Restrained supply and expanding demand are offering some hope that the current dire milk price situation may improve, according to National Milk Producers Federation’s Peter Vitaliano. Summarizing dairy markets in the August 2023 Dairy Management Inc./National Milk Producers Federation Dairy Market Report, he said that’s potentially offering a rapid recovery in dairy margins that are currently at punishing levels for dairy farmers.

The past year’s relatively modest increase in U.S. milk production that faltered in the spring came to a full stop in June and July. Additionally, Vitaliano noted, the recent bout of intense dairy product retail price inflation also eased, with retail prices of fluid milk, cheese and butter all lower than a year earlier and retail prices of all dairy products up an average of just 1.3%.

With that, dairy futures markets have been signaling that milk prices will rapidly improve in the remaining months of 2023, as will the Dairy Margin Coverage (DMC) program margins.

However, a third key driver of milk prices, U.S. dairy exports, continues to languish relative to the last two years of consecutive record-setting export volumes, potentially limiting the upside of price recovery.

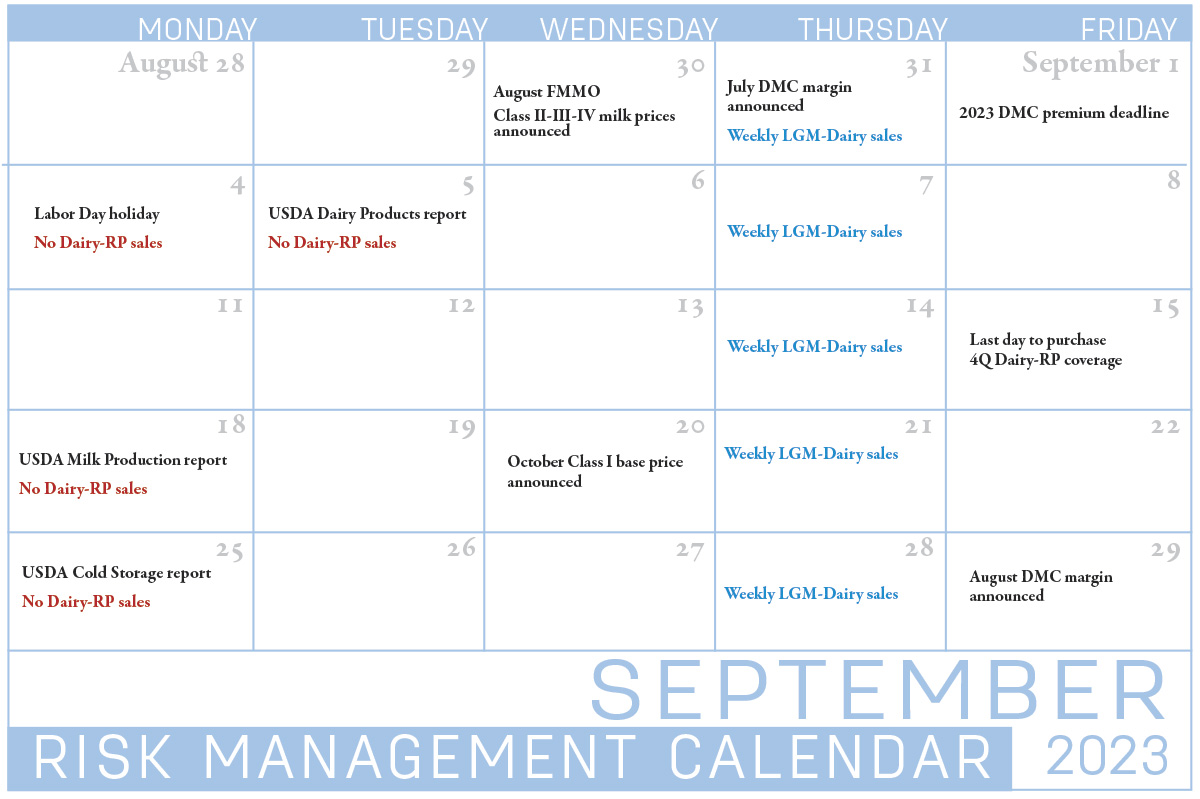

Here’s a monthly update on risk management tools available through the USDA and/or USDA’s Risk Management Agency (RMA), as well as other information impacting your milk check.

