Here’s a summary of news impacting your dairy as we approach the middle of February 2024.

- Fewer dairy cows in drought areas

- Cash receipts from milk, DMC payments expected to fall $1.8 billion in 2024

- GDT index increases 4%

- Ag producer survey shares outlook, carbon payments

- Coming up

- In case you missed it

Fewer dairy cows in drought areas

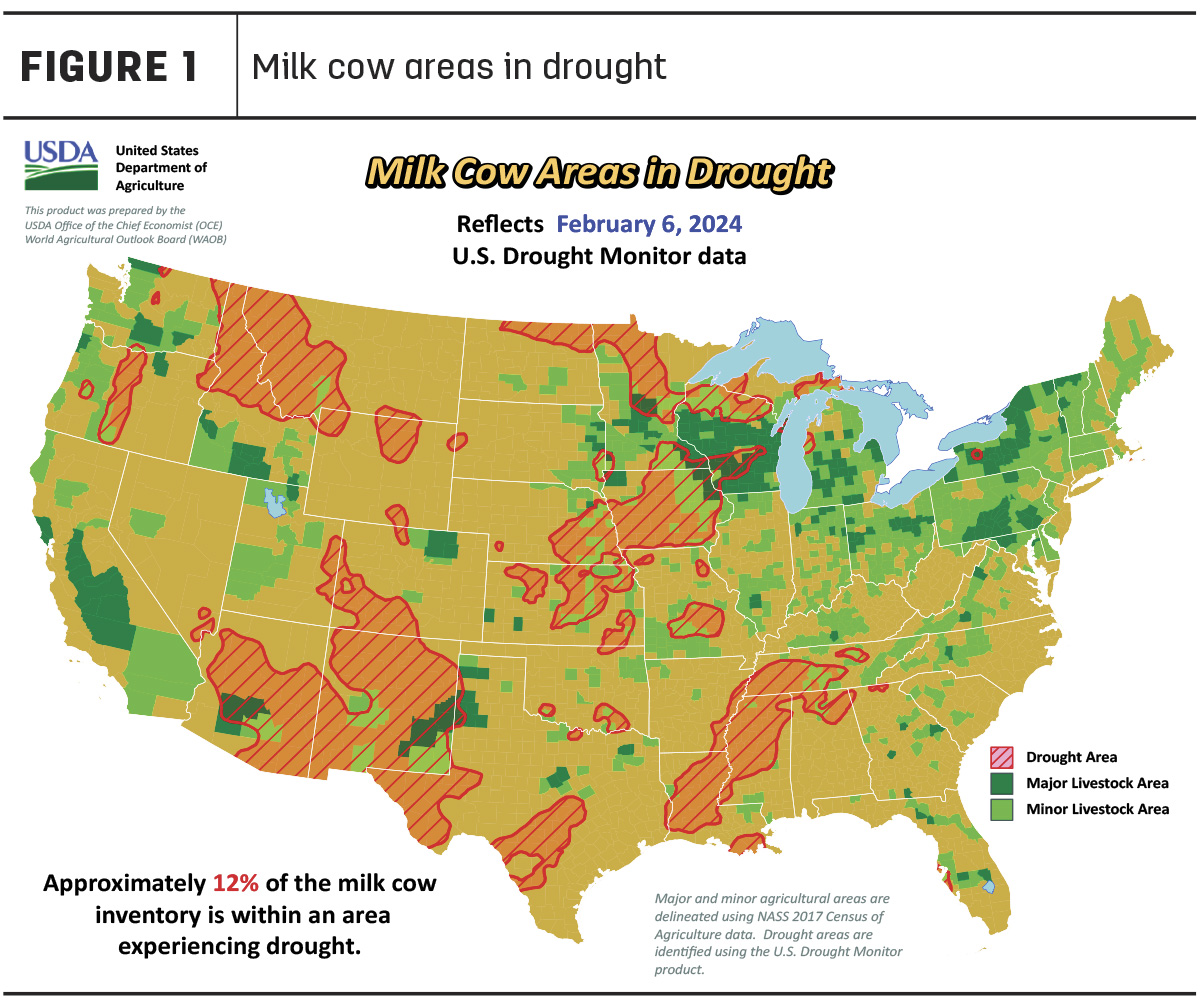

About 12% of all U.S. dairy cows were located in drought areas to start February 2024 (Figure 1), according to the USDA’s World Agricultural Outlook Board.

Dairy cow areas classified as affected by drought have been on the decline since peaking at 36%-38% last June and October, and now match the most recent lows in May 2023.

Prior to that, the percentage of dairy cows in areas classified under drought conditions were at or above 40% from October 2021 through February 2023, a period of 69 weeks, peaking at 55%-56% in March 2022.

