Over the past three years, fertilizer prices have been among crop producers’ top concerns.

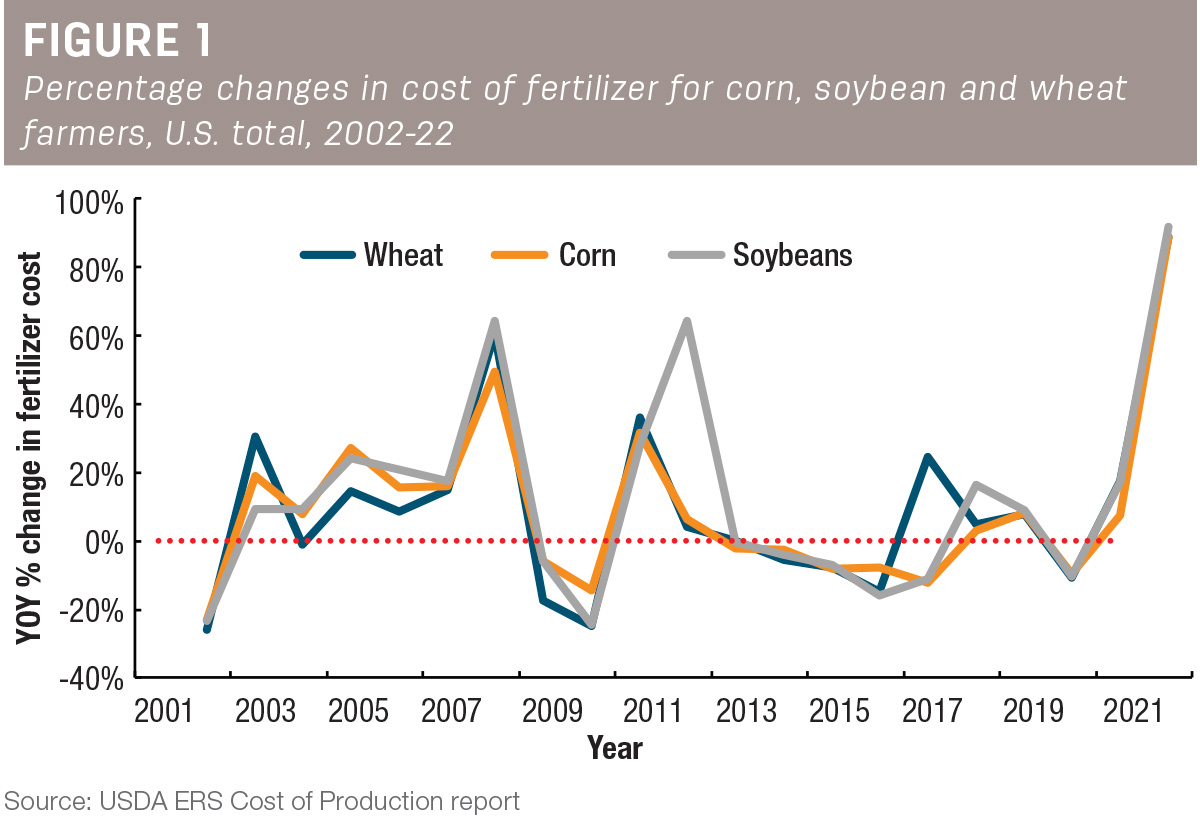

This is clearly illustrated in Figure 1, which charts the year-over-year changes in fertilizer costs per acre for wheat, corn and soybeans from the USDA’s Cost of Production report.

While the period from 2020-22 witnessed the sharpest increase in fertilizer costs, it is not the first time farmers have grappled with such price spikes. Other notable years include 2008 and 2011-12 when costs surged by as much as 60%.

