Every farm manager must make decisions about equipment. When to buy, when to sell and when to hire out the work are common questions. All of these decisions start from the same place: understanding your costs.

Equipment costs fall into two major categories: annual ownership costs, which occur regardless of machine use, and operating costs, which are variable depending on use.

Ownership costs

Ownership costs, or fixed costs, begin with the purchase of the machine. Ownership costs can be as much as 60% to 80% of the total annual cost of running a piece of equipment and, as a rule of thumb, can be estimated at around 10% to 20% of the original cost of the machine. These costs include depreciation, interest, taxes, insurance and housing.

- Depreciation is a non-cash expense that reflects a loss in value due to age, wear and obsolescence. It is also an accounting procedure to recover the initial purchase cost of an asset by spreading this cost over the entire ownership period.

- Interest expense should be accounted for regardless of a financed or a cash purchase. If you borrow money to purchase equipment, you should use the interest rate agreed upon by you and your lender. If cash was used, the rate of return will depend on the opportunity cost of that capital had it been used elsewhere in your farm business.

- Insurance is generally an annual charge to protect yourself from fire, theft, hail, wind, collision and general liability. A charge for insurance should always be included in ownership costs, even if the owner carries no formal insurance because some losses can be expected over time.

- Housing is included in most machinery cost estimates at around 1% of the average machine value. A housing cost can also be determined by calculating the annual cost per square foot of the machine shed and multiplying this by the number of square feet the machine occupies. Even if a machine is not housed, a charge should be included to reflect the cost of wear and tear. A national study found that tractors left outside had a 16% lower trade-in value after 10 years than those kept inside.

Operating costs

Operating costs, or variable costs, are directly related to the level of use of the machine. If you have a piece of equipment that sits unused, its operating cost is zero. These costs include repairs, lubrication, fuel, labor and other general maintenance.

- Repair costs will vary widely due to routine maintenance protocols, terrain, soil type, climate and operator skill. Most machinery cost calculators utilize factors based on average costs that are maintained by the American Society of Agricultural and Biologic Engineers. An important consideration is that machinery costs generally increase over time. Repair costs on a new machine (especially when purchased under warranty) can be extremely low. As more parts wear out, repair costs can increase rapidly, making them difficult to estimate. The best source of information when forecasting your costs is detailed recordkeeping of actual repair costs for each machine under the existing level of use, cropping system and maintenance program.

-

Fuel and lubrication costs include dollars spent on gasoline, diesel, oil and other lubricants. In general, fuel use can be estimated as follows:

- Fuel cost per hour can be estimated by multiplying the estimated fuel use by the purchase price of the fuel.

- Labor costs are generally estimated separately from machinery costs, but need to be included in the cost of performing a given machine operation. The amount of labor needed depends on the operation being performed, field speed and efficiency, and the size of machinery being used. The total labor charge should also include time spent fueling, lubricating, repairing, adjusting and moving machinery between fields. The value placed on labor should reflect local rates, with higher rates being placed on more skilled operations.

In practice, true costs are unknown until equipment is sold or worn out and the annual operating cycle has ended. However, there are several excellent calculators available which can help with the process. The University of Idaho recently developed an Excel-based Machinery Cost Calculator, which includes used equipment values collected from cooperating producers in the Northwest region. Farm managers can also input their own information, if known, to make management decisions. This worksheet can be found on the Idaho AgBiz Management Tools page under the headline: “Software and Calculators: Machinery Cost Calculators.”

How does it work?

These calculators help us find the cost of a single machinery operation. To start, we need answers to the following major questions:

- What operation am I performing? (disking, spraying, combining, etc.)

- On how many acres?

- What equipment am I using? (power unit only or power unit and implement?)

