Entering the final month of 2023, dairy producers have assurances a major dairy risk management safety net will be in place for the new year.

A stop-gap federal spending measure, signed into law in November, extended the Dairy Margin Coverage (DMC) program into 2024. It also rolled the Supplemental DMC program – approved in 2019 to allow milk production history adjustments for small-sized and midsized producers – into the regular DMC program. Both were set to expire at the end of 2023.

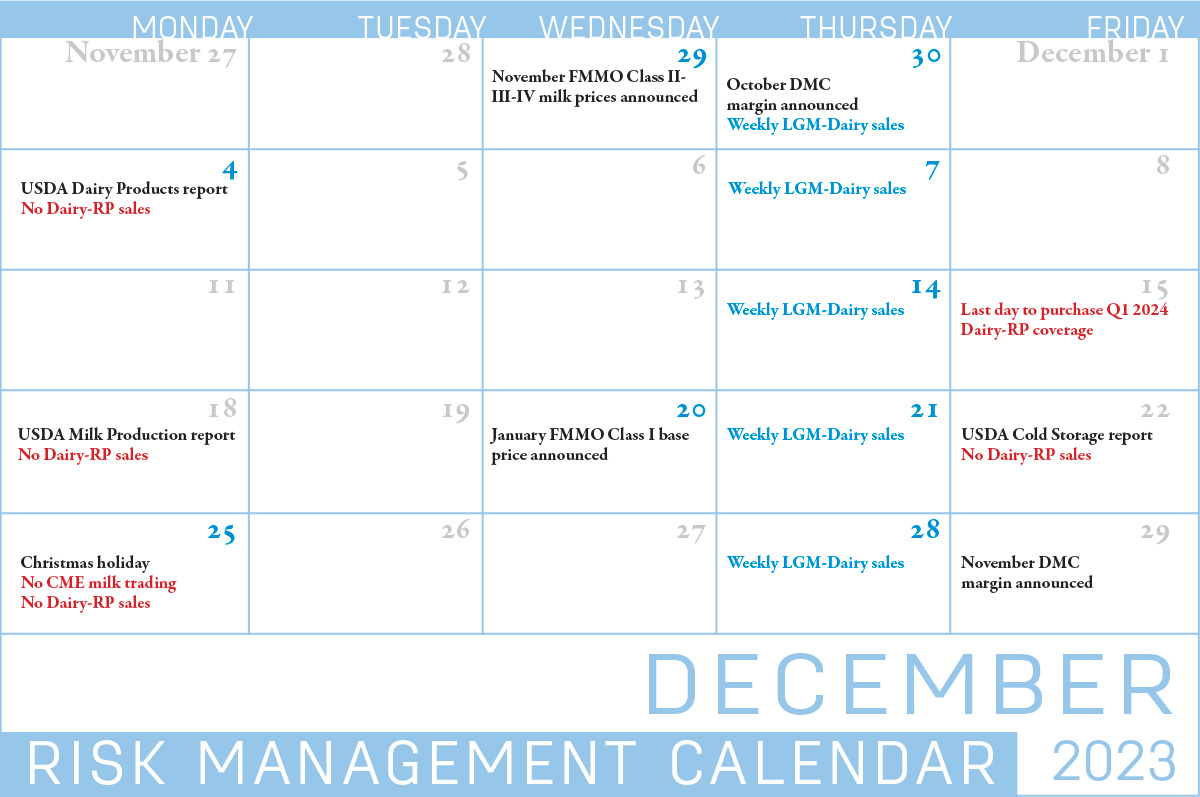

At Progressive Dairy’s deadline, the USDA had not yet announced a 2024 DMC sign-up period. For now, here’s a look ahead at important dates, reports and factors affecting dairy risk management decisions, as well as other information impacting your milk check in December.

DMC program

The October 2023 DMC margin and indemnity payments will be announced on Nov. 30, with November data released on Dec. 29.

