The majority of milk produced in the U.S. is paid for based on the Federal Milk Marketing Order formulas. Within the federal order system, there are four classes of milk – defined below – and two payment systems: the “Advanced” system and the “Class and Component” system.

The prices for each class and system are determined by mathematical formulas, and the price of milk is calculated based on prices of cheese, butter, dry whey and nonfat dry milk. The National Agricultural Statistics Service (NASS) determines the price for each of these commodities.

The price of Class IV skim milk is based on the NASS price for nonfat dry milk (NDM). During 2014, the price of Class IV skim milk has varied from a low of $12.74 per hundredweight (cwt) to a high of $17.50 per cwt, a 37 percent difference.

-

Class I – Grade A milk used in all beverage milks

-

Class II – Grade A milk used in fluid cream products, yogurts or perishable manufactured products (ice cream, cottage cheese and others)

-

Class III – Grade A milk used to produce cream cheese and hard manufactured cheese

- Class IV – Grade A milk used to produce butter and any milk in dried form

The current federal order payment system was established in January 2000, but similar systems have existed for over a century. At the time these systems were originally developed, dairy was a regional business, and the federal orders were also regional.

Over time, the U.S. dairy industry has evolved into a national business. National supply and demand, and the resulting level of inventories of the dairy commodities listed above, largely determine producer milk prices. Today, the U.S. dairy business is evolving into an international business.

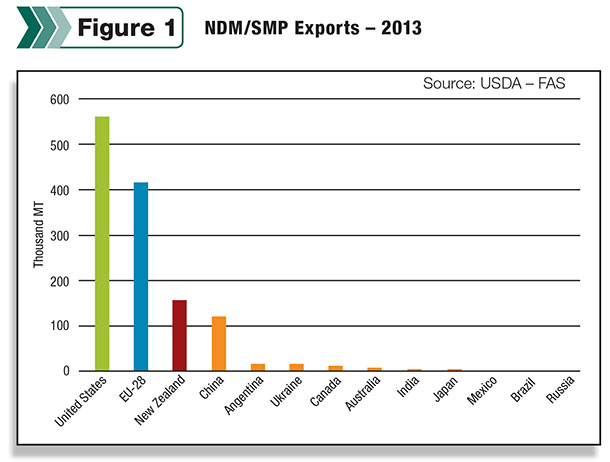

Global supply and demand influence the global prices for dairy products. Europe and New Zealand are the main suppliers to the dairy export markets, with the U.S. a distant third but growing exporter.

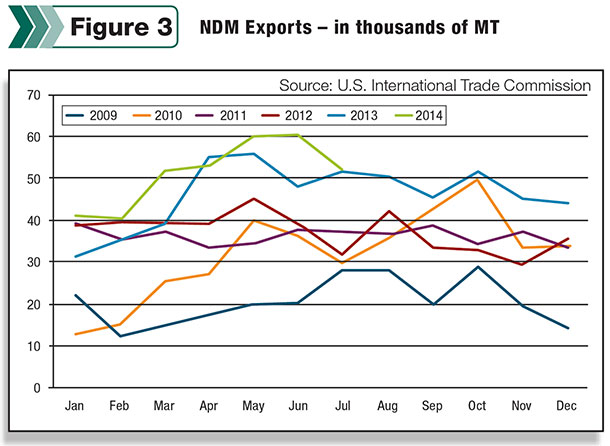

Traditionally, the U.S. exported less than 6 percent of the produced dairy solids, and most of this went to Mexico. Year-to-date through August 2014, the U.S. has exported more than 16 percent of U.S. dairy production. In terms of export volume, NDM is the largest export product, with 398 KMT exported year-to-date through August 2014. This represents 56 percent of the U.S. production of NDM.

Before going further, there is one term that should be defined. In the U.S. domestic market, powdered milk that has the fat removed is referred to as nonfat dry milk. It is sometimes listed as NFDM, but increasingly it is now listed as NDM.

The international market defines this product as skim milk powder (SMP). Technically, SMP is defined as dried fat-free milk with a minimum of 35 percent protein. There is no protein minimum for NDM. Most NDM meets this standard and on the international market is referred to as SMP.

In 2013, the U.S. became the leading exporter of NDM/SMP. The EU had typically been the leading exporter of SMP. In 2013 and early 2014, international demand was very strong and prices were excellent (Figure 1).

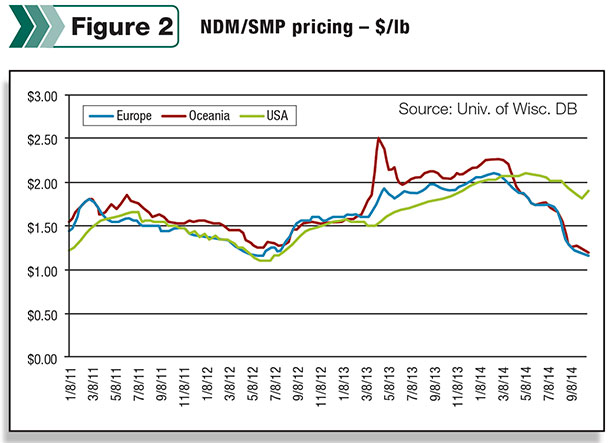

Because most of the NDM is exported, the international price really becomes the U.S. domestic price. If a NDM producer can get $2 per pound on the international market, he will want the same price from a domestic buyer. Figure 2 is a comparison of international and domestic NDM/SMP prices.

The U.S. has been holding pricing and is now above the competitive world market. The U.S. will have to lower prices or suffer loss of international market share and export volume.

Figure 3 is the U.S. year-by-year export volume of NDM/SMP. It is a growing market which has the potential for additional exports. While much of the NDM production is done on the coasts, where it can easily be exported, most U.S. dairy producers benefit from this strong international demand and pricing.

How does the pricing of NDM impact dairy producers?

First of all, the formula for Class IV milk is based on the price of NDM.

Class IV skim milk price = [(NDM-.1678) x .99] x 9 percent x 100

The only variable in determination of the Class IV skim price is NDM. The constants in the formula are the “make allowance” of $0.1678 per pound, a factor for NDM water content of 1 percent, a factor of 9 percent for the water in skim milk times 100 to convert the price from pounds to cwt.

In turn, the Class II skim milk price is based on the Advanced Class IV skim price + $0.70.

And finally, the Class I skim price is based on “higher of Advanced Class III or IV skim milk pricing factors.” For the last year, the Class IV price has frequently been above the Class III price, so Class IV pricing has dictated the Class I price.

Those paid on the component system have had an advantage with a higher producer price differential; those on the advanced system, which is primarily Class I, get an advantage in higher Class I prices, and those paid on the California system get a similar advantage.

What is the downside?

International prices for SMP are falling, as can be seen in Figure 3. It is possible that with the Russian embargo of dairy products from the EU, the EU may try to export more SMP with the excess milk resulting from the embargo.

Additional supply would further deteriorate pricing internationally and thereby decrease NDM prices domestically in the U.S. This is mentioned only as an example of how international events can influence U.S. dairy producers.

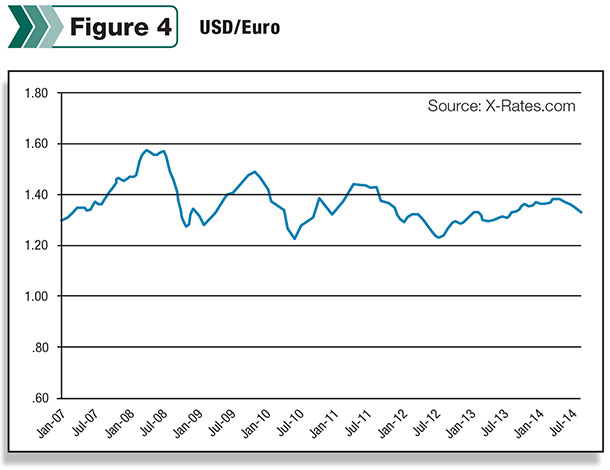

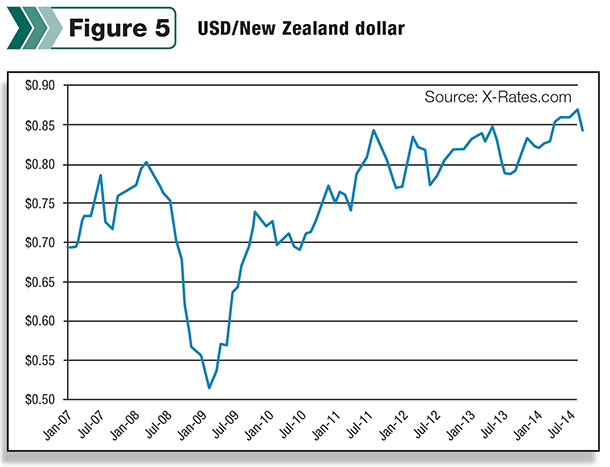

Exchange rates can have a major influence. Figures 4 and 5 are the exchange rates between the U.S. and the euro and the New Zealand dollar (NZD). When the U.S. dollar (USD) is weak, it makes the price better than the competition. Exchange rates can easily shift plus or minus 10 percent. Recently, the USD has strengthened versus the euro and the NZD, adversely impacting U.S. export prices.

While dairy prices were previously influenced primarily by domestic events, they can also now be influenced by international events. Producer dairy prices were always volatile, and the international markets will clearly increase this volatility.

Why is this a trend that will spread to other dairy products?

Today, there are only two other dairy products that are primarily export items: dry whey, which is 61 percent exported, and lactose, which is 64 percent exported. Dry whey is the basis of “other solids” pricing, and the export demand has kept the price of dry whey and therefore “other solids” higher than historical levels.

The real pricing impact will come from cheese exports. The dominant Class III price is based largely on the wholesale price of cheese. With increasing cheese exports, international events make the price of cheese more volatile, and in turn, it will have a major impact on volatility of the Class III price.

Historically, not much cheese has been exported and only once (2007) did cheese exports have a major impact on the Class III price. Cheese exports are now up to 7.7 percent of production and rising. Mexico remains the largest customer for U.S. cheese, but South Korea and Japan are close behind.

Butter prices have been at historical highs. While the export of butter is nowhere near that of NDM, butter exports did briefly double from 5,000 MT to 10,000 MT, depleting inventories and causing historical price spikes. Butter is now back to the 5,000 MT level, and butter prices are falling.

What can be concluded?

Just like the transition from regional dairy businesses to national dairy businesses, the transition to a global market will happen. There will be more volatility. One way to manage this risk is to hedge commodities and exchange rates. This changes the nature of dairy from being a cow and employee-oriented business to a sophisticated business with global issues to deal with. Nothing stays the same. PD

John Geuss is an independent dairy consultant. He can be reached by email.

John Geuss

Independent Dairy Consultant