Cattle prices exhibit resilience

The price for feeder steers 750 to 800 pounds at the Oklahoma City National Stockyards averaged $169.26 per hundredweight (cwt) in July, up more than $16 from last year. The most recent available price from Aug. 8 put feeder steers at $178.56 per cwt, a jump of more than $9 from the prior week.

Based on anticipated firm feedlot demand in second-half 2022 and current price data, the third- and fourth-quarter 2022 price forecasts are raised $3 to $171 per cwt and $2 to $173 per cwt, respectively. The outlook for feeder steer prices in 2023 is unchanged at $199 per cwt.

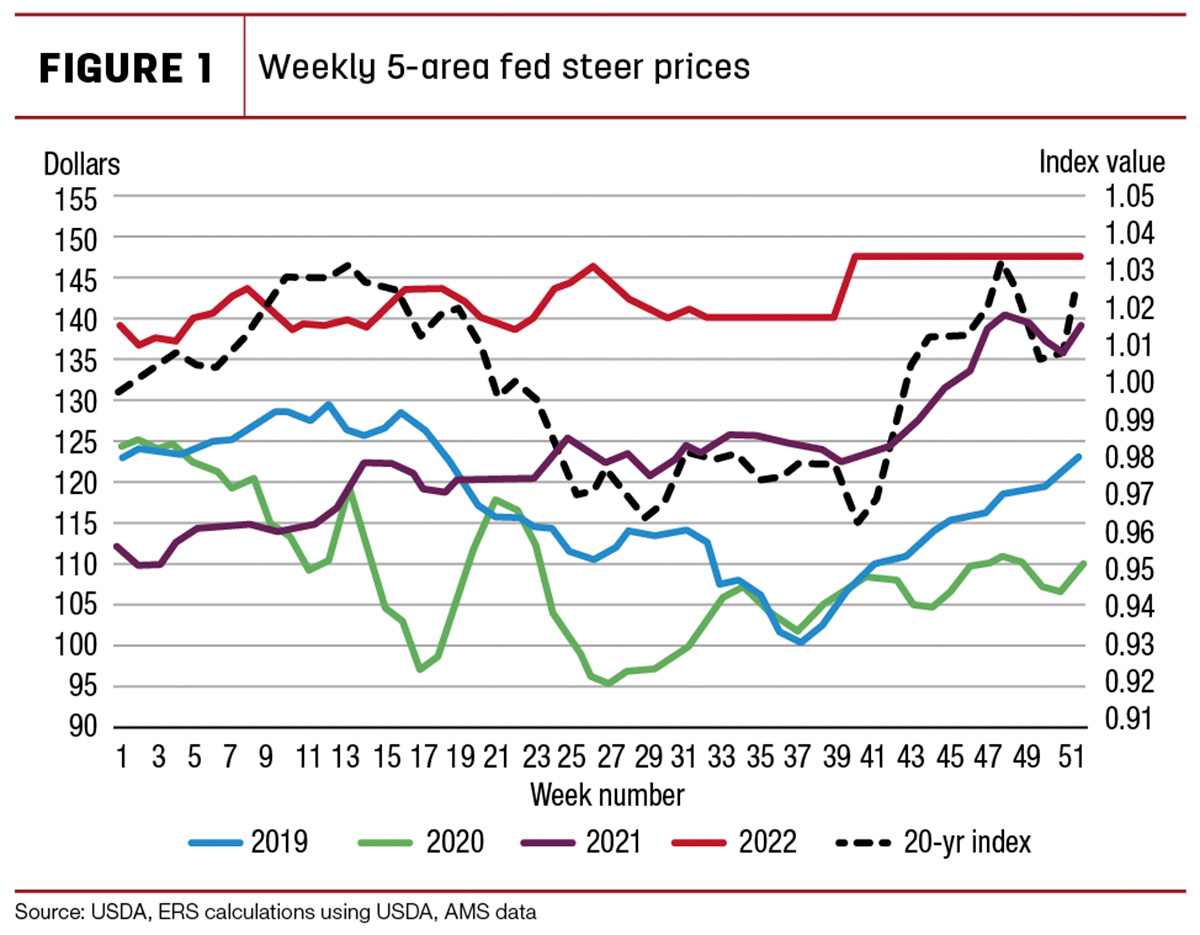

Based on Figure 1, weekly fed steer prices have trended upward throughout the year but have traded in a narrow range when compared to typical seasonal movements. Although weekly prices had retreated more than $5 by the end of July from the year-to-date high set the week ending July 3, it is expected that prices will continue the overall trend upward through the rest of the year. The fed steer price for the 5-area marketing region for the week ending Aug. 14 was $144.39 per cwt, more than $21 above a year ago.