The weekly U.S. Drought Monitor also overlays areas experiencing drought with maps of major production areas for alfalfa and other hay. As of Feb. 6, 19% of the U.S. alfalfa-producing acreage and 16% of hay-producing acreage was considered affected by drought, both the lowest since May-June 2020.

Cash receipts from milk, DMC payments expected to fall $1.8 billion in 2024

U.S. dairy producers will have less money to invest and spend in 2024. The USDA’s 2024 Farm Sector Income Forecast was released on Feb. 7. Specific to dairy, 2024 cash receipts from milk sales were forecast at $45.5 billion, down $900 million from the $46.4 billion in 2023 cash receipts, due to lower milk prices.

The 2024 estimate is down $11.75 billion from the $57.25 billion in 2022 milk cash receipts. Cash receipts from milk sales averaged $40.89 billion in 2019-21 and $35.86 billion from 2015-18.

The Farm Sector Income Forecast projected 2024 Dairy Margin Coverage (DMC) program payments at $264.5 million, also down $900 million from the record high of $1.2 billion in 2023.

In addition to cash receipts, the USDA forecasts steady feed costs but higher outlays for labor and interest in 2024.

There may be some room for a slight improvement in the dairy cash receipts projections. In its latest World Ag Supply and Demand Estimates report, released on Feb. 8, the USDA did raise the projected 2024 all-milk price to $20.95 per hundredweight (cwt), up 95 cents from the January forecast and up 47 cents from the 2023 average all-milk price of $20.48 per cwt. The 2022 average all-milk price was $25.34 per cwt.

GDT index increases 4%

The price index of dairy product prices sold on the Global Dairy Trade (GDT) platform increased in an auction held Feb. 6. Compared to the previous auction, prices for individual product categories were mostly higher, led by 10.3% and 6.3% increases in the prices for butter and cheddar cheese. Others posting smaller price increases were anhydrous milkfat, lactose, skim milk powder and whole milk powder. For the second auction in a row, only mozzarella declined, down 1.8%.

The GDT platform offers dairy products from several global companies: Fonterra (New Zealand), Darigold, Valley Milk and Dairy America (U.S.), Amul (India), Arla (Denmark), Arla Foods Ingredients (Denmark) and Polish Dairy (Poland).

The next GDT auction is Feb. 20.

Ag producer survey shares outlook, carbon payments

With the anticipation of lower income, short- and long-term economic outlooks of most agricultural producers became a little more pessimistic in January, according to the latest Purdue University/CME Group Ag Economy Barometer.

The percentage of producers choosing lower commodity prices as a top concern matched the percentage of producers who chose higher input costs.

“This combination indicates that U.S. farmers are worried about a possible cost/price squeeze leading to lower farm incomes," said James Mintert, the barometer's principal investigator and director of Purdue University's Center for Commercial Agriculture.

One other survey question of note: 8% of survey respondents reported engaging in discussions with companies about carbon contracts. Producers reported that payment rates remain low. Among those who have engaged in discussions about carbon contracts, 61% were offered payment rates below $10 per metric ton while just 12% reported being offered a rate of $30 or more per ton.

The Ag Economy Barometer provides a monthly snapshot of farmer sentiment regarding the state of the agricultural economy. The survey collects responses from 400 producers whose annual market value of production is equal to or exceeds $500,000. Minimum targets by enterprise are as follows: 53% corn/soybeans, 14% wheat, 3% cotton, 19% beef cattle, 5% dairy and 6% hogs. Latest survey results, released Feb. 6, reflect ag producer outlooks as of Jan. 15-19.

Coming up

- On Feb. 13, USDA’s National Agricultural Statistics Service (NASS) will release the 2022 Census of Agriculture data. The release event will start at 12:30 p.m. (Eastern time) and be livestreamed on USDA’s YouTube channel and website.

- Administrators of the 11 Federal Milk Marketing Orders (FMMOs) will report January uniform prices and pooling data, Feb. 11-14. That will be followed up on Feb. 15 by Progressive Dairy’s monthly review of the numbers to provide some additional transparency to your milk check.

In case you missed it

- Cornell University dairy economist Christopher Wolf recently presented the Farm Credit East Knowledge Exchange 2024 Dairy Market Situation and Outlook report. The summary reviews production and economic data for 2023, provides a look ahead at 2024 prices and feed costs, and discusses three major factors impacting milk prices and producer profitability: milk supply, exports and ending stocks.

- Concerned that foreign ownership of U.S. farmland poses risks to security and the U.S. food supply, the U.S. General Accounting Office (GAO) issued six recommendations to speed and enhance reporting of foreign investment in agricultural land. Foreign investment in U.S. agricultural land grew to about 40 million acres in 2021, per USDA estimates.