Cattle markets continue to be strong, with all classes of cattle trading above year-ago and five-year average historical prices. High farmgate prices can lead to exciting marketing opportunities across the value chain, but they can also lead to complacency. Mixed range conditions along with higher labor, feed, transportation and interest expenses have almost certainly increased break-even costs.

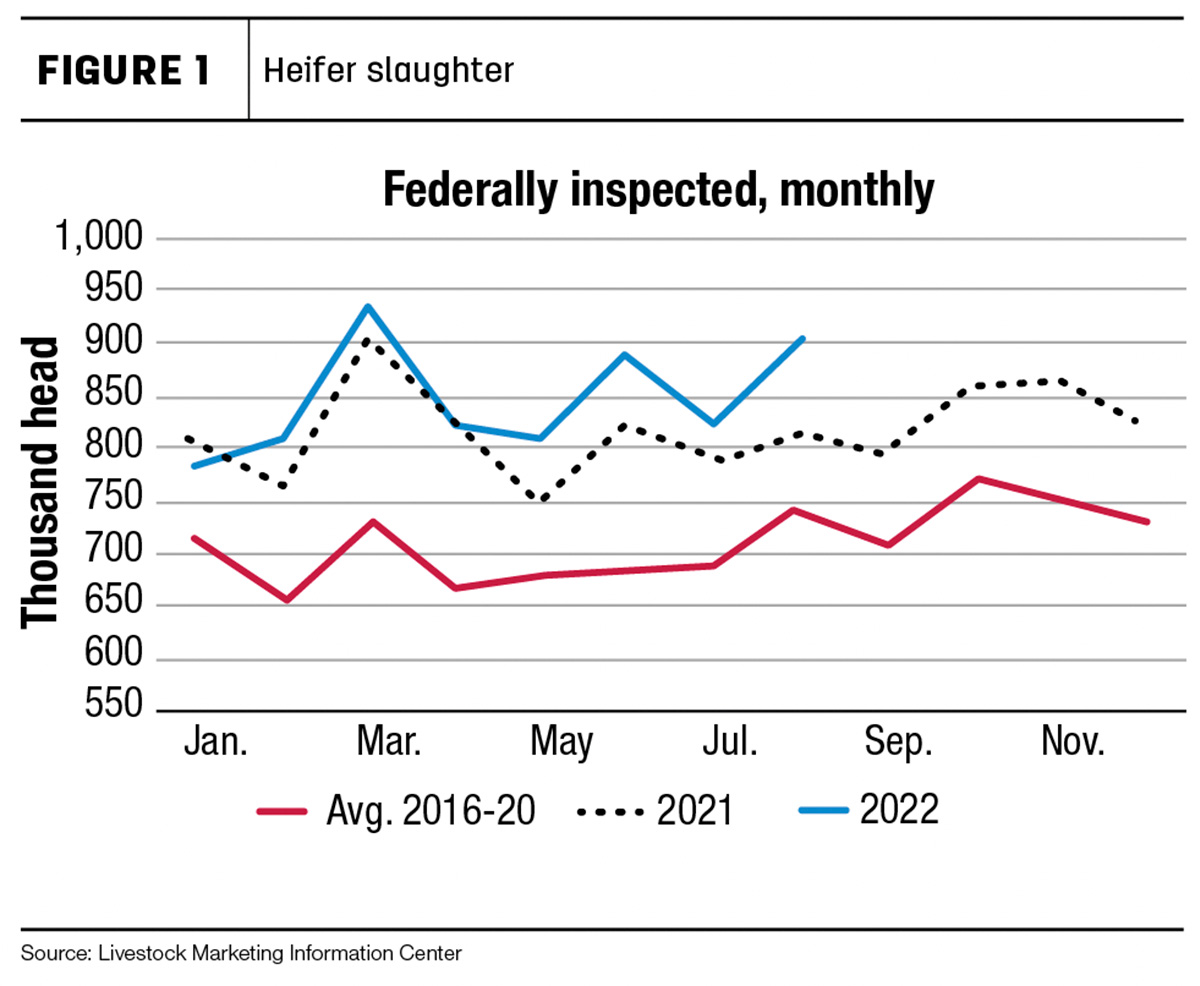

The USDA published a summer weather review in its Sept. 20, 2022, Weekly Weather and Crop Bulletin. By summer’s end, drought had covered more than 40% of the country for 101 consecutive weeks, a 21st century record. By Aug. 28, nearly one-half (46%) of the nation’s rangeland and pastures were rated in very poor to poor condition, unchanged from the end of May. We’re seeing the continued influence of drought conditions in the form of herd liquidation. Slaughter data through Aug. 27, 2022 (see Figure 1) showed heifer and beef cow harvest levels running 11.1% and 8.8%, respectively, above a year ago. If these slaughter trends continue, we can expect a tighter calf crop supply in 2023.