Recent fed cattle prices have been supported by a generally faster pace of slaughter than last year, lighter weights and relatively stable boxed-beef prices. Carcasses grading Choice and higher have fallen below year-ago levels, likely supporting higher cutout values for Choice carcasses.

Based on current price data, the third- and fourth-quarter 2022 fed steer prices are projected higher at $140 and $147 per cwt, respectively. The 2023 fed steer price is up slightly from the previous month at $154 per cwt, as that price strength was carried forward into early next year.

Record-high first-half beef exports suggest increase to 2022 and 2023 forecasts

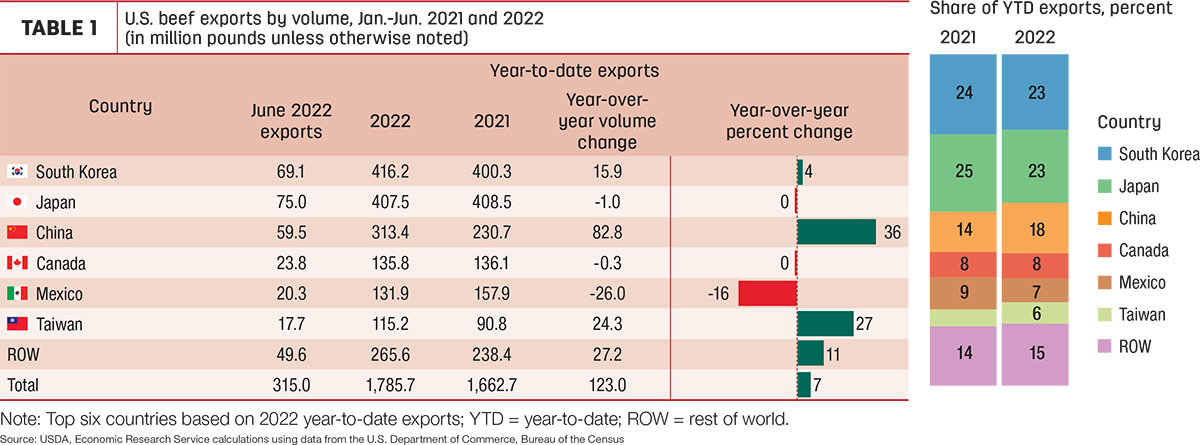

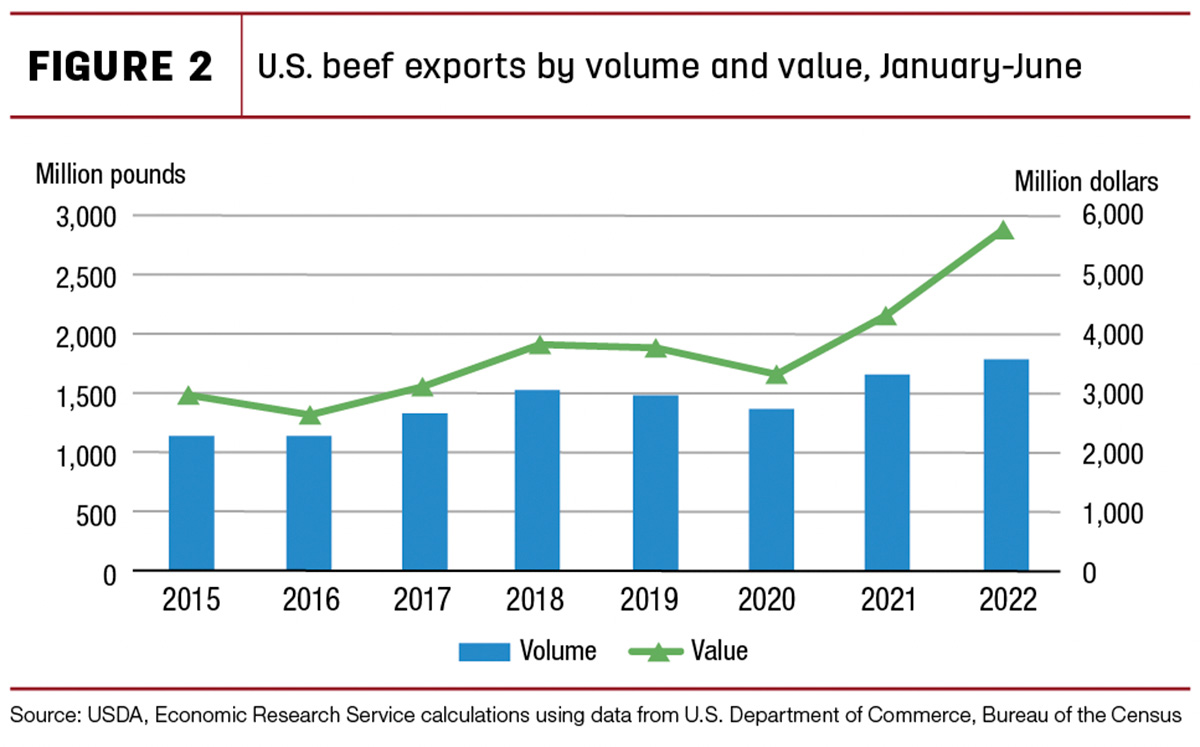

Beef exports continue to set new records, totaling 315 million pounds in June, the highest exports on record for the month. This was also the third-largest export month overall, behind August 2021 and May 2022. Total beef exports in the second quarter hit a new high at 940 million pounds, 7% above last year. Exports for the first six months of the year totaled nearly 1.8 billion pounds, a record for the first half of the year.

As Table 1 shows, cumulative exports to all destinations from January through June this year were 7% above last year. The largest increase was to China, up 83 million pounds (36 percent) compared to the previous year. Increases to other countries not in the top five also contributed to the strength in exports. Year-to-date exports to Taiwan were up 24 million pounds, 27% above a year ago. The next five-largest year-to-date increases were to the Netherlands, Indonesia, Colombia, the Philippines and the Dominican Republic, which together had a cumulative year-over-year increase of over 34 million pounds.