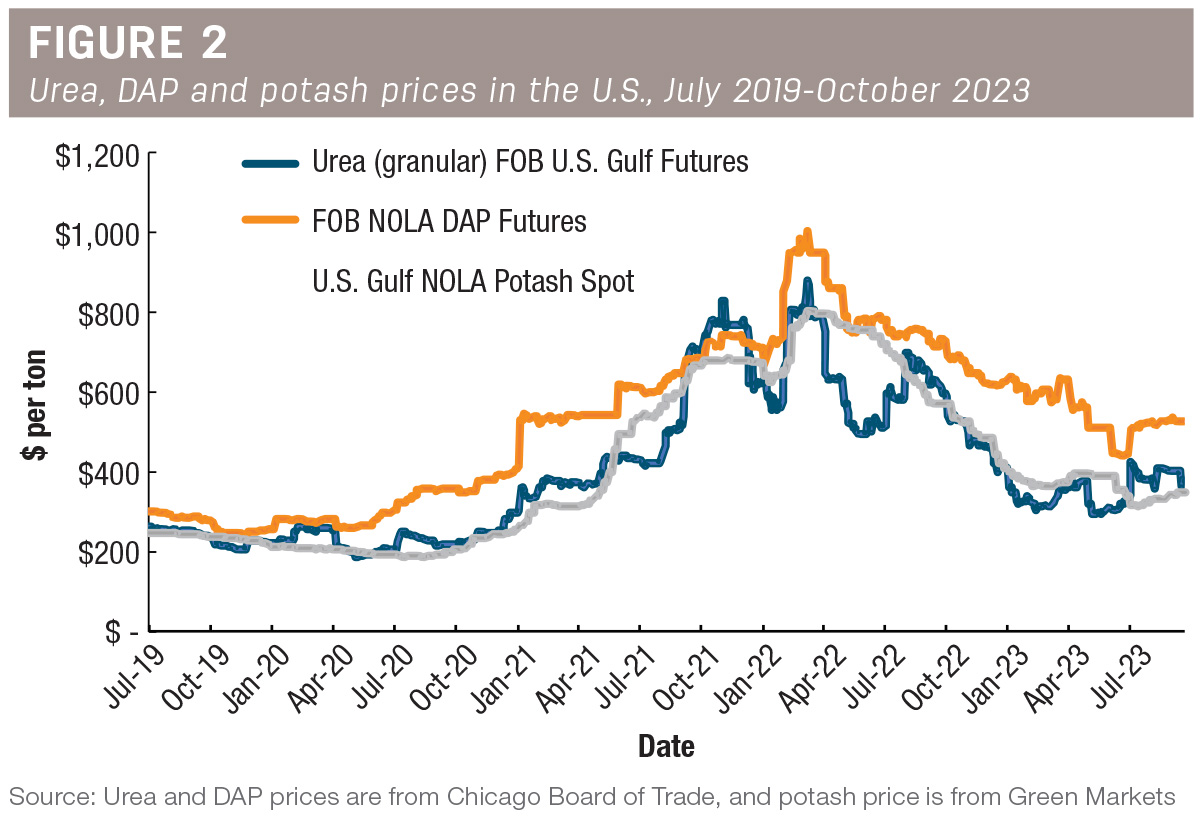

After enduring two years of soaring fertilizer prices, as shown in Figure 2, producers are finally finding some relief in 2023 as fertilizer prices have moved closer to pre-pandemic levels.

As we wrap up the 2023 crop year, we take a look at what happened during this turbulent time and how things are shaping up for 2024.

The U.S. and global fertilizer markets

Fertilizers primarily consist of three essential nutrients: nitrogen (N, in the forms of anhydrous ammonia, urea or liquid nitrogen), phosphorus (P, in the forms of diammonium phosphate – DAP – and monoammonium phosphate – MAP) and potassium (K, in the form of potash). While the U.S. is a significant fertilizer producer, its domestic production is unable to fully meet demand. Currently, the U.S. imports 12% of its annual nitrogen consumption, 9% of phosphate and 93% of potash from other countries. Nitrogen fertilizers mainly come from Trinidad, Tobago and Canada, while phosphate and potash come mostly from Peru and Canada, respectively. This heavy reliance on imports makes U.S. fertilizer prices susceptible to global supply and demand fluctuations.