At $8.44 per hundredweight (cwt), the September DMC margin triggered Tier I indemnity payments at coverage levels of $8.50 per cwt and above. The top payment was $1.06 per cwt at the maximum Tier I $9.50 coverage level.

Although very small indemnity payment are still in the near-term outlook, October DMC margins are expected to continue to improve, combining a small recovery in milk prices and a slight decline in projected feed costs. As of Nov. 24, the DMC decision tool forecast the October margin at $9.21 per cwt, the November margin at $9.46 per cwt and the December margin at $8.62 per cwt.

Through Nov. 6, DMC indemnity payments for the first nine months of 2023 had reached nearly $1.27 billion, a new annual record high.

Check the Progressive Dairy website or your Farm Service Agency for 2024 enrollment details as they become available.

Dairy Revenue Protection

Another possible change in the year ahead regards the Dairy Revenue Protection (Dairy-RP) program.

Producers managing risk through Dairy-RP are eligible to cover revenue on a quarterly basis. Currently, that coverage is available for the first quarter of 2024 (January-March) through the first quarter of 2025.

Specific to December (see Calendar), Dairy-RP quarterly endorsements are available for sale until about the 15th of the month preceding the quarter to be covered. That means coverage availability for the first quarter of 2024 closes on Dec. 15.

Looking further out, one of the limitations to participation in the Dairy-RP program is the high cost of premiums for coverage on distant quarters. The premiums for near-term quarters are lower than the premiums for deferred quarters. However, risk management strategies using distant quarters may be more effective in providing coverage that lasts for the entire duration of a typical slump in milk prices.

A proposal to be considered in early 2024 would boost premium subsidies on deferred quarters (quarters three through five), providing more financial incentives for producers to seek longer-term revenue protection under Dairy-RP.

The market changes daily and Dairy-RP endorsements must be purchased between the Chicago Mercantile Exchange (CME) market closing and the next CME opening. Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when CME trading is closed due to holidays. In December, that includes the Christmas holiday. New Year’s Day impacts availability on Jan. 1, 2024.

Also, Dairy-RP coverage cannot be purchased on days when major USDA dairy reports that could impact markets, including Milk Production, Cold Storage and Dairy Product reports.

Livestock Gross Margin for Dairy

Livestock Gross Margin (LGM-Dairy) is another subsidized margin insurance program administered by the USDA’s Risk Management Agency (RMA).

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM‑Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the coverage period available during the final week of November contains the months of January-November 2024.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

Production and price outlooks

U.S. milk production fell below year-ago output for a fourth consecutive month, according to the USDA’s October Milk Production report, released Nov. 20. Based on preliminary October 2023 cow estimates, the U.S. dairy herd is now the smallest dating back 21 months to January 2022. October 2023 U.S. cow numbers were estimated at 9.37 million head, down 42,000 from a year earlier.

Read: Milk production decreases in USDA October estimates

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report was released Nov. 9. The milk production forecast for 2023 and 2024 was reduced from last month as milk cow numbers and output per cow were revised lower. The projected average all-milk price for 2023 unchanged from last month at $20.70 per cwt. The projected all-milk price for 2024 was raised 10 cents to $20.80 per cwt.

Read: USDA outlook sees slower-than-expected growth in milk production

FMMO data

Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported October 2023 prices and pooling data, Nov. 11-14. Compared with September, October 2023 statistically uniform milk prices were higher in eight of 11 FMMOs. In most cases, October uniform prices were the highest since January. In the other three FMMOs, uniform price weakness was the result of a substantial decline in the value of protein and the impact on Class III prices.

Read: October FMMO uniform prices mixed as Class IV pooling dips

November 2023 uniform prices and pooling totals will be announced around Dec. 11-14. Based on FMMO advanced prices and current futures prices, the current price outlook is mixed.

Check the Progressive Dairy website for updates affecting milk prices as they become available.