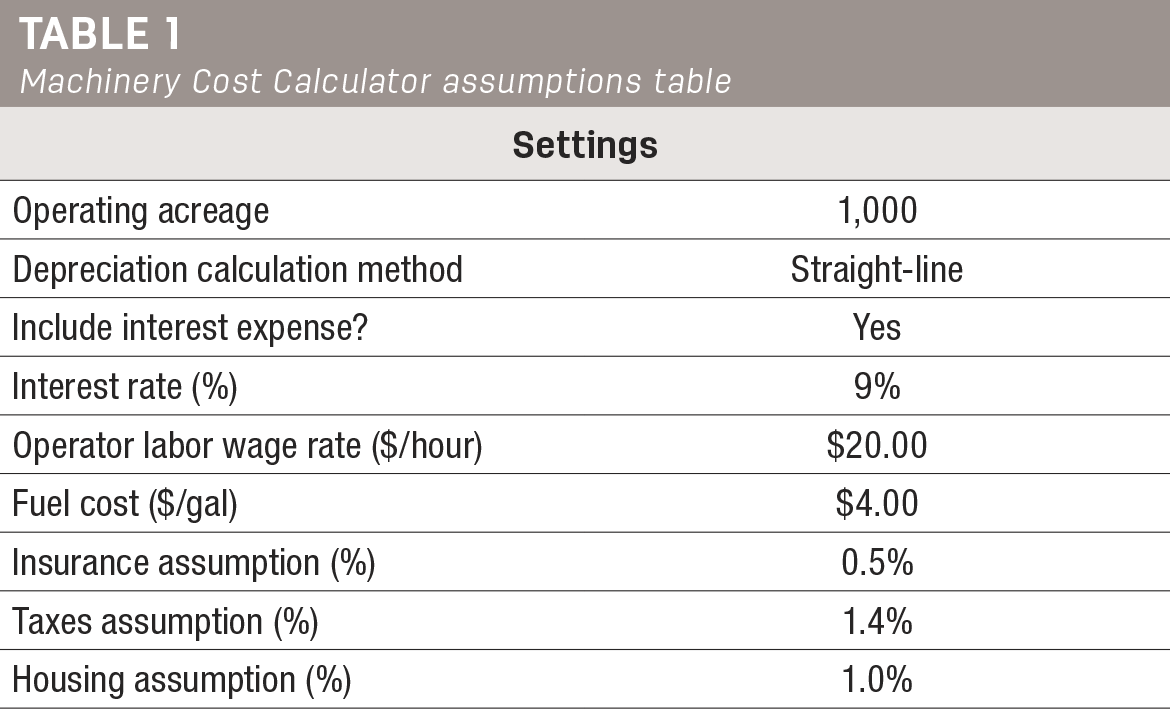

For our example (Table 1), we’ll look at spraying operations on 1,000 acres using used equipment values from farmers in the region. We’re also assuming straight-line depreciation, a 9% interest rate on equipment, $20 per hour equipment operator wage, $4 per gallon fuel cost and are estimating insurance costs, taxes and housing at 0.5%, 1.4% and 1% of value, respectively.

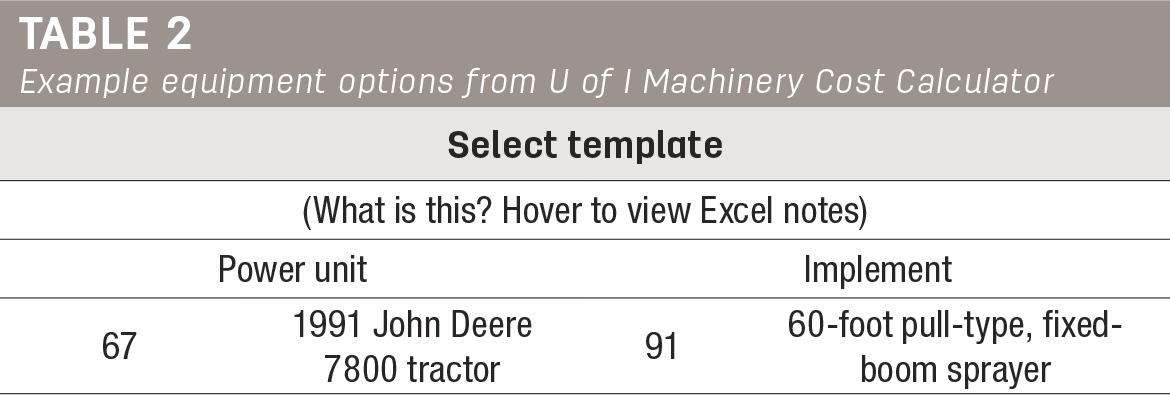

We’ll be using pre-loaded (farmer-reported values) for a 1991 John Deere 7800 tractor and a 60-foot pull-type, fixed-boom sprayer (brand not reported) (Table 2).

