Beef cattle producers continue to face widespread drought and higher operating costs as the holidays approach. For the week ending Nov. 1, the U.S. Drought Monitor reported that 85% of the U.S. is experiencing some level of drought. According to the USDA World Agricultural Outlook Board, approximately 76% of the U.S. cattle herd is being raised in drought-stricken areas; this is an increase of 40 percentage points from a year ago.

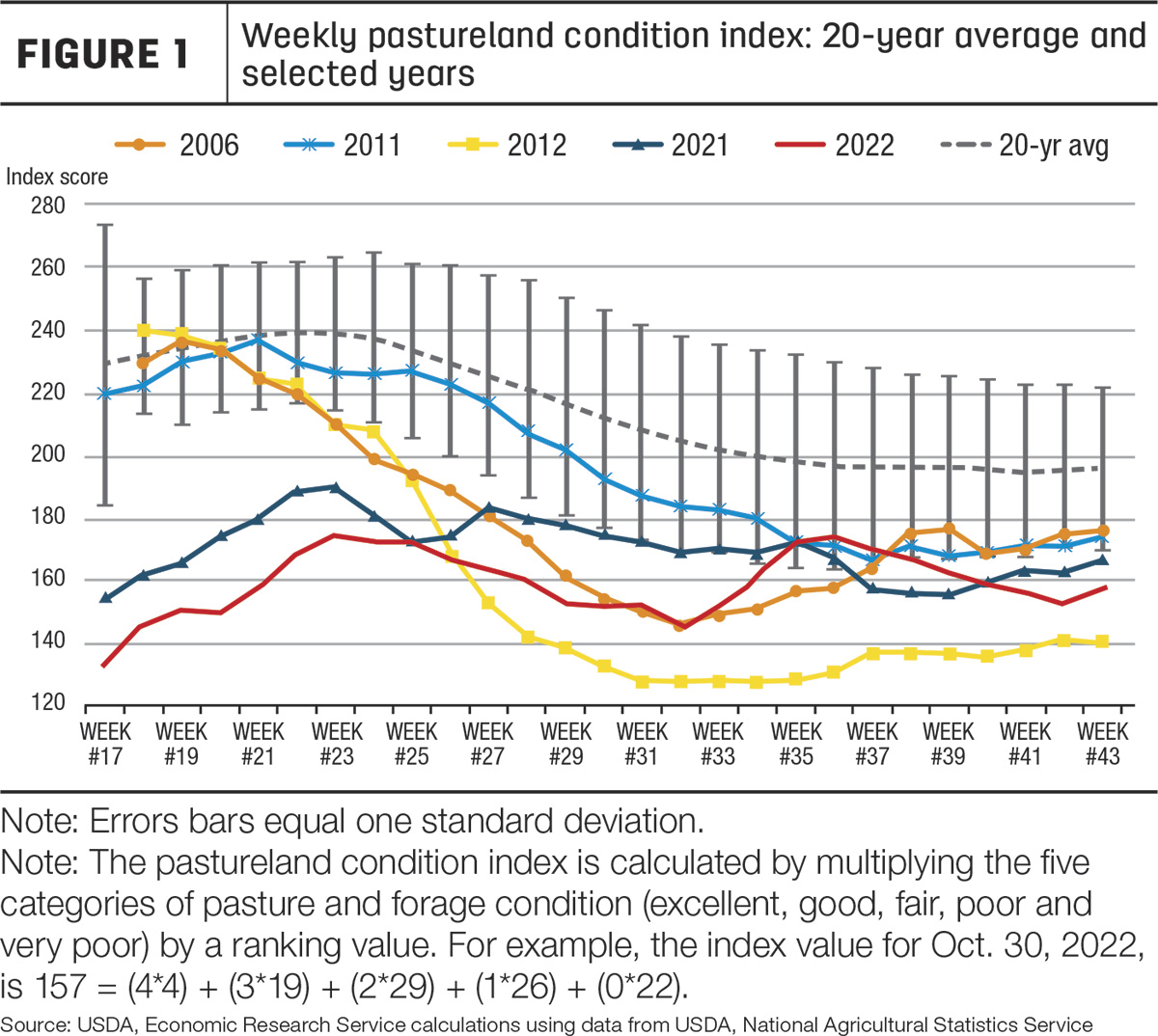

These conditions likely point toward limited pasture and forage availability this winter. A pasture condition index score for the week ending Oct. 30 is provided in Figure 1. This index score for the end of the reporting cycle in week 43 shows the fourth straight year of below-average rating for pasture conditions and the lowest rating since 2012. In addition, based on the October 2022 USDA, National Agricultural Statistics Service (NASS) Crop Production report, other hay production is estimated to be down 11% from last year, primarily on lower yield estimates. This supported higher prices for other hay in the U.S., which was up 12% in September from the same month last year.