South Korea has maintained its position as the largest cumulative market for U.S. beef throughout the first six months of the year after taking an early lead with a record shipment in January. Japan, the largest export market from 2013 to 2021, is now the second-largest market so far this year. Year-to-date exports to China have surpassed those to all of North America combined, making the country the third-largest destination for U.S. beef.

Beef exports continue to set records, despite headwinds that include a stronger U.S. dollar on top of already-high beef prices. The value of beef exports in the first half of the year spiked dramatically over last year, as shown in Figure 2. While the export volume was 7% higher than last year, the total value of those exports increased nearly 33%.

Typically, a strong U.S. dollar causes exports to lose competitiveness in the global market. Over the past six months, the Nominal Broad Dollar Index, calculated by the Federal Reserve, has increased 7%, indicating a stronger U.S. dollar. Limited beef supplies from other major exporters such as Australia and New Zealand, along with strong demand for U.S. beef, has allowed U.S. exports to overcome these obstacles and post record exports so far this year.

Based on anticipated sustained demand in Asia and other smaller markets, the export forecasts are raised 15 million pounds for the third and fourth quarters of 2022. The annual forecast for 2022 is 3.561 billion pounds. The first- and second-quarter forecasts for 2023 are each raised by 10 million pounds, and the outlying forecast for 2023 is raised 20 million pounds, for a total of 3.02 billion.

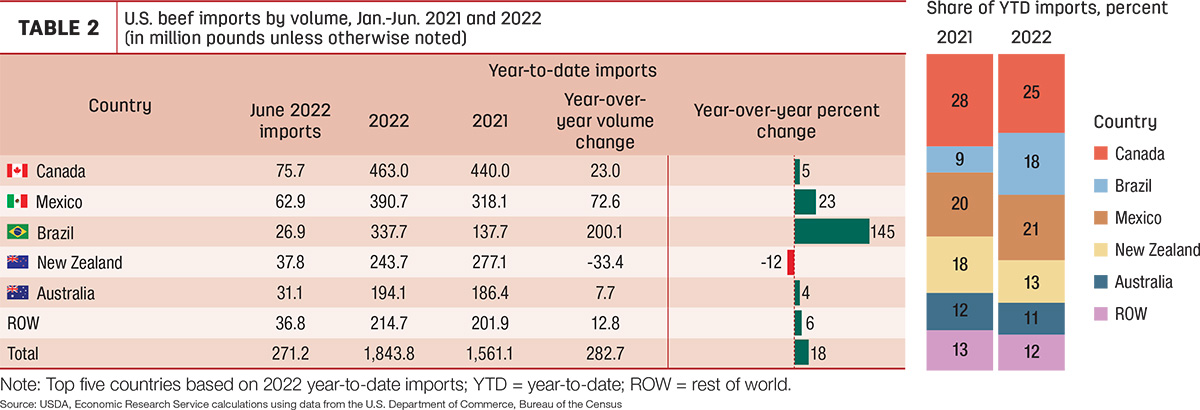

Beef imports slow in second quarter; import forecast lowered

After a strong first quarter, driven mostly by a spike in imports from Brazil, total U.S. beef imports were slower in the second quarter. Imports in June were 271 million pounds, a year-over-year decrease of about 15%. This was the first year-over-year decline since September 2021. Monthly imports from all major suppliers decreased year over year, with the largest decreases from New Zealand (33%) and Australia (26%).