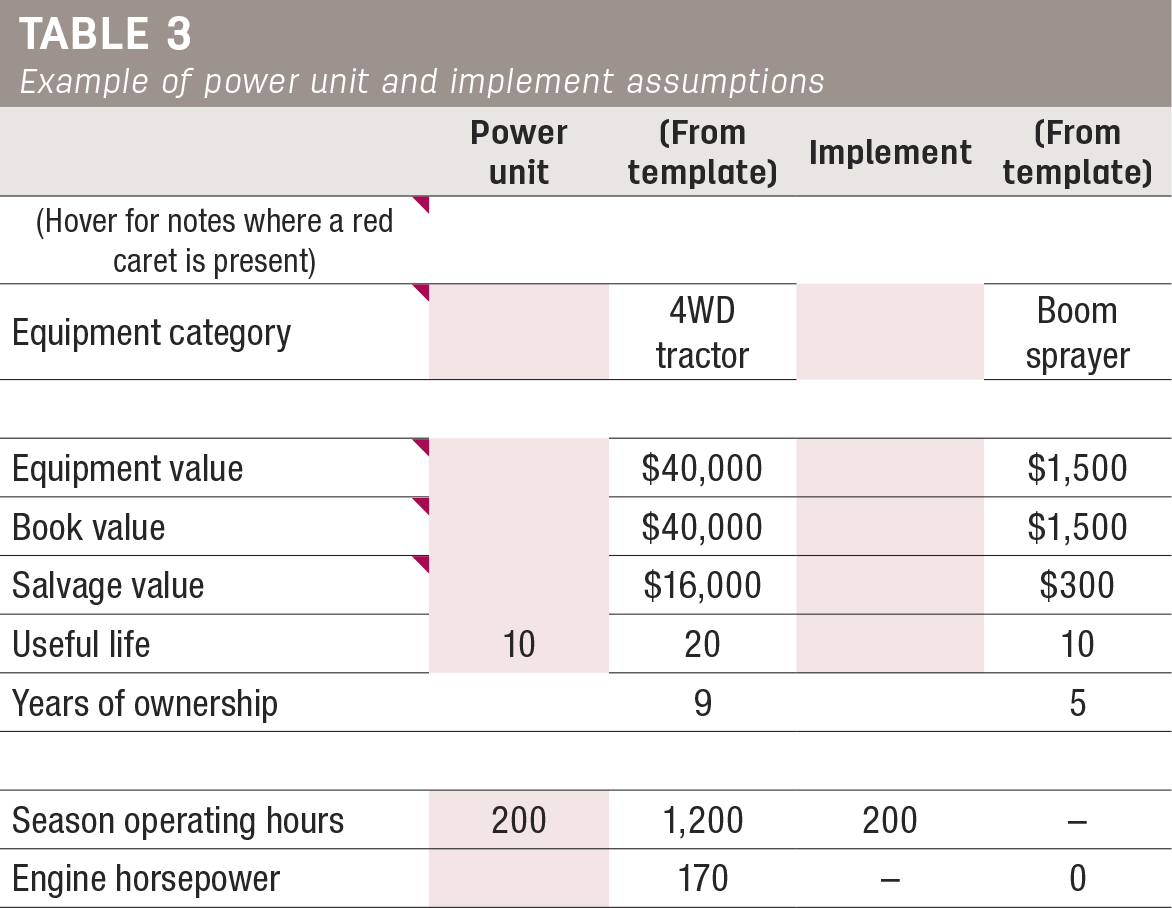

When using our calculator (Table 3), these reported values are pre-loaded and can be used to make assumptions about your own similar equipment. However, if your own equipment values are known, they can be entered.

