Inflation

The rate of annual inflation has steadily declined per the consumer price index (CPI), since reaching a peak of 8.9% in June 2022, with the most recent data reflecting a 5% annual rate of inflation. The producer price index (PPI) has also declined from its high of 9.4% and was only up 2.1% in March 2023.

The PPI for all farm products, a measure of prices received by agricultural producers, fell in March on a year-over-year basis to -3.3%, the first annual decline in this measure since 2020.

Why does inflation matter for agriculture?

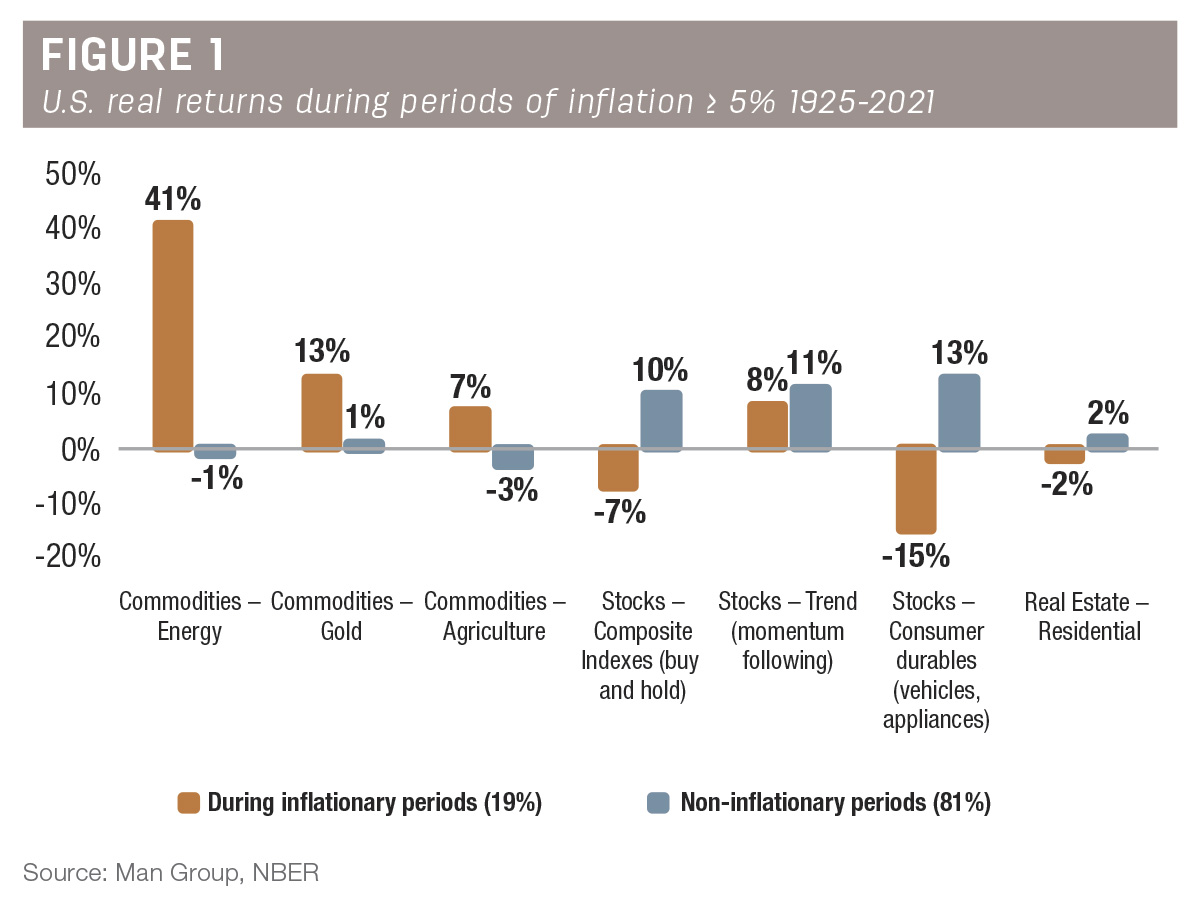

Research by the Man Institute found that over the past 95 years the U.S. experienced rates of inflation that were 5% or higher 19% of the time (Figure 1).

- During periods of high inflation, agricultural commodities increased in price with real adjusted returns that were above 7%.

- When inflation fell below 5%, agricultural commodities realized negative real returns of minus 3%.

During lower periods of inflation, agricultural producers rely on increasing total farm production and improved productivity to support earnings. With annual rates of inflation trending down and likely to move below 5%, we can anticipate lower real returns for agricultural commodities.

Inflation history vs. today

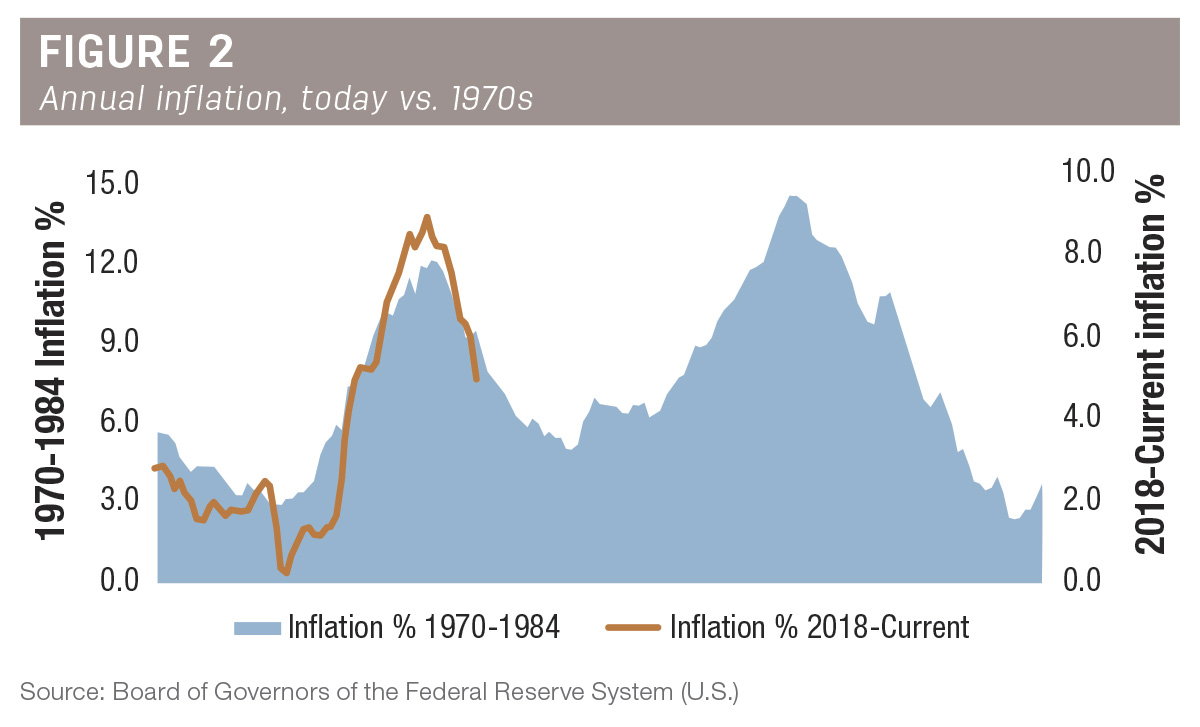

Historically, inflation tends to follow a wave pattern. After the initial rise, it tends to recede swiftly and then form another wave. Even if inflation continues to decline in the near term, it is likely there will be further episodes of inflationary pressure before this era of inflation is over. Figure 2 illustrates the inflation wave pattern from the 1970s compared to today.

The fall in inflation during the 1970s came because of the 1973-74 recession, which was steep, painful and drawn out. The Federal Reserve pivoted early because of the economic challenges facing the U.S. economy and set the stage for the next wave of inflation.

Arthur Burns was chairman of the Federal Reserve at the time, and his legacy has been associated with the economy of the 1970s and having failed to curb inflation. The current chairman of the Federal Reserve, Jerome Powell, is concerned about his legacy and frequently references his commitment to fighting inflation as “Keeping At It” during press conferences and speeches, a not-so-subtle reference to the title of Paul Volcker’s autobiography.

Powell will soon come under pressure to begin easing monetary policy as the U.S. economy faces a possible recession. After being late to recognize inflation as more than a “transitory” phenomenon, Powell’s legacy will be defined by this economic cycle and whether he is successful in preventing a second wave of inflation. As a result, the Federal Reserve’s bias will likely be to maintain interest rates higher for longer, even as the U.S. economy continues to slow.

Federal Reserve policy

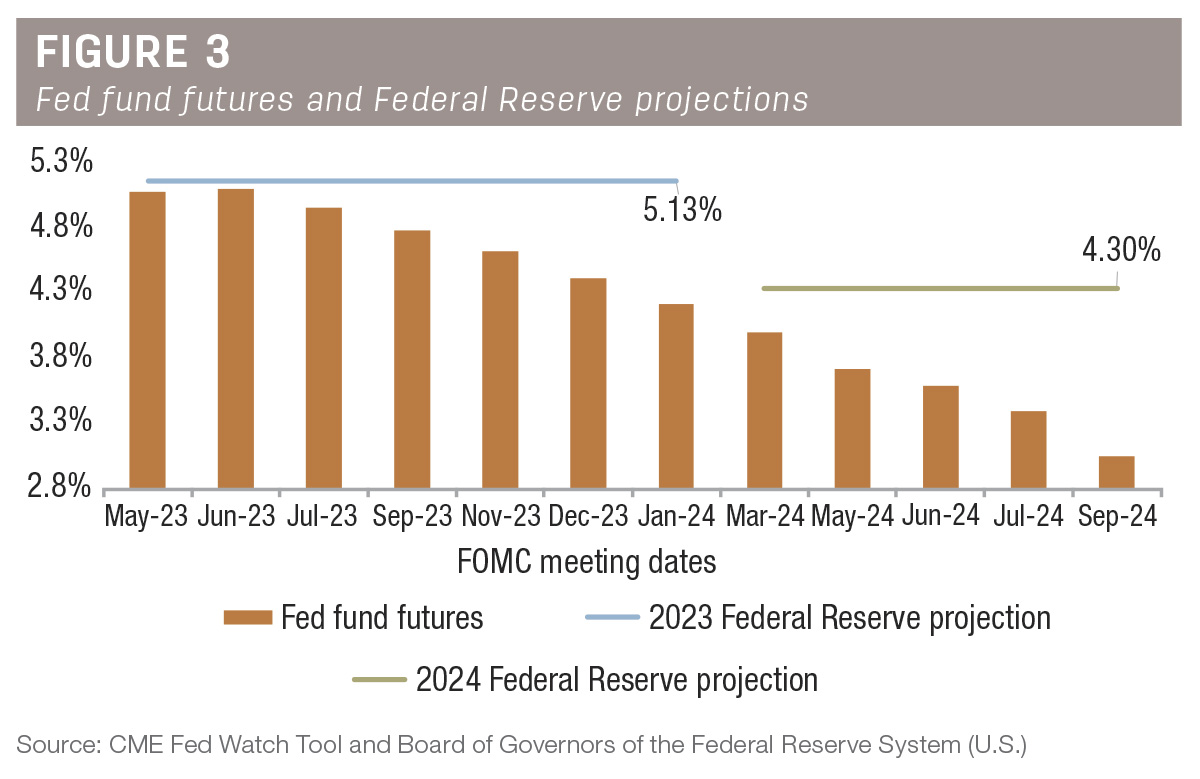

The most recent rate hike by the Federal Reserve was most likely the last rate increase of this cycle. Fed fund futures suggest market participants believe the Fed will begin cutting rates during the second half of 2023. Fed fund futures are pricing in a 2.1% decrease by September 2024, as illustrated in Figure 3.

The Federal Reserve’s projections are more conservative and suggest they will hold short-term rates at their current level through the end of 2023 before easing in 2024. The interest rates on most agricultural producers' operating lines of credit and other variable-rate loans will change in similar fashion as the federal funds rate.

Over the past two decades, the Fed has cut the fed funds rate an average of 3.5% during recessions, which has led some analysts to suggest the Fed fund futures are also pricing in a 60% chance of recession. A recent Bloomberg survey placed the odds of a U.S. recession at 65% during the next 12 months.

What happens next?

