June and July continued to apply stress to milk prices, feed costs and dairy producer income margins. In the midst of the “dog days” of summer, here’s a monthly update on risk management tools available through the USDA and/or USDA’s Risk Management Agency (RMA), as well as other information impacting your milk check.

Dairy Margin Coverage (DMC) program

The June 2023 DMC margin will be announced on July 28, with extremely large indemnity payments expected.

The May DMC margin was $4.83 per hundredweight (cwt), triggering Tier I indemnity payments at $5-$9.50 per cwt coverage levels and Tier II indemnity payments at $5-$8 per cwt coverage levels.

Payments on May 2023 milk marketings enrolled in the program totaled about $172.3 million, bringing total payments for the first five months of 2023 to nearly $611.94 million. January-May DMC payments averaged $36,147 per dairy operation enrolled in 2023. All payments are subject to a 5.7% sequestration deduction.

Read: May 2023 DMC margin plummets to $4.83 per cwt

Based on current futures prices and DMC decision tool calculations as of July 18, the forecast DMC margin falls to about $4.10 per cwt for June and $3.75 per cwt for July, before rebounding to $5.16 per cwt for August.

Dairy Revenue Protection (Dairy-RP)

Dairy-RP quarterly endorsements are available for sale until about the 15th of the month preceding the quarter to be covered. Producers managing risk through Dairy-RP are now eligible to cover revenue from the fourth quarter of 2023 (October-December) through the fourth quarter 2024.

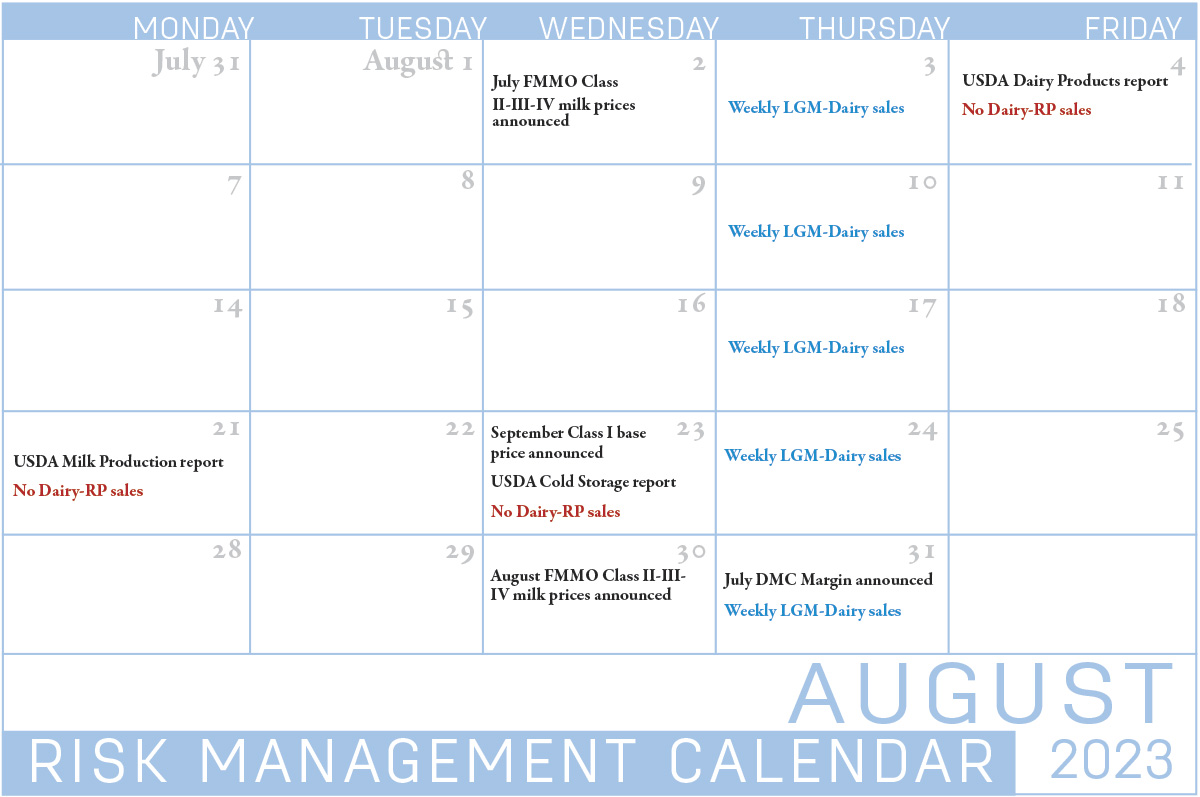

Dairy-RP coverage cannot be purchased on days when major USDA dairy reports are released that could impact markets, including Milk Production, Cold Storage and Dairy Product reports (see Calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when Chicago Mercantile Exchange (CME) trading is closed due to holidays.

The market changes daily and Dairy-RP endorsements must be purchased between the CME market closing and the next CME opening.

Livestock Gross Margin for Dairy (LGM-Dairy)

LGM-Dairy is another subsidized margin insurance program administered by the USDA’s RMA.

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM‑Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the coverage period available during the final week of August contains the months of October 2023 through August 2024.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

June milk production

The USDA’s preliminary June 2023 Milk Production report was released on July 20. Compared to a year earlier, the USDA estimated June milk production was unchanged to slightly lower in the U.S., and up just 0.2% in the major dairy states, the fourth straight month output was up less than 1% from a year ago.

Among the 24 major dairy states, June 2023 cow numbers were estimated at 8.929 million, up 14,000 from June 2022 but down 20,000 from May 2023.

Read: June U.S. milk production held in check

FMMO data

Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported June 2023 prices and pooling data. Uniform or blend prices were lower in all FMMOs. With a widening Class III-IV price spread, Class IV milk pooling moved to a six-month low.

Read: June FMMO uniform prices fall further and Class IV milk stays out of the pool

WASDE outlook

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report was released July 12. Compared to last month, the USDA left the 2023 milk production estimate unchanged but reduced 2024 production expectations slightly. The outlook for prices continues to weaken.

Read: USDA outlook sees little change in 2023-24 milk production but weakening prices

Check the Progressive Dairy website for updates affecting milk prices as they become available.

Other news and resources

- Pennsylvania Center for Dairy Excellence (CDE) Risk Education Manager Zach Myers presents a monthly recorded “Protecting Your Profits” webinar/podcast, generally the last week of each month. Myers reviews current milk market data and provides updates to guide decision-making and risk management strategies.

Live interactive sessions are also held in January, April, July and October. The July 26 webinar will feature Hayley Springer, Penn State University Extension veterinarian and assistant clinical professor, discussing biosecurity.