Improved working capital and equity positions in 2022 helped reduce the number of U.S. farms filing for Chapter 12 bankruptcy in 2023. There will likely be additional financial stressors in 2024.

Based on data from the U.S. district bankruptcy courts, Chapter 12 filings fell to 139 in 2023, down 30 (18%) from 2022 and the lowest in two decades.

Chapter 12 was introduced in bankruptcy law as a temporary measure in 1986 and became permanent in 2005. With 139 filings, farm bankruptcies in 2023 were the lowest since 108 in 2004 and the lowest since Chapter 12 became permanent in 2005.

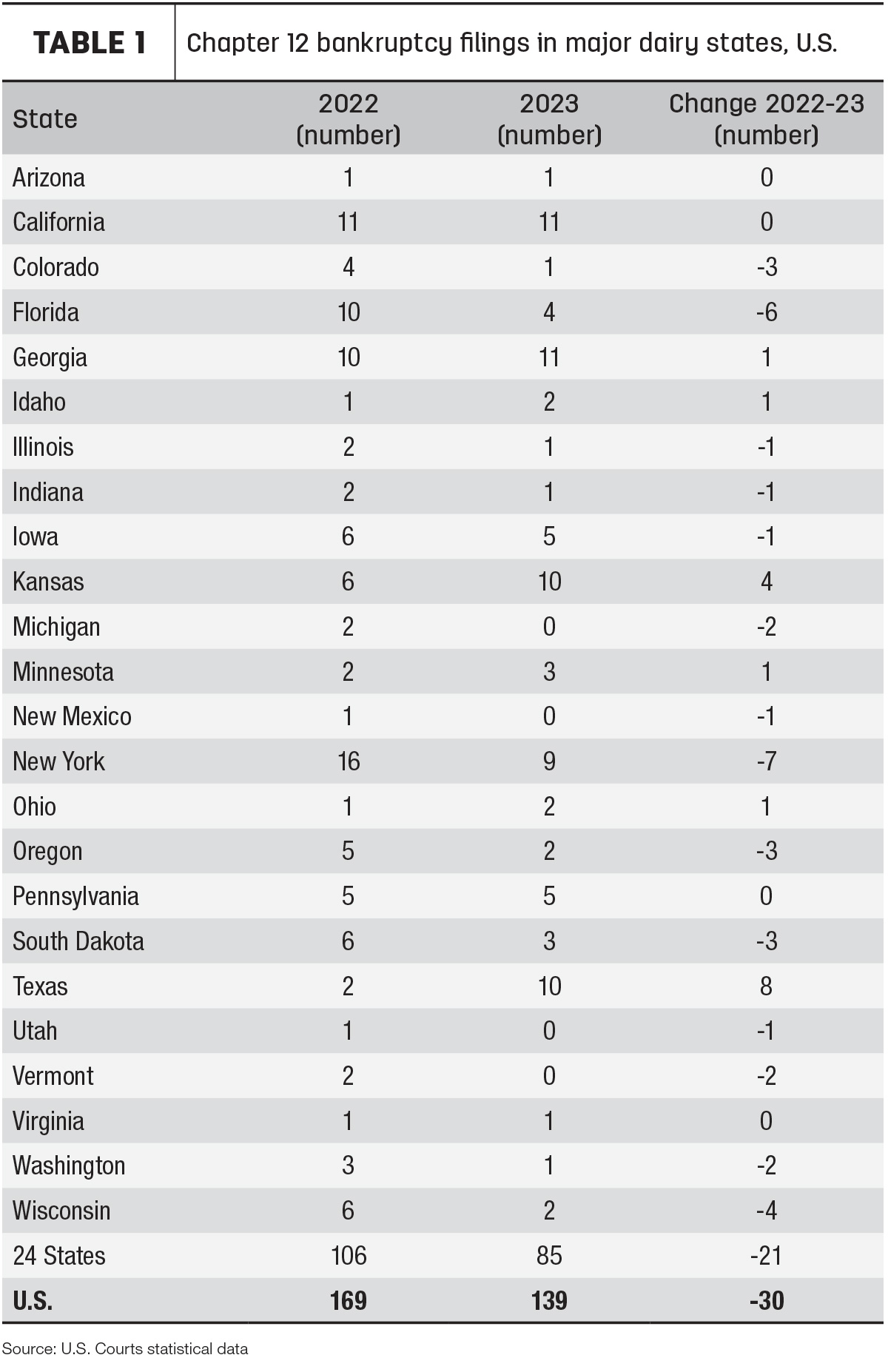

Among the 24 major dairy states (Table 1), Chapter 12 filings totaled 85 for the year ending Dec. 31, 2023, down from 106 in 2022. The total does not necessarily mean the filings were by dairy operations. Among those states, 2023 filings were highest in California and Georgia (each 11), Kansas and Texas (each 10) and New York (nine).

Chapter 12 bankruptcy does not mean the loss of the farm. Designed for family farmers with "regular annual income,” Chapter 12 bankruptcy allows financially distressed farmers to restructure financials and propose a repayment plan – usually over a three- to five-year period.

The number of U.S. farms filing for Chapter 12 bankruptcy during 2021-23 were in sharp contrast to previous years, when filings hit 599 in 2019 and 560 in 2020. Previous high filings hit 723 in 2010, 712 in 2003 and 637 in 2011.

The USDA’s Farms and Land in Farms report, released on Feb. 16, estimated the number of farms in the U.S. for 2023 was estimated at 1,894,950, down 5,700 farms from 2022. In 2023, 48.3% of all farms had less than $10,000 in sales, down from 50.8% in 2022, and 79% of all farms had less than $100,000 in sales, down from 81.4% the prior year. In 2023, 9.7% of all farms had sales of $500,000 or more, up from 7.5% in 2022.

Looking ahead to 2024, U.S. dairy producers are expected to have less money to invest and spend in 2024. The USDA’s 2024 Farm Sector Income Forecast was released on Feb. 7. Specific to dairy, 2024 cash receipts from milk sales were forecast at $45.5 billion, down $900 million from the $46.4 billion in 2023 cash receipts, due to lower milk prices. The 2024 estimate is down $11.75 billion from the $57.25 billion in 2022 milk cash receipts. Cash receipts from milk sales averaged $40.89 billion in 2019-21 and $35.86 billion from 2015-18.

The Farm Sector Income Forecast projected 2024 Dairy Margin Coverage (DMC) program payments at $264.5 million, also down $900 million from the record high of $1.2 billion in 2023.

In addition to lower cash receipts and a decline in direct government farm payments, the USDA forecasts steady feed costs but higher outlays for labor and interest in 2024.

Across the entire agricultural sector, debt-to-asset levels are forecast to worsen slightly to 12.78% in 2024. Working capital is forecast to fall 16.6% in 2024 relative to 2023.

High interest rates are adding another expense to farmers’ lists of rising input costs, according to analysis by the American Farm Bureau Federation. Operating loans and other forms of financing cost farmers a whopping 43% more in 2023 than in 2022 and are forecast to remain elevated for much of 2024, causing working capital (cash) stocks to decline faster and forcing farmers to lean on expensive credit to provide liquidity.