Further, for the week ending Nov. 7, prices for over-the-road diesel reported in the U.S. Energy Information Administration report Weekly Retail Gasoline and Diesel Prices are up 43% across the U.S. on average from a year ago, which is likely reflected in increasing operation costs for cattle producers.

The latest NASS Cattle on Feed report showed an Oct. 1 feedlot inventory of 11.449 million head, about 1% below 11.55 million head in the same month last year but still the third-largest for the month since the series began in 1996. Feedlot net placements in September were down almost 4% year over year at 2.027 million head, in line with industry analysts. Marketings in September were 1.86 million head, up 4% year over year with the same number of weekdays in the month. On Oct. 1, the number of cattle on feed over 150 days was above year-ago levels, led principally by larger supplies in Texas and Nebraska, while supplies in Kansas and Iowa are tighter.

Based on actual and estimated slaughter for October, the weekday pace of fed cattle and cow slaughter is up almost 1% and 5%, respectively, from last year. With poor pasture and higher operating costs than last year, beef cow slaughter is expected to remain higher than previously assumed through the end of the year. In addition, anticipated fed cattle marketings are raised on a relatively strong pace of fed cattle slaughter through early November as well as relatively high numbers of 150-plus-day cattle in feedlots. As a result, the beef production forecast for fourth-quarter 2022 is raised by 215 million pounds on higher expected total cattle slaughter, along with slightly heavier carcass weights. Considering adjustments for official estimates for the third quarter, total 2022 beef production is raised 211 million pounds from October to 28.3 billion pounds, an increase of more than 1% from 2021.

With the more rapid pace of cow slaughter expected in fourth-quarter 2022, anticipated cow slaughter in 2023 was lowered. Accordingly, the 2023 beef production forecast is lowered by 90 million pounds to 26.3 billion pounds, which is more than 7% below the 2022 projection.