Drought is also contributing to an early start of the fall run. There were 2.1 million head of cattle placed on feed from July to August, and placements of lighter-weight cattle (under 700 pounds) were up around 30,000 head compared to a year ago. Lighter-weight cattle mean more days on feed and more pressure on feeder margins. We can expect that feedlots and packers will be looking at all input costs under a microscope, including the price paid for cattle and calves.

Tight margins point the spotlight on a variety of important marketing considerations:

- Adding value: Can I earn a premium for my cattle?

- Timing: How long should I retain ownership?

- Risk management: Do I know my cost of production? What opportunities are available to protect profits?

Added value

Added value can come from entry into a branded-beef program and also building strong relationships with buyers based on a reputation for creating a premium product. That premium product, a problem-free calf, may ensure the prices an operation receives this year will carry on to subsequent years when the market shifts, the cattle cycle starts over, and buyers are again in a position to avoid high-risk cattle. Implementing a vaccination protocol at the ranch level that is supported with solid nutrition and stress reduction by weaning prior to shipping strengthens an operation's reputation.

Calves ideally receive two rounds of vaccines prior to shipping, around 2 to 3 months old and again two to three weeks prior to weaning or during weaning while calves are being held for backgrounding.

When considering a vaccination protocol, it is vital to build a relationship with your veterinarian and discuss what vaccines to utilize, as well as working with your buyer or the yard they represent on what type of protocol they like to see calves come in with. Many of the branded beef programs and programmed cattle entities will also have vaccine protocol preferences.

It’s impossible to eliminate stress in cattle production, but we can take advantage of opportunities to reduce the level of stress calves experience. One of these opportunities is weaning calves prior to shipping. Holding calves for several weeks to 60 days allows for the monitoring of early illness while reducing separation stress.

Vaccine products can feel like an expensive input cost up front, but in the long run, they are a valuable step in the process of creating a premium calf. With that expense in mind, along with stress management, it makes even more sense to implement the necessary nutritional protocols to support this process. The immune system of a calf requires a high amount of energy to function properly. Vaccine response of a calf’s immune system can be reduced by stress, but with proper nutritional support, the stress response can be managed.

Shortly before weaning and during backgrounding, consider exposing calves to concentrate feedstuffs, along with free access to forage or hay. This practice initiates the process of preparing the population of rumen microbes to shift to types that digest concentrates, which will be a large part of the ration calves will be on once in the feedyard. Implementing this management step helps curb digestive issues for the calf while lessening the stress experience of switching to a new feed. Additionally, providing calves with a high-quality mineral supplement will improve overall health status of the calf as it will be receiving trace minerals that are important for proper immune function as well as proper vaccine response.

