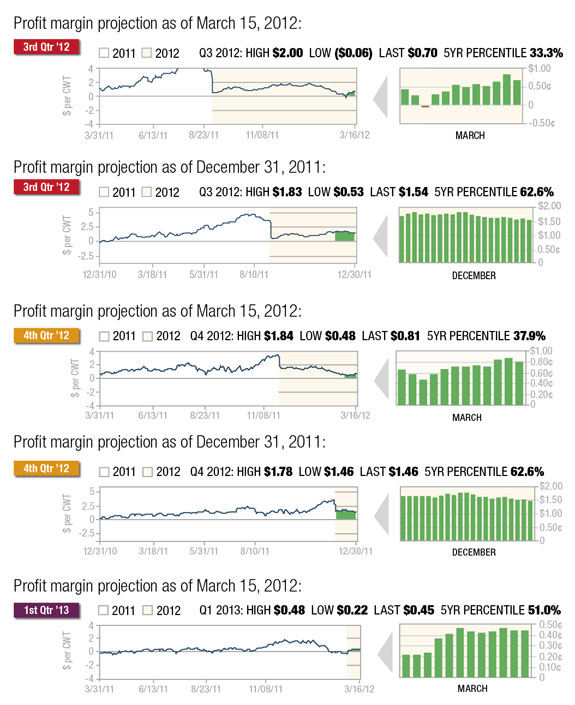

Dairy producer profitability deteriorated sharply over the past few months as milk prices plummeted while feed costs increased. Where the market was projecting a positive margin for nearby Q2 at the beginning of the year, the open market margin for that period is now negative. Moreover, the projected profitability has moved from a very high historical value above the 90th percentile of the past 10 years to below the 10th percentile between mid-January and early March – a nearly $4-per-hundredweight (cwt) drop.

Dairy producers who failed to contract earlier in the year for their inputs and their milk sales are now facing losses expected to continue for the next few months based on current prices. While margins in the second half of 2012 through early 2013 are currently positive, profitability is still forecast to be slim and generally at or below average from a historical perspective.

Figure 2 , below right, reflects both the current outlook for dairy margins through the first quarter of 2013, as well as comparison graphs to these same forward profit margin projections back in December.

The sharp drop in milk prices over the past two months has been the main catalyst behind negative margins for dairy producers. Class III futures at the CME Group have declined over $3 per cwt from their highs in early January and are still around $2 per cwt below that level as of this writing.

Following the strong finish to 2011 with the announced Class III price by NASS for December at $18.77 per cwt – the highest for that month since 2007 – the market started the year off optimistic that milk’s strength would carry over into 2012.

Unfortunately, the product market was signaling a different message back in January following a significant loss in value for cash cheese and butter, which eventually led to a collapse in milk futures beginning in the second half of January.

Without strength in the cash cheese market in particular, it was difficult for the Class III milk contract to sustain its strength earlier this year.

While both the cheese and butter markets have begun to recover of late, and this has supported deferred milk futures at the CME, the market has a long way to go in order to restore profitability and forward margins for dairy producers.

To be sure, not all is negative for the milk market from a fundamental standpoint. According to data from USDA’s Foreign Agricultural Service (FAS), January total cheese exports were up 3.1 percent from 2011, with cheddar cheese in particular up 27.2 percent from the year before to 10.8 million pounds.

Mexico was a very strong market for cheddar cheese exports on the month, importing 2.3 million pounds, which represented 21 percent of total exports for the month and an increase of 560 percent from January 2011. Moreover, American cheese stocks as of January 31 were down 4 percent from the prior year, despite the fact that production was up 3.1 percent for the month compared to 2011, suggesting higher commercial disappearance year-over-year.

Unfortunately, the latest WASDE report forecasts higher milk production in 2012 based upon larger milking cow numbers as herds are increasing more rapidly than expected. As a result, the average price forecast was lowered for both the Class III and Class IV prices from February by $0.40 per cwt and $0.45 per cwt, respectively.

While the drop in milk futures has been the primary catalyst in lower dairy margin profitability, it is certainly not the only factor as feed costs have been rising also. Soybean meal prices, in particular, are sharply higher than where they were to start the year, rising around $50 per ton or 15 percent since early January.

Lower South American soybean production due to a La Niña-inspired drought has caused world buyers to react by bidding up for both old-crop and new-crop U.S. supplies. USDA’s WASDE reduced Argentina’s soybean crop by 4.0 million tons over the past two months to 46.5 million, while Brazil’s crop has been cut by 5.5 million tons since January to 68.5 million.

Paraguay’s soybean production was also reduced sharply this past month by 1.4 million tons to 5.0 million. Meanwhile, there remains concern that corn will win the lion’s share of the acreage battle this spring, compromising a needed increase in soybean-planted area.

In addition to deferred new-crop futures reacting to increased demand from China, the market may also be attempting to bid up for soybean acreage as producers get ready to begin their spring planting.

The USDA released its Prospective Plantings report at the end of March and, as of this writing, the consensus trade estimates anticipate corn acreage of around 94.7 million and soybean acreage of around 75.5 million.

The corn figure would represent an increase of about 2.8 million acres from last year, while soybean acreage would be up about 0.5 million from last year. In addition to acreage, spring weather will be very important again this season to help assure each crop gets off to a good start.

Current weather conditions across the Midwest reflect much-above-normal temperatures for mid-March, with this trend expected to continue through the second half of the month. Historically, an early planting season portends an increase in corn acreage, which would be consistent with current trade thinking.

Ultimately though, summer weather will determine crop yields, and dairy producers need to see cooperative weather this year to help moderate feed costs in the second half of 2012 into early 2013.

Although the profit margin outlook is not as favorable as it once was for 2012, positive margins are still indicated beyond Q2. In managing forward profitability, it will be important for dairy producers to remain flexible with their feed procurement and milk marketing strategies.

Allowing for higher milk prices and lower feed costs to be realized over time is necessary in helping to preserve margin potential as we move forward.

This should not be confused with doing nothing. Ranges of lower milk prices and higher feed costs can be protected for minimal cost, which can at least help a dairy producer feel more comfortable that they have some measure of protection in place to safeguard against a further deterioration in forward profit margins.

Our own clients are treading very carefully in the current environment but remain keenly aware that just because margins are poor doesn’t mean they can’t get worse.

One point to highlight in the current market is how profit margin management is a dynamic process. Many dairies who had previously established forward margin protection based on the historically strong profit margins being projected earlier in the year have been actively making adjustments to increase their flexibility now that the margin has deteriorated.

As an example, for someone who had either forward sold milk or committed to a sale using a futures contract or a short call option, the market recently offered the opportunity to remove those short calls or adjust the forward futures or cash market sale into something more flexible for a reasonable cost.

These adjustments will benefit the dairies that took advantage of them now that the milk market is recovering. As another example, someone who had purchased their soybean meal requirements through a long futures contract or physical cash market commitment now has the opportunity to protect that purchase or add flexibility to their contracting in order to allow for a savings to be realized should the market drop from current levels.

It is easy to incorrectly assume that margin management means “locking in” a forward profit margin when an opportunity presents itself. While it certainly may be approached this way, active margin management doesn’t end with simply securing or protecting a forward opportunity.

Realizing historically strong margins is a dynamic process of working with what the market allows you to do and taking advantage of opportunities when they present themselves.

While it starts with identifying when a historically strong margin is available, and this ultimately drives the initial contracting decisions, these strategies are protecting a risk that, in most cases, is several months forward in time. The markets by nature are dynamic and move significantly both up and down over time.

Managing profitability is a function of managing the volatility in forward prices, and making periodic changes to strategies in order to take advantage of these swings is a fundamental part of the process.

Also, while the value of commodities may be somewhat related in that higher prices in one market such as feed may eventually translate to higher prices in another market such as milk, as dairy producers respond to the increased costs and cut back their production, these changes do not necessarily occur in tandem.

The current environment for dairy producers is a perfect case in point. Milk prices moved lower over the past two months while feed costs moved higher.

There is a weak correlation at best over any given time period that these markets move up and down together. This is why it is important to look at the problem from a margin perspective and manage one’s forward profits accordingly.

Understanding when opportunities present themselves and which strategies apply to which situations will ultimately give you more control over your profitability and make you a better margin manager. PD

Whalen is a senior risk manager and director of education for Commodity & Ingredient Hedging based in Chicago, Illinois. Click here for more information.

Chip Whalen

Senior Risk Manager and

Director of Education

Commodities & Ingredient

Hedging, LLC