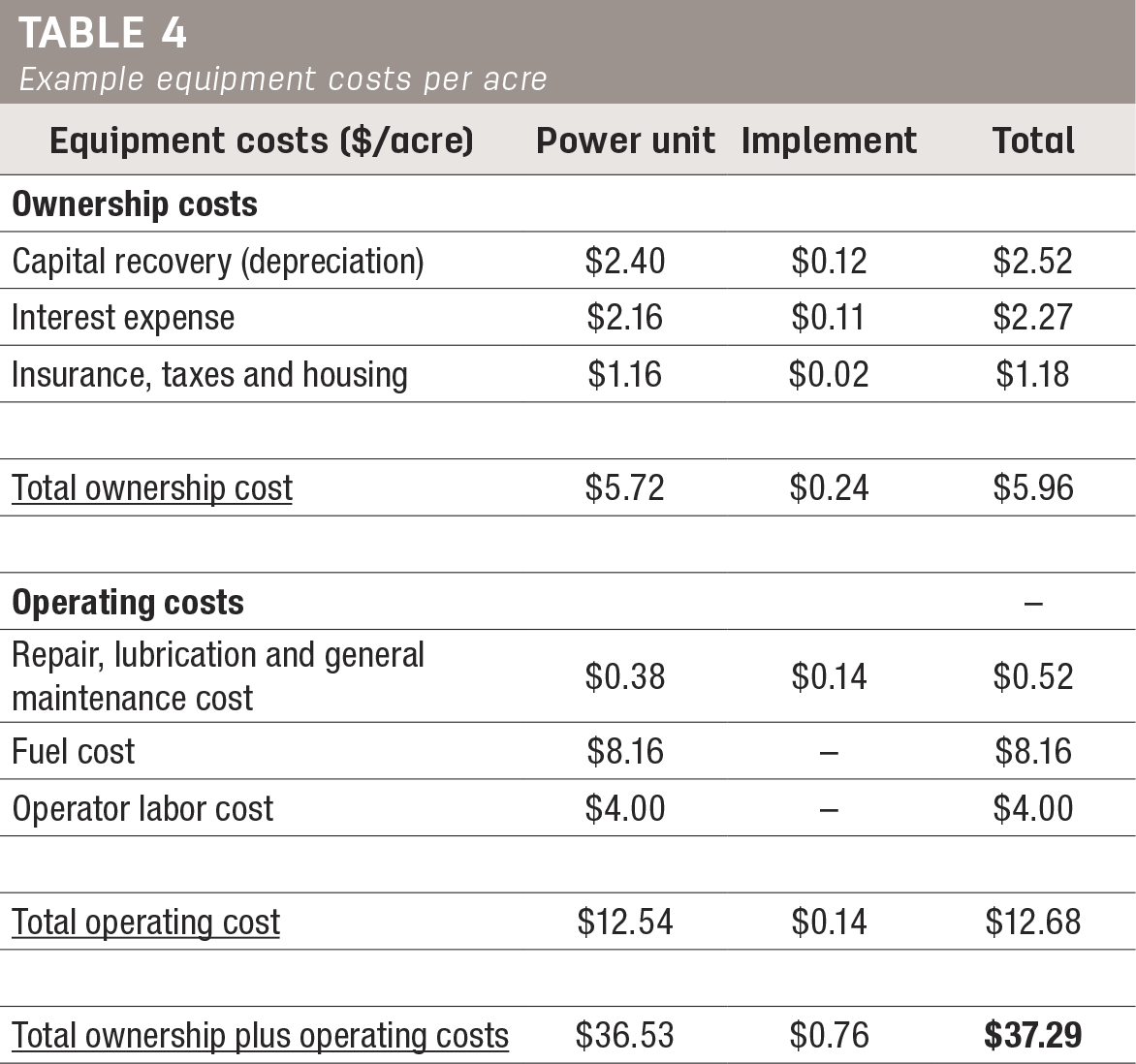

In moments, we now have a solid estimate of the total dollar per acre cost for spraying operations on this farm. For total costs, simply multiply the dollar per acre cost by the operating acreage. On this farm, spraying operations are expected to cost $37.29 per acre, or $37,290 (Table 4).

As you might guess, this is an excellent planning/budgeting tool – but it can also be used to compare your cost with current equipment, your cost with new equipment and the cost of custom hire.

References omitted but are available upon request by sending an email to the editor.