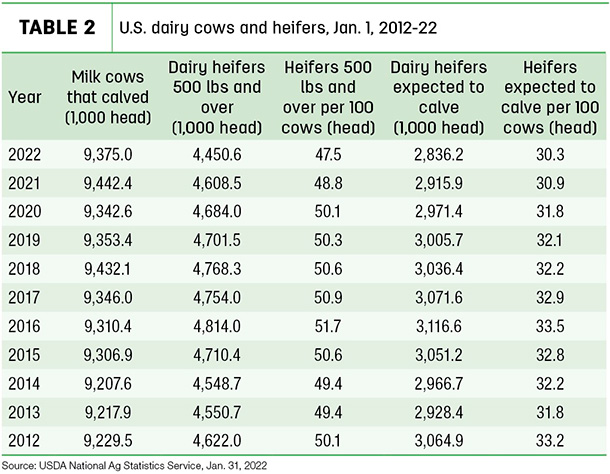

After setting a quarter-century high in 2021, the USDA’s semiannual estimate of cattle inventories indicates there were fewer dairy cows and replacement heifers to start the new year.

As of Jan. 1, 2022, U.S. dairy herds contained about 9.375 million dairy cows that calved in 2021, down about 67,400 (1%) from a year earlier (Table 2).

Just 10 states had more cows to start 2022 than a year ago, led by South Dakota (+29,000), Wisconsin (+15,000) and Texas (+10,000). In contrast, herds in New Mexico (-45,000), Washington (-18,000) and Ohio (-10,000) led the 29 states with fewer cows than a year earlier.

Looking at potential replacements, there were about 4.450.6 million dairy heifers weighing 500 pounds or more, down 157,900 from a year earlier and the lowest number to start a year since 2009. That averages out to be about 47.5 heifers per 100 cows, the smallest ratio since 2009.

Of the dairy replacement heifers, 2.836 million head are expected to calve in 2022, down about 79,700 from 2022. As of Jan. 1, 2022, there were 30.3 replacements expected to calve for every 100 cows currently in the herd, the smallest percentage since 2001.

The inventories are based on data compiled by the USDA from about 34,800 dairy and beef operations during the first half of January.

(Detailed statistical analysis of state and national dairy herds and milk production will be featured in the April 1, 2022, issue of Progressive Dairy.)

Cull cow prices hold

Finally, U.S. prices received for cull cows (beef and dairy, combined) averaged $69.10 per hundredweight (cwt) during December 2021, just 10 cents less than November and highest average for December since 2015.

The December 2021 average was up $11 per cwt from a year ago. With December’s estimate, the 2021 average cull cow price was $70.14 per cwt, the highest annual average since 2016.

Drought and higher feed costs drove beef and dairy cow culling rates higher for most of the second half of the year, and U.S. annual dairy cull cow slaughter was estimated at 3.1 million head in 2021, about 42,700 head more than 2020 and the fourth consecutive year above 3 million. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke