Editor's note: CEO Corners are editors' compilations of business news from top publications, which they have tailored for the dairy industry. The cover story of this week’s Bloomberg Businessweek (April 3, 2017, issue) tells the story of a company with an unlikely parallel to the dairy industry.

According to the article “Got any ideas?” young people aren’t consuming this company’s product like they once did; its customer base is on the decline; and some are calling the company a “failing, sinking ship.” Sounds like some opinions about the dairy industry. These are just a few of the comments published in Bloomberg Businessweek’s article about ESPN, the self-proclaimed worldwide leader in sports.

And just how is ESPN like the dairy industry? Consider these two ways:

First, due to digital broadcasting and social media, the company is losing younger viewers, according to the Businessweek article. They’ve lost more than 12 million viewers since 2011, which is when the Disney-owned media giant’s viewership reached a peak of 100 million viewers, according to Nielsen data. Does that sound familiar to the decline in fluid milk consumption seen in the dairy industry? It should. While the dairy industry’s decline hasn’t been as fast as ESPN’s 12 percent decline in just six years, the overall decline is still somewhat similar.

According to USDA Agricultural Marketing Service data, volume of fluid milk sales peaked in 1991 at more than 55 million pounds of milk per year. Since then milk sales have declined 9 percent, with consumers buying just under 50 million pounds of milk in 2015, the most recent year of data available.

How is ESPN responding to the loss of customers? Doubling down. According to the article, ESPN’s strategy is “to defend the cable TV bundle at all costs.” In other words, keep charging for a product even when consumers are actively turning to other alternatives. This sounds like the dairy industry’s approach to competition in the fluid milk aisle from “milk” alternatives. The industry just recently pushed support for the Dairy Pride Act, which would prohibit non-dairy products, such as almond milk or hemp milk, to be labeled as milk. While there is some competition in the dairy-cow fluid milk space, the dairy industry’s current strategy seems similar to ESPN’s: Expect that most consumers will still be willing to pay for a product they’ve loved in the past.

Read the original article here.

Will more Americans be buying their milk from Amazon?

Amazon made the news this week with an announcement it would continue attempts to disrupt supermarket retailers by launching Amazon Fresh Pickup in select cities. The service would allow customers to shop for food online and then pull up to an Amazon brick-and-mortar store for pick up, according to a March 29 Wall Street Journal article. Pickup is a twist on the company’s Fresh service, which allows customers to shop for food online and have items delivered, which is also available only in select markets.

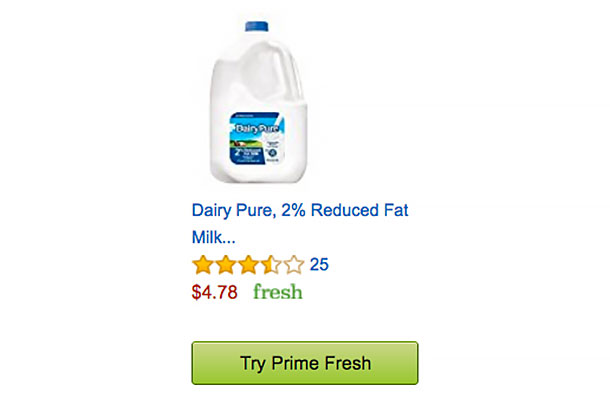

I was curious if Amazon Fresh, the delivery service, sold milk as one of its “fresh” offerings. They do in fact sell milk by the gallon – $4.78 per gallon of 2 percent conventional milk as of April 4, 2017. I guess you pay for the convenience at that price.

An organic gallon of milk was listed on the site at $7.89. The site definitely promotes organic labels and alternative milks heavily. The opening page of the dairy section had a large banner ad for almond milk.

Fresh beef is finally happening at McDonald’s

McDonald’s announced this week that it would begin serving fresh beef patties on its iconic quarter pounders. The story was published in the Wall Street Journal on March 31; the decision had been rumored for some time. The burger chain is making the move to compete with other burger chains that have stolen sales from the Golden Arches with similar offerings of fresh beef patties.

Some dairy beef does go into McDonald’s hamburgers. Pinning down just how much is a question I’m still looking into. This article claims that meat for McDonald’s burgers comes from more than 400,000 cattle farms.

I do know McDonald’s is interested in the dairy industry as a supplier because I’ve had representatives of slaughterhouses that provide beef for the McDonald’s supply chain in my office. The meat processors said McDonald’s was encouraging them to tell their suppliers – dairy farmers – to tell more stories about farmer stewardship and sustainability. ![]()

-

Walt Cooley

- Editor-in-chief

- Progressive Dairyman

- Email Walt Cooley

PHOTO 1: Photo by Walt Cooley.

PHOTO 2: Screenshot taken April 4, 2017, at amazon.com.