The largest one-third of California dairies – producing about two-thirds of the state’s milk – saw a first-half 2016 breakeven milk price of about $15.20 per hundredweight, according to the Rabobank Food & Agribusiness Research and Advisory Team. Unfortunately, they’ll see an actual milk price well below that.

Although recent milk futures prices show hope for better things to come, California’s mailbox price has recently fallen below $13 per hundredweight. Based on USDA monthly estimates, California’s all-milk price averaged $14.30 per hundredweight through the first four months of the year.

While a slow milk price recovery is forecast at the end of 2016, Rabobank projects prices will be below breakeven for a majority of California producers through the first half of 2017, according to James Williamson, Rabobank’s associate analyst for dairy based in Fresno, California.

Pre-purchased feed and deferred income from a very profitable 2014 help support many dairies through much of 2015. Dairies who diversified into nuts were able to remain profitable.

But as feedstocks were worked through and cash reserves were drained, many quickly felt the effect of lower milk prices. Some dairies saw losses as early as the first quarter of 2015, Williamson said.

Frazer LLP releases 2015 financial data

Frazer LLP, a certified public accounting and consulting firm with offices in Visalia and Brea, California, recently shared annual financial summaries from its western U.S. clients.

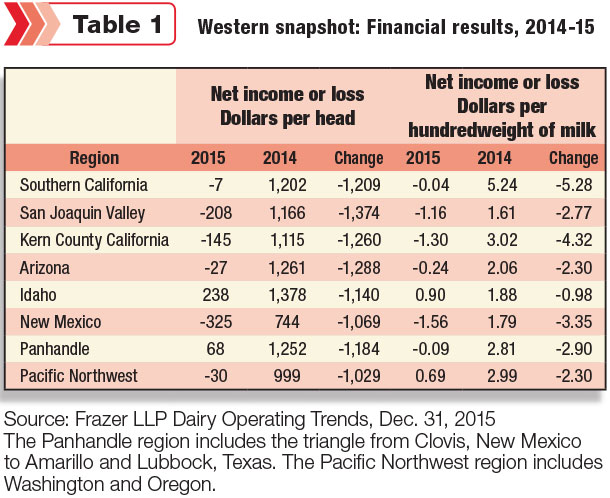

Data released in Frazer LLP’s Dairy Farm Operating Trends report showed dairy producers in five of the seven regions realized a net loss per cow and per hundredweight of milk for the year ending Dec. 31, 2015 (Table 1).

When compared to a year earlier, net income was down more than $1,000 per cow across the entire area.

The data is compiled from Frazer LLP dairy operation clients in Southern California, the San Joaquin Valley, Kern County (California), Arizona, Idaho, New Mexico, the Texas Panhandle and the Pacific Northwest. Collectively, those herds represent about 323,000 head of mature cows and produced more than 7 billion pounds of milk in 2015.

Total income includes milk sales, the value of a calf and other income. Total costs include feed, labor, herd replacements and overhead costs.

Contributing to the bottom line, feed costs were down from 2014, but milk prices were $6 to $7 per hundredweight lower.

Impact on management

Moving into 2016, California’s dairies faced even lower milk prices, with less available capital than the year before, Rabobank’s Williamson said. Many have sought to alter their feed rations to further reduce input costs, and subsequently, production.

Relative to other U.S. producers, California dairies rely more heavily on exports, and were the first to feel the pain of lower global milk prices. They will also likely be the last of the U.S. producers to feel any relief provided by upward movement in global dairy prices, Williamson said.

Over the last 10 years, California’s dairy producers have received an average of $1.85 per hundredweight less than the U.S. all-milk price. That’s creating multiple pressure points, and the state’s dairy herd is shrinking.

From 2014-2015, cow numbers and total milk production decreased by 2.3 percent and 4 percent, respectively. A further 1.5 percent decline in the 2016 total herd size would reduce it to 1.72 million cows, the lowest since 2004. Combining this with lower quality inputs, California’s total milk production could be reduced by 3 percent, to 39.2 billion pounds, in 2016.

Read: California dairies squeezing costs

Read Frazer LLP’s Dairy Farm Operating Trends report. PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke