Meanwhile, many questions remain concerning drought conditions in the Midwest and Plains, and whether or not precipitation over the winter will be sufficient to recharge soil moisture levels.

Another concern surrounds feed availability given this past season’s drought that severely impacted corn yield and production.

While recent USDA data suggest a larger crop than initially expected, corn stocks are still projected to be historically tight at the end of the marketing year.

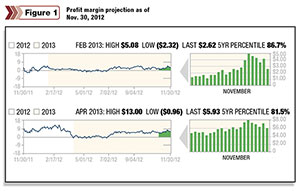

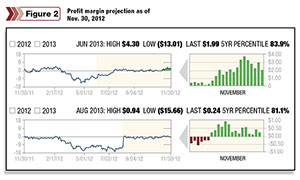

The charts below reflect current beef cattle margins as well as comparison graphs to those same profit margins three months ago.

With the exception of nearby February, all deferred marketing periods are reflecting stronger profit margins than those available at the end of August.

With the exception of nearby February, all deferred marketing periods are reflecting stronger profit margins than those available at the end of August.

Moreover, margins exist above the 80th percentile, which suggests profitability is historically strong for those periods.

Obviously much can change between now and then, although given these current projections it may be prudent for a cattle finisher to consider ways in which this profitability can be protected.

Going back to the observation that feed supplies may be tight later this year, it may be tempting to book feed early in the cash market to assure availability of those supplies in the summer.

Going back to the observation that feed supplies may be tight later this year, it may be tempting to book feed early in the cash market to assure availability of those supplies in the summer.

One would want to take into consideration the basis, which would have to be paid in order to secure those supplies, and how that would factor into the overall profit margin. Perhaps a price can be set without a corresponding basis commitment?

What about the cost of feeder cattle for the spring? Are there ways to protect this expense from rising further should prices advance over the next few months?

Given that prices are already quite high from a historical basis, maybe there is a way to cap this cost without committing to a firm price level in the marketplace.

Turning to the revenue side of the equation, what about the value of live cattle further out in 2013?

Like feeder cattle, prices are very high from a historical perspective, although that doesn’t mean the market can’t move higher. Is there a way to protect current price levels while allowing for the possibility of higher prices if the market does continue to advance?

All of these questions whether on the cost or revenue side of the equation suggest it may be beneficial to allow for flexibility in one’s marketing plan and profit margin management. This boils down to including options in your toolbox.

There may be times when profitability is so strong that it makes sense to simply “lock in” a margin to secure that profitability.

More often than not, however, margins will not be that strong or it may be that individual pieces of the margin on either the cost or revenue side of the equation would argue for incorporating flexibility into their price management profiles.

In very basic terms, an option is a contract that conveys the right without the corresponding obligation to a purchase or sale price in a future period.

The difference between an option and a futures contract is that in using futures, one is setting a firm commitment to a price level – either a purchase or sale.

While this may be fine if and when a profit margin is strong enough where having added flexibility is not a priority, it is rarely the case that forward profitability is projected to be so strong.

Furthermore, if you are protecting a risk in a far deferred time period that is several months into the future, the potential opportunity cost of making that firm price commitment increases with the added uncertainty of the extended time horizon.

While having added flexibility is a desirable feature in price management, it does come with a cost.

The main objection cited to using options is the cost of the premium, and this indeed can be substantial depending on market conditions and the time remaining to the option’s expiration.

It is also easy to think of this cost as sunk, given that the option is paid for in full at the time of purchase.

While it is true that options can be expensive and you have to pay for them up front, there are several different ways the cost of an option can be managed over time.

Just as options can be purchased, they can also be sold, and selling options brings in premium which provides revenue to help offset cost.

Where buying options yields a right to the buyer, selling options involves taking on a potential obligation. The easiest way to think of this is an insurance analogy which is often used to describe options.

Buying options is like purchasing insurance – you pay a premium in order to insure against an unfavorable change in price.

How much that premium costs is relative to both a deductible or where you would like that insurance to begin as well as the term or amount of time you wish to purchase.

If buying options means you are like a policy holder, selling options therefore means you are like the insurance company.

You are taking on a potential obligation should the buyer choose to exercise their right to a purchase or sale price, and in consideration of that, you are paid a premium in return.

The amount of the premium you receive is a function of the perceived risk you will have to perform on the obligation over the particular period of time. While this may sound risky, it is not necessarily a bad thing.

As an example, you may not wish to sell cattle at current price levels, although you would be willing to sell cattle $10 above the market because that would translate into a very strong profit margin relative to your current costs and breakeven level.

Similarly, you may not want to commit to purchasing corn based on current old-crop prices, but you would be inclined to buy old-crop corn at new-crop prices.

Assuming either one of these statements are true, it may make sense to sell options that would correspond to these potential obligations in order to receive a premium to help pay for the cost of purchasing a right at a different price level.

Creating these sorts of option-spread strategies is one way to help manage the cost of using options.

When doing so however, you would want to take into consideration the cost/benefit relationship of the range you are creating.

The cost should make sense relative to the benefit you receive in allowing for that range of opportunity to work in your favor over time.

Options can also be used in conjunction with cash contracting alternatives to provide added flexibility to price commitments set in the local marketplace.

In this sense, they are not substitutes for physical market contracting, but rather complements to the existing strategies already being employed to manage price and margin risk exposure.

While option positions and strategies may appear more complicated than futures, understanding their features and benefits is well worthwhile for a cattle finisher to explore in order to help maximize the return to their operation. ![]()