DMC program

The July 2023 DMC margin will be announced on Aug. 31, with extremely large indemnity payments expected. As of Aug. 24, the DMC decision tool forecast the July margin at just $3.23 per hundredweight (cwt).

The August DMC margin and indemnity payments will be announced on Sept. 29.

The June DMC margin was $3.65 per cwt, below the program’s “catastrophic” floor of $4 per cwt, its lowest level since inception of the DMC program and its predecessor, the Margin Protection Program for Dairy (MPP-Dairy). With that tiny margin, the July DMC margin triggered Tier I indemnity payments at all coverage levels. The top payment was $5.85 per cwt at the maximum $9.50 coverage level.

Based on latest enrollment data as of Aug. 14, 16,996 dairy operations are enrolled in the 2023 DMC program, representing about 73% of operations with established production history. Annual milk volume covered under the program totals 156.2 billion pounds, about 77% of production history established in 2023. The report does not include enrollment in the Supplemental DMC program.

January-June DMC payments totaled nearly $610.6 million, averaging $35,925 per dairy operation enrolled in 2023 (minus the 5.7% sequestration deduction).

Most dairy farmers participating in the program have likely had premiums already deducted from indemnity checks. Those who haven’t are reminded that 2023 DMC premiums are due by Sept. 1. Those failing to pay outstanding premium by the deadline will be mailed “receivables” letters on Sept. 5. County Farm Service Agency (FSA) offices will not send letters to dairy operations with $25 or less of total unpaid premium balances.

Failure to pay the premium may affect producer eligibility in the DMC program in future years.

Dairy Revenue Protection (Dairy-RP)

Producers managing risk through Dairy-RP are eligible to cover revenue from the fourth quarter of 2023 (October-December) through the fourth quarter 2024. Dairy-RP quarterly endorsements are available for sale until about the 15th of the month preceding the quarter to be covered. That means coverage availability for the fourth quarter of 2023 closes on Sept. 15.

Dairy-RP coverage cannot be purchased on days when major USDA dairy reports are released that could impact markets, including Milk Production, Cold Storage and Dairy Product reports (see Calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when Chicago Mercantile Exchange (CME) trading is closed due to holidays.

The market changes daily, and Dairy-RP endorsements must be purchased between the CME market closing and the next CME opening.

Livestock Gross Margin for Dairy

Livestock Gross Margin (LGM-Dairy) is another subsidized margin insurance program administered by the USDA’s RMA.

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM‑Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the coverage period available during the final week of August contains the months of October 2023 through August 2024.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

July milk production lower

Reductions in cow numbers and weaker average milk output per cow contributed to a decline in U.S. and major state milk production in July, the first year-over-year decline since June 2021-22. (Read: Cow, milk reductions evident in USDA July estimates)

Preliminary July 2023 U.S. cow numbers were estimated at 9.4 million head, down 13,000 from a year earlier and down 3,000 from June’s revised estimate. Among the 24 major dairy states, July 2023 cow numbers were estimated at 8.92 million, down 7,000 from June 2023 but unchanged from July 2022. The U.S. and major dairy state dairy herd is now the smallest since last December.

Contributing to the smaller milking herd, about 1.85 million head of dairy cull cows were marketed through U.S. slaughter plants through July 29, up about 101,300 from the same period in 2022.

FMMO data

Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported July 2023 prices and pooling data. In a summer repeat, uniform or blend prices continued to decline, and Class IV milk pooling volume stayed low. (Read: July FMMO uniform prices moved lower while pooling levels changed little)

WASDE outlook

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report was released Aug. 11. Milk production forecasts for 2023 and 2024 were reduced from the previous month, with cow numbers lowered for both years. Output per cow was reduced for 2023 but unchanged for 2024. Restrictions on production growth provided some support for a slightly better price outlook. Read: (USDA reduces 2023-24 milk production estimates, adding a little support to price forecasts)

Check the Progressive Dairy website for updates affecting milk prices and income margins as they become available.

'Protecting Your Profits' update

Pennsylvania’s Center for Dairy Excellence (CDE) has posted its monthly “Protecting Your Profits” dairy risk management discussion. CDE Executive Director Jayne Sebright invited Jacob Thompson, who serves as a dairy business adviser for Land O’Lakes, to share his perspective on milk markets, supply factors and risk management program margins. Access the recording in a webinar or podcast format here.