Perhaps the most notable supply shock contributing to the price spike over the past few years is the Russia-Ukraine war that broke out in late February 2022. This conflict significantly disrupted global fertilizer availability, given that Russia and Belarus (a close ally of Russia) were among the largest fertilizer exporters. Combined, the two countries contributed to roughly 17% of the overall global fertilizer exports in 2020. Russia alone accounted for 16% of nitrogen exports and 12% of phosphate, while the two countries combined represented 40% of the global potash trade.

As seen in Figure 2, pandemic-related supply disruptions had already driven up fertilizer prices between 2020 and early 2022. However, prices took a substantial leap with the onset of the war, as international sanctions on Russia and Belarus were imposed. During this period, some countries also implemented export quotas on agricultural goods, including fertilizers, to protect their domestic producers and national food security goals. This further exacerbated supply issues in the global fertilizer market.

To address these supply challenges, the U.S. and European Union eased restrictions on fertilizer exports from Russia and Belarus in mid-2022. Additionally, the price of natural gas, the key ingredient for nitrogen fertilizers, significantly declined due to lower-than-expected demand and record-high production. The U.S. also scaled up its fertilizer production and announced new investments to expand fertilizer production capacity. Further, starting in mid-2022, China significantly increased its fertilizer exports. These factors collectively led to a rapid decline in prices during the second half of 2022 and 2023.

Currently, while still above 2019 levels, urea, DAP and potash prices have decreased by more than 50% from their spring-2022 peaks. However, prices have slightly rebounded beginning in September 2023. Several reasons contribute to this resurgence. First, with significantly lower prices, some producers have locked in fertilizers for the 2024 crop year, exerting upward pressure on prices. Moreover, the Mississippi River, crucial for transporting imported and domestically produced fertilizers within the U.S., has experienced record-low water levels due to a lack of precipitation. This, coupled with a shortage of rail cars and trucks, has significantly constrained the transportation availability in the U.S. for fertilizers.

What lies ahead in 2024?

As we look ahead to 2024, it's crucial to factor in several key considerations when assessing the fertilizer market's trajectory.

The first is the persistent elevated geopolitical risk. While supply chains have largely normalized, the Russia-Ukraine war shows no signs of imminent resolution. This suggests that uncertainty in energy and fertilizer prices will remain high. Furthermore, the conflict between Israel and Palestine that erupted in October 2023 has exacerbated global geopolitical uncertainties. Israel is a key supplier to the global potash market, and the conflict has led to a substantial portion of the country’s potash export being at risk. Additional concerns may arise if Iran, a major nitrogen exporter in the region, gets involved in the conflict.

Secondly, ongoing trade restrictions likely add further uncertainties to the market. Although exports increased substantially over the past 12 months, China (the world’s largest urea producer) imposed export restrictions in September 2023 to support domestic supply. This raises the possibility of additional availability issues if China enforces further restrictions on its exports. Additionally, energy markets will likely remain volatile in 2024. Natural gas prices in the U.S. are projected to slightly increase in 2024, according to the most recent forecast by the U.S. Energy Information Administration. While nitrogen-based fertilizer production has picked up in Europe due to declining natural gas prices, the European energy landscape remains precarious, with insufficient storage capacity to meet winter heating and industrial demands.

Overall, as we navigate the fertilizer market landscape in 2024, it's essential to remain vigilant and adaptable in response to these multifaceted challenges. The interplay of geopolitics, trade dynamics and energy prices will continue to exert influence, shaping the course of the fertilizer industry in the coming months. In light of these uncertainties, growers are advised to diversify the timing of their fertilizer procurements for the 2024 crop year. As the saying goes, it's wise not to put all your eggs in one basket.

Tyler Hand contributed to this article and is a University of Idaho graduate student.

.jpg?height=auto&t=1713304395&width=285)