Table 2 shows that year-to-date imports are up just over 18%. The largest increase has been 338 million pounds from Brazil so far this year, an increase of nearly 150%. Imports from Brazil in the first quarter were 230 million pounds, while the second quarter decreased to 108 million pounds after the quota was filled in the first three months of the year.

Year-to-date imports from Mexico are also higher compared to the same period last year, up 23%. Mexico is the only major supplier to gain market share other than Brazil. Although imports are up slightly from Canada and Australia as well, the share of imports from those suppliers has decreased due to the rapid spike in share from Brazil. Imports from New Zealand in the first half of the year are down 12% from the same period last year.

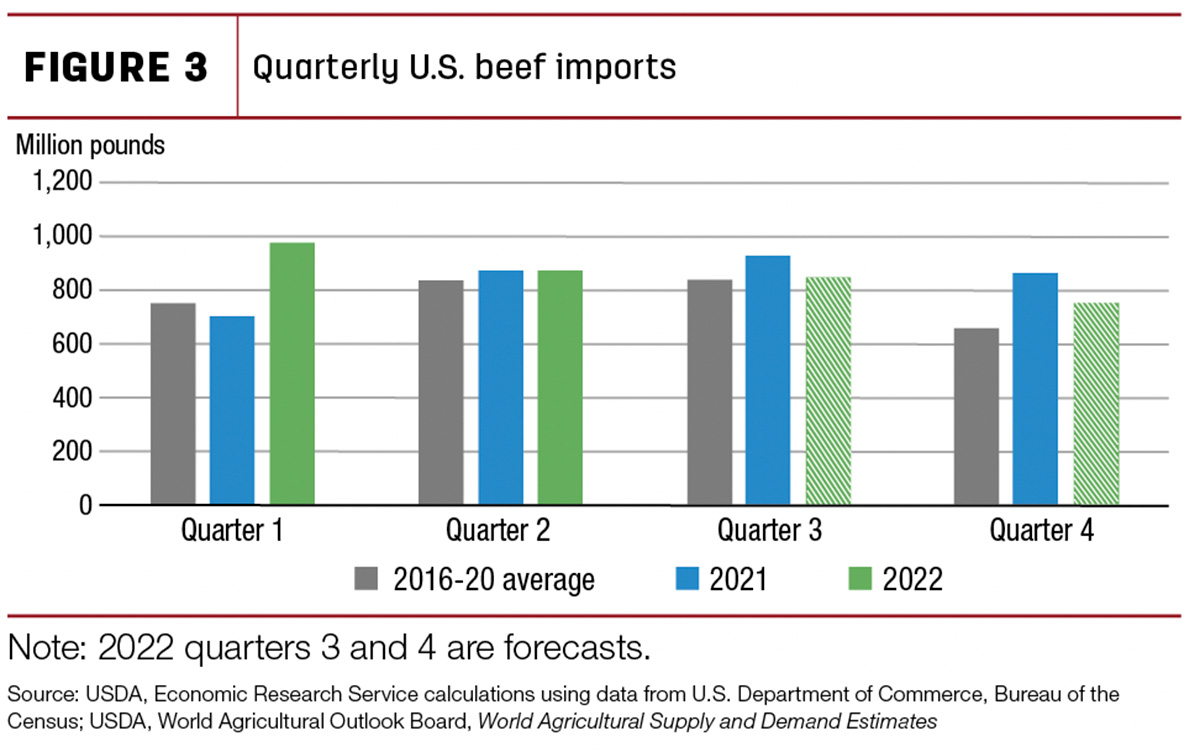

The expectation for the remainder of the year is that fewer supplies from Oceania and continued high U.S. cow slaughter will put downward pressure on imports. Figure 3 outlines the quarterly imports for the first two quarters, as well as the forecasts for the remainder of the year. There was a counter-seasonal decrease from first to second quarter due to the record-breaking first quarter. The third and fourth quarters are still forecast above the five-year average but well below last year.

The third-quarter 2022 forecast is decreased by 20 million pounds to 850 million, and the fourth quarter is lowered 5 million pounds to 765 million. The 2022 annual forecast is 3.459 billion pounds. The annual forecast for 2023 remains unchanged from last month at 3.2 billion pounds.