Cattle prices raised on robust demand

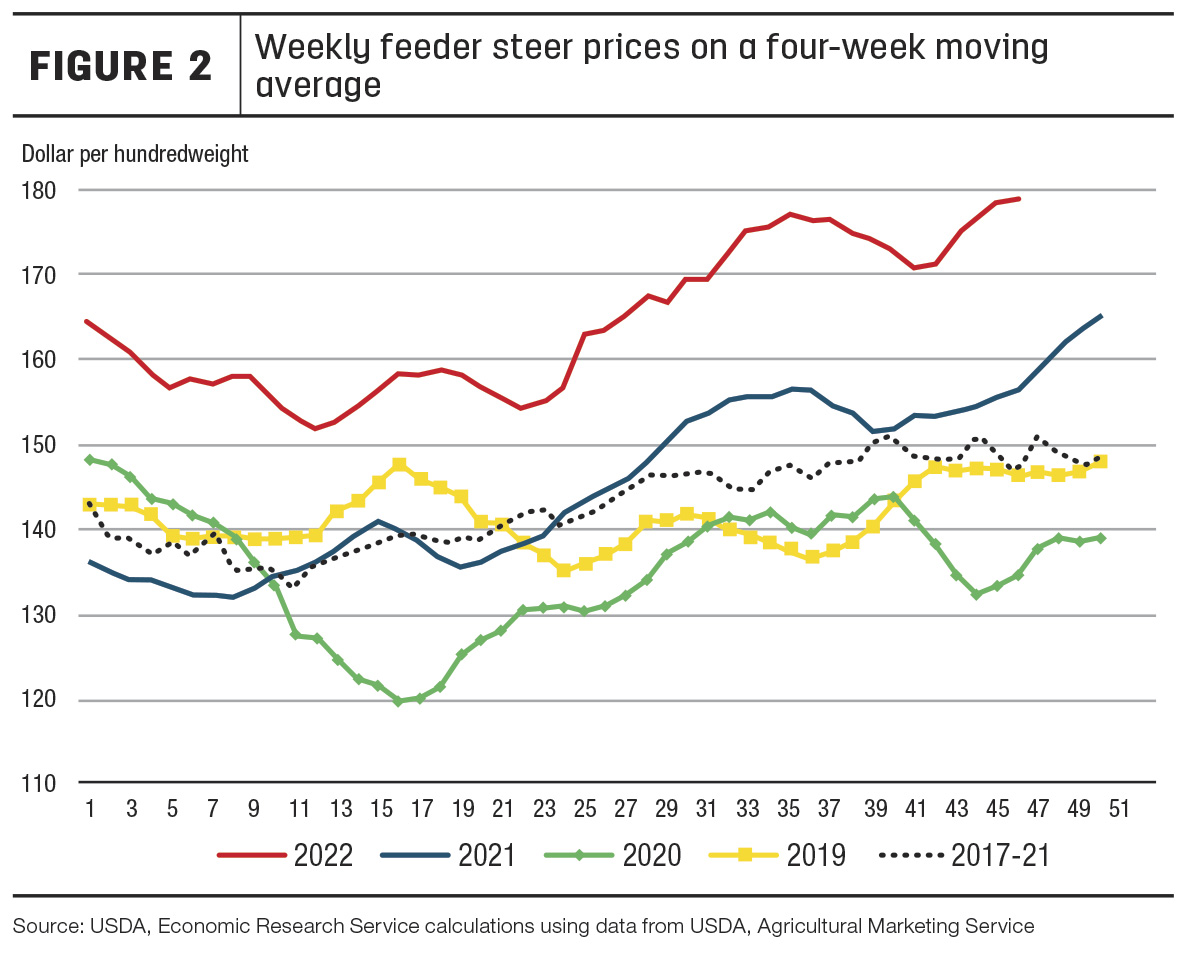

In early October, prices recorded for feeder steers 750-800 pounds at the Oklahoma City National Stockyards started lower month over month before setting a new high for the year at $185.66 per hundredweight (cwt). The October weighted average was $173.96 per cwt. Prices have since pulled back about $9. The most recent available price from Nov. 14 reports sales of feeder steers at $175.96 per cwt, down $2.42 from the previously reported week. Despite higher operating costs, firm feedlot demand is expected for the remainder of 2022, and with current price data, the fourth-quarter 2022 price forecast for feeder steers is raised $3 to $176 per cwt.

To illustrate the rebound in feeder prices, Figure 2 shows four-week moving averages for feeder steer prices. In week 35, prices declined from the current peak for the year through week 41 before rebounding to a new four-week average high in week 45. Based on current price strength, the price projection in first-quarter 2023 is raised $2 to $177 per cwt. However, expected feeder calf prices were unchanged for the remainder of the year.

In recent weeks, packer margins have improved with the seasonal rally of wholesale prices and a smaller increase in fed cattle prices. Further, as packing capacity has improved over the last two years, weekday slaughter volumes remain high, likely reducing costs on a per-animal basis and mitigating costs of operating on Saturdays. Continued levels of weekday throughput and Saturday slaughter has likely sustained sufficient demand to support higher fed cattle prices than forecast last month.

For the week ending Nov. 6, the negotiated price for fed steers in the 5-area marketing region reached $151.98 per cwt, the highest since 2015. Accounting for current price data and a stronger year-over-year pace of fed cattle slaughter in the fourth quarter, the fourth-quarter 2022 price is projected $4 above last month to $152 per cwt.

Higher expected fed cattle marketings in late 2022 will likely tighten fed cattle supplies in 2023. With tighter supplies of cattle, packers are likely going to have to pay higher prices for slaughter-ready cattle, even as feedlot operations are likely to limit feeding cattle for an extended period given the increase in operating costs from a year ago. Based on current price data and expected demand next year, 2023 fed steer prices are projected $2 higher in the first half and $4 higher in the third quarter, raising the annual forecast by $2 to $156 per cwt.