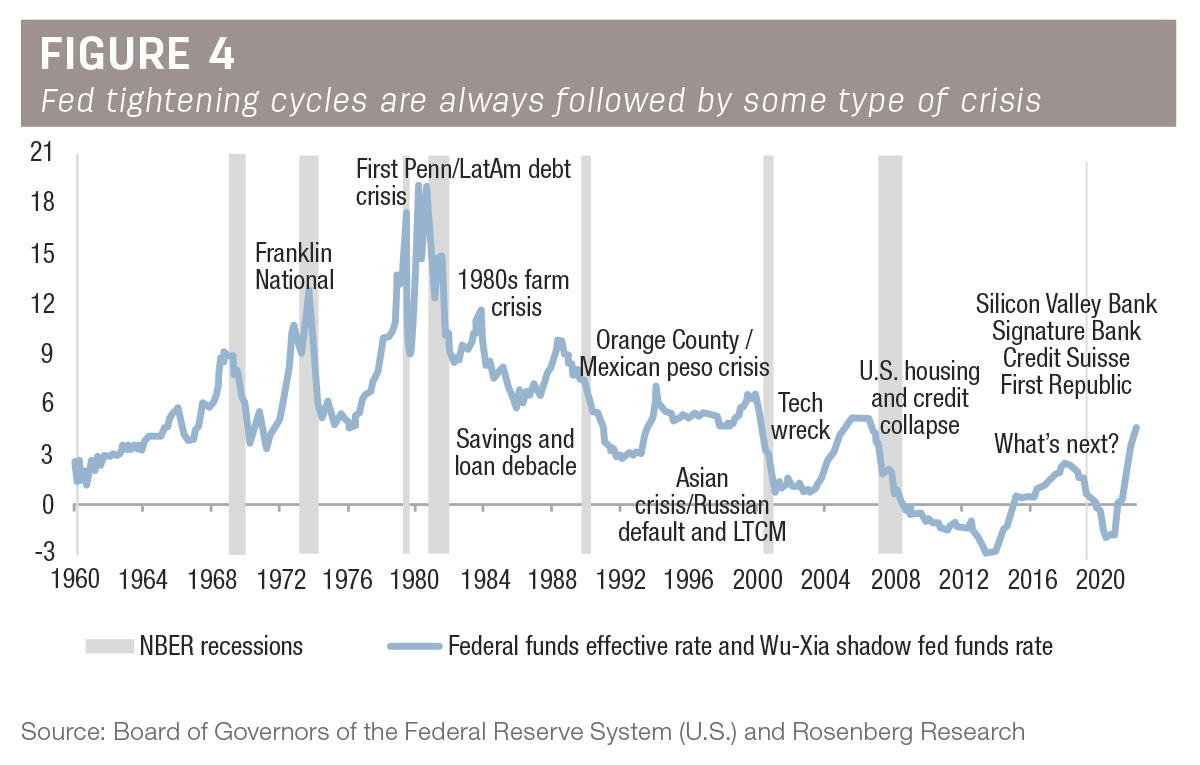

Federal Reserve tightening cycles have always been followed by some type of crisis event. As noted in Figure 4, these crisis events played out on both the world stage and domestically.

The reserve currency status of the U.S. dollar results in Federal Reserve policy having considerable influence on foreign exchange markets, international liquidity and interest rates around the globe. Notably, the farm crisis of the 1980s occurred after the most aggressive Fed tightening cycle in history. Paul Volcker was chairman of the Federal Reserve and took short-term interest rates to 20%.

The recent increase in interest rates and the resulting devaluation of bond holdings has led to the collapse of Silicon Valley Bank, Signature Bank and, most recently, First Republic. Credit Suisse was also combined with USB in a forced merger by Swiss banking regulators. The further impact of the recent banking stress already includes reduced lending from commercial and community banks. With deposits being drawn down, it will be difficult for banks to lend aggressively in this environment, creating a significant headwind to economic growth.

The natural consequence of higher interest rates is slower economic growth, with a lag. A large body of research suggests it may take 18 months or longer for the full impact of tighter monetary policy to be realized in the broader economy.

Conclusion

The current rate hiking cycle kicked off just over a year ago. While the most recent Fed rate hike is likely the last increase of this cycle, it will take many months for the full effect of higher interest rates to be realized. High interest rates, decreasing inflation and slower economic growth will lead to lower prices in many sectors of the agricultural economy.

.jpg?height=auto&t=1713304395&width=285)