New-crop corn futures have steadily increased over the past two months. Thus, there is not any relief in sight for higher feed costs. With higher interest rates, the cost of storage becomes a larger concern. There is currently very little carry in the corn futures prices, suggesting that going hand-to-mouth for feed needs could be considered if the feeder can ensure they can secure supplies later.

Corn yields in the northern Plains are not great, but production levels and old-crop stocks levels suggest that securing feed later in the marketing year would not be an issue. However, the price may not be attractive. For those looking for price protection, the implied volatility in the corn market remains in normal ranges despite the higher price levels. Thus, end users may consider buying a call option to protect from further price increases.

Continued high corn prices would be expected to impact livestock feed use. For example, higher prices should result in lower slaughter weights or fewer animals slaughtered at very heavy finish weights. Costs of gain should have downward pressure on returns to feeding at heavy weights. However, the prices have been high on the cash side for a long time, so the impact is not being reflected in recently observed weights.

The recent price shock has been observed in feeder cattle futures, which have fallen as corn has increased on the futures side. In the recent World Agricultural Supply and Demand Estimates (WASDE) report, there is very little feed use adjustment even though the corn price is high. The market continues to act hungry for corn, which also limits the carry in that market.

The other prominent feed is hay, either from alfalfa or grass. In the October Crop Production report, the production of both types was revised to sharply lower than in August. Grass hay production is much lower in 2022 than in 2021 from South Dakota to Texas. At the national level, old-crop hay stocks were a modest 16.8 million tons on May 1. The 2022 production total of 112 million tons gives a supply of 128.8 million tons. A little checking suggests this is the lowest U.S. production and supply level since the 1950s.

Very severe rationing with recent prices suggests fall hay use of 56.6 million tons and Dec. 1 stocks of 72.2 million tons; both would be levels not seen in decades. In August (the most recent national numbers available), the U.S. all hay price of $246 per ton was sharply higher than the price of $193 per ton in 2021. A slightly softening of fuel costs may help mitigate the most extreme price differences, but the general price level will remain high until supplies can improve in future years.

The higher U.S. dollar, compared to most other currencies in recent months, would have a slight dampening effect on the hay situation. The U.S. is a net exporter of hay, as exports exceed imports. The stronger dollar would push the U.S. price higher for importers, making it less attractive in the global market. However, there are not many economical sources for imported hay for U.S. feed consumption.

The markets

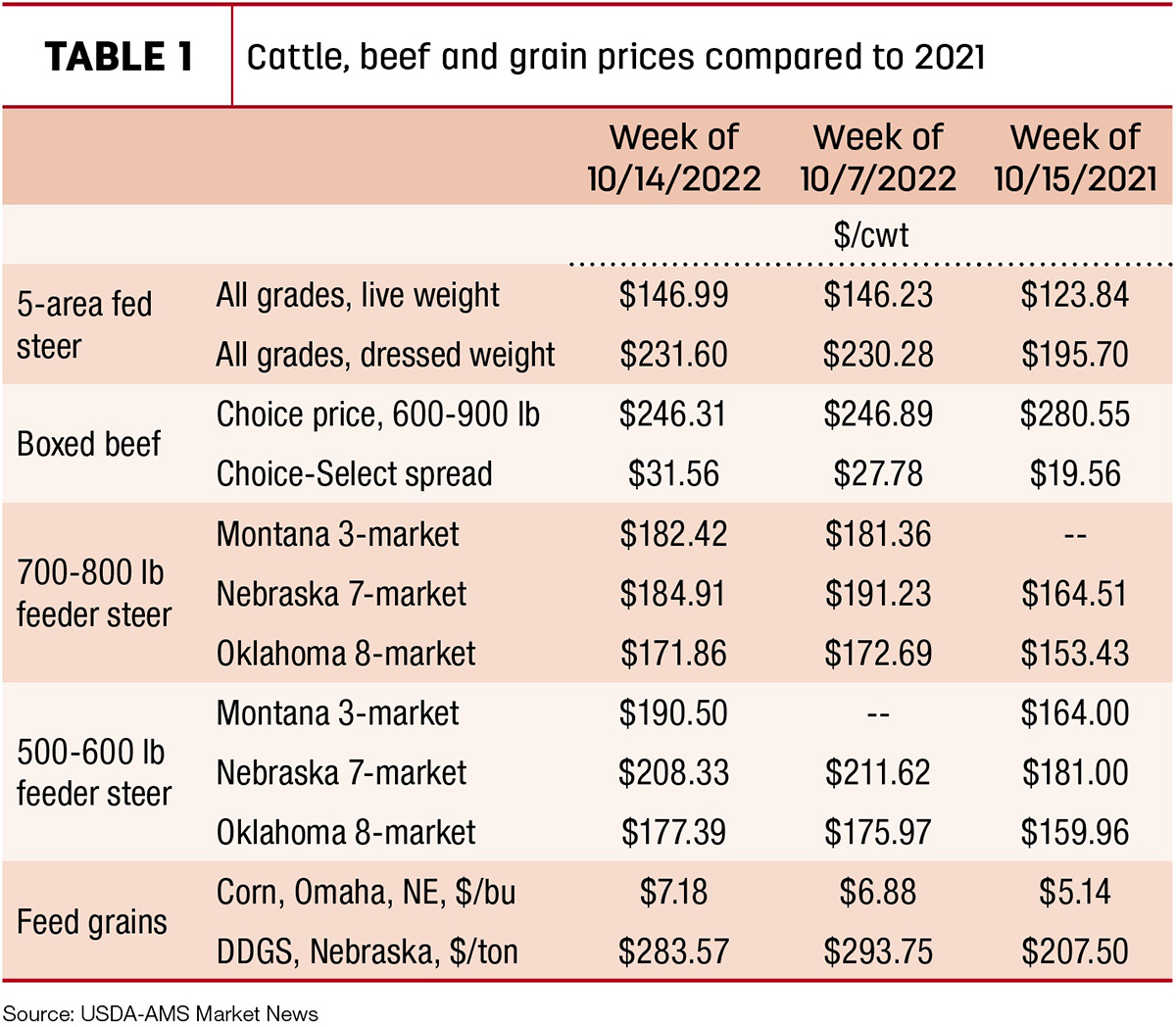

The cattle markets finished mixed for the week. In the cash trade, fed cattle were higher on a live basis and on a dressed basis. Feeder cattle prices were mixed as heavier-weight cattle traded higher and lighter-weight cattle traded lower, mostly higher on limited volume. On the futures side, live cattle were higher, while feeder cattle were steady. Cash corn was higher, while on the futures side, new-crop prices remained steady.

This originally appeared in the Oct. 17, 2022, Livestock Marketing Information Center In The Cattle Markets newsletter.