Exports slow marginally in September; 2022 forecast lowered

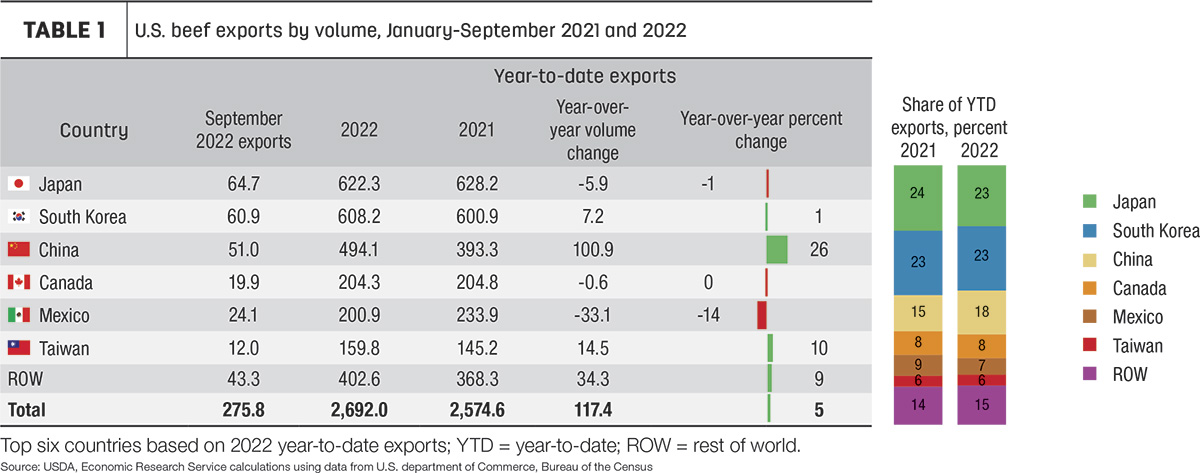

September beef exports were slightly lower than expected, perhaps showing some signs of the effects of economic headwinds that have been threatening trade all year. Exports have been higher year over year through August, despite a strong U.S. dollar on top of already high beef prices. September exports were 276 million pounds, a year-over-year decrease of 6% but 7% above the five-year average (Table 1). Year-to-date exports are still 5% above last year.

September exports to nearly all major export markets decreased year over year. Shipments to Taiwan were down over 26% year over year, while exports to Canada were down nearly 11% and exports to South Korea were down 10%. Exports to China were down year over year for the first time since 2019; shipments to China had been higher year over year since 2020, reflecting tight supplies of domestic proteins and aided by provisions in Phase One of the Economic and Trade Agreement Between the United States and China, which have allowed for increased beef exports to China. After peaking in August, exports to China dropped nearly 27% month over month, falling to just below the level of exports in September of last year.

Out of the largest six export markets, only exports to Mexico increased year over year in September, up 5% from last year, although year-to-date exports to Mexico are still 14% below last year. September exports to other countries not in the top six were also higher than a year ago, but by a smaller margin than previous months this year. Exports to these smaller markets peaked in April and have been decreasing throughout the year. Third-quarter beef exports were 906 million pounds, less than 1% below last year’s record. Of the top six markets, only exports to China were higher year over year (11%) for the quarter. Exports to Taiwan were 18% lower, and exports to Mexico were 9% below a year ago. Combined exports to smaller markets not included in the top six were just over 5% higher year over year. The value of exports in the third quarter totaled 2.7 billion dollars, just over 1% below last year but 32% above the five-year average.

The U.S. beef export forecast for fourth-quarter 2022 is lowered 10 million pounds to 850 million based on recent trade data and lower expected exports to Asia. The 2022 annual forecast is 3.542 billion pounds. The 2023 annual forecast is unchanged at 3.07 billion pounds.