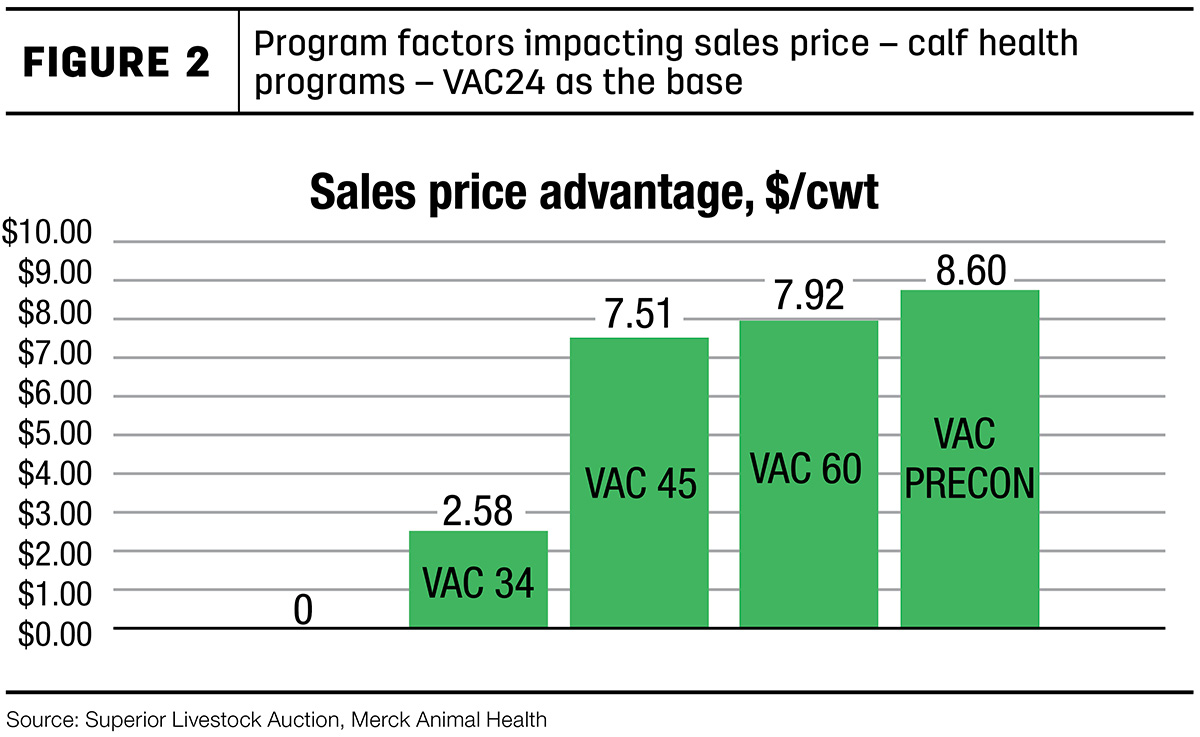

Several common calf health programs, and the premiums received for cattle placed in those protocols, are tracked by auction houses and video auction companies. Figure 2 shows the reported premiums from Superior Livestock Auctions’ 2020 data.

When seeking out premiums and management steps to capture those, there are several additional marketing program options for producers to consider as well, such as non-hormone-treated, source- and age-verified, verified natural and branded beef programs. While most programs seem simple enough to participate in, some can require significant operational changes and much higher input costs. Before diving in headfirst, it’s recommended to put pen to paper and ensure the premiums received outweigh the risk.

We don’t have data for all of the marketing programs mentioned above, but we received 2020 data from Superior Livestock Auctions tracking the following common programs and premiums. The following marketing claims are based on the average additional price per hundredweight (cwt) received versus calves with no claims as the base.

- Beef Quality Assurance, 50 cents per cwt premium

- Global Animal Partnership (GAP) (calves), $5.48 per cwt premium

- Non-hormone-treated cattle (NHTC), $3.30 per cwt premium

- Progressive genetics, $1.27 per cwt premium

Timing

The beef value chain consists of many production segments and therefore provides a variety of opportunities to market calves. Assuming your operation produces a spring-born calf, marketing options could include:

- Sell calves at weaning in the fall.

- Background calves or place on feed through the winter months and market winter yearlings.

- Background calves through the following spring/summer and market fall yearlings.

- Retain ownership of cattle in an outside feeding operation.

- Retain ownership through slaughter and market your beef directly.

While each of these options has pros and cons, it’s important to make choices that fit within the constraints of your operation. Not all producers have access to the capital required to retain ownership after cattle have been placed on feed, and even fewer have the access to capital and labor required to retain ownership through slaughter and market a large number of cattle directly.

•As with any good marketing strategy, it’s also important to remember that you don’t have to pick just one option. For example, if you believe market conditions will reward you for retaining ownership but have an opportunity to market calves for a profit, consider doing both.

Price risk management

Cattle producers are also fortunate to have a number of risk management tools at their disposal, which can assist in making timing decisions. While we recommend discussing specific details with your insurance agent, commodity broker or cattle buyer, some of the most common tools are:

- Livestock risk protection (LRP) – beef producers may choose from a variety of coverage levels and insurance periods that correspond with the time your market-weight cattle would normally be sold.

- Pros: Customizable coverage prices, heavily subsidized

- Cons: Not very flexible

- Hedging with commodity futures and options – consists of buying or selling futures contracts to exchange price risk for basis risk.

- Pros: Highly flexible

- Cons: Can be complex and is still subject to basis risk. Depending on the strategy used, producers can also be subject to margin calls.

- Forward contracting – consists of negotiating a set quantity, quality, price and delivery location with a buyer. This can be done at many stages of production.

- Pros: Eliminates both price and basis risk

- Cons: No flexibility