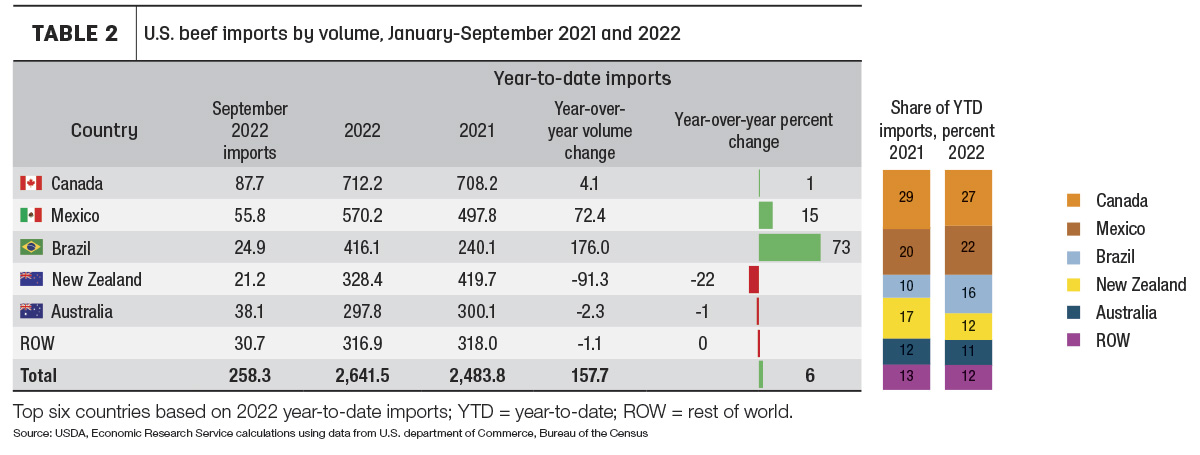

Multiple factors affecting slower pace of imports

U.S. beef imports in September were 258 million pounds, 9% below 2021 (Table 2). Year-to-date imports were 2.6 billion pounds, 6% above last year and 9% above the five-year average. Imports from Canada increased 7% year over year, but imports from the remaining major suppliers showed a decrease from last year. Monthly imports from New Zealand were down 36% year over year, while imports from Brazil decreased 28%. Year-to-date imports from Brazil remain elevated due to the spike in imports in the first quarter, but monthly imports from Brazil have remained relatively constant since June, at levels slightly below last year. After filling the tariff-rate quota (TRQ) open to countries without a specific TRQ in April, Brazil now faces a higher tariff on beef imports to the U.S.

Third-quarter imports were 798 million pounds, 14% less than last year and 8% below the five-year average. Imports for the quarter from most major suppliers decreased year over year, with the largest decrease from New Zealand, down nearly 41%. Year-to-date imports from New Zealand are 22% below last year. New Zealand has been faced with labor shortages and other supply chain issues affecting beef production. According to data from the Trade Data Monitor, year-to-date global beef exports from New Zealand were down 6% through September. However, New Zealand’s exports to China were up 9%. Australia has been faced with similar supply chain issues; its year-to-date global beef exports were down 3% through September. Similarly, exports from Australia to China were up almost 5% so far this year. The lower supplies caused by supply chain issues, combined with increased competition for exports from China, has likely contributed to the decline in shipments from Oceania to the U.S.

Third-quarter imports were 798 million pounds, 14% less than last year and 8% below the five-year average. Imports for the quarter from most major suppliers decreased year over year, with the largest decrease from New Zealand, down nearly 41%. Year-to-date imports from New Zealand are 22% below last year. New Zealand has been faced with labor shortages and other supply chain issues affecting beef production. According to data from the Trade Data Monitor, year-to-date global beef exports from New Zealand were down 6% through September. However, New Zealand’s exports to China were up 9%. Australia has been faced with similar supply chain issues; its year-to-date global beef exports were down 3% through September. Similarly, exports from Australia to China were up almost 5% so far this year. The lower supplies caused by supply chain issues, combined with increased competition for exports from China, has likely contributed to the decline in shipments from Oceania to the U.S.

Higher beef cow slaughter also typically decreases the demand for imported lean trimmings. Third-quarter U.S. cow slaughter was 13% above the average for the past five years, while third-quarter imports were 8% below the five-year average. Higher cow slaughter, importers such as Brazil facing a higher tariff from the filled TRQ and limited supplies from Oceania have likely all contributed to the slower pace of imports throughout the second half of this year. The fourth-quarter import forecast is decreased 10 million pounds to 735 million pounds. The 2022 annual forecast is 3.376 billion pounds. The annual 2023 forecast is unchanged at 3.35 billion pounds.