It is important for dairy farmers to know what is taking place in consumption of dairy products. The consumers of dairy products keep the dairy industry in business. No consumers, no dairy industry. The amount and type of dairy products consumers purchase changes over time. Consumers today are not eating the same dairy products, in the same amount, as they did 20 or 25 years ago.

Dairy farmers need to be knowledgeable about these consumer changes. These changes impact the farm milk price and potential markets for a farm’s milk production. For cooperative members, the type of dairy plant facilities a cooperative may own for handling members’ milk production can and will change based on consumer dairy product preferences.

This article takes a look at the USDA’s Economic Research Service’s recently released dairy product per-capita numbers. We will start with an overview of total dairy product consumption followed by looking at trends of specific dairy products.

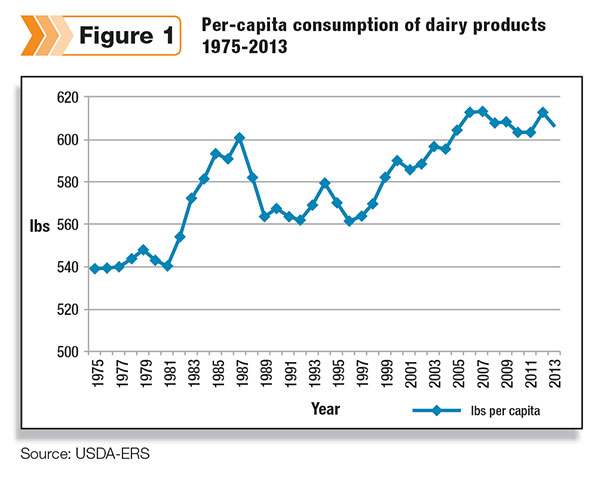

In 2013, the U.S. per-capita consumption of all dairy products was 604 pounds on a milkfat equivalent basis. Even though 2013 consumption was down 7 pounds from last year, this is the ninth consecutive year per-capita consumption of dairy products has exceeded 600 pounds (see Figure 1).

In 2013, compared to 1975, consumers consumed an additional 68 pounds of dairy products. There would be fewer dairy cows and dairy farms today without that significant increase in consumption.

A further look at the numbers shows increases in per-capita consumption are starting to slow. Per-capita consumption in 2005 was 605 pounds, only 2 pounds less than 2013. Let’s be optimistic that per-capita consumption will continue to grow in the future. However, we must be realistic that future growth will be much slower compared to the past 30 years.

That is why the U.S. dairy industry must continue to expand its export markets and constantly look for new ways dairy products can be utilized. The increased interest in milk plants designed to produce dairy ingredients is positive news for the dairy industry and should help grow the consumption of dairy products.

Good news

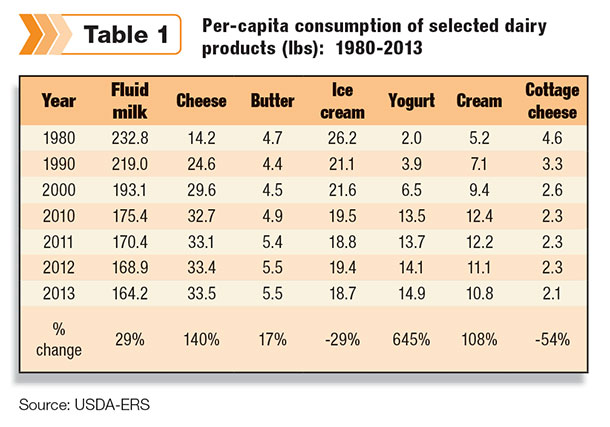

Table 1 provides a per-capita consumption summary of selected dairy products. As one looks at 2013 per-capita consumption compared to 1980, there is good news and not-so-good news.

With per-capita consumption increasing sevenfold from 1980 to 2013, yogurt is obviously good news. I see no slowing down in increased yogurt consumption in the near future for five reasons:

- First, yogurt per-capita consumption in Europe is about double that here in the U.S. The potential is there.

- Second, yogurt is convenient, nutritious, has a large variety to select from and is tasty – characteristics that sell food items in today’s marketplace.

- Third, several major companies have invested millions of dollars in manufacturing and promoting their own national yogurt brand. Look at all the yogurt television advertising. Most of these companies have the financial resources to continue to do so. Healthy competition sells products.

- Fourth, yogurt is a profitable item for retail grocers. Profit items have ample shelf space.

- Fifth, yogurt companies continually work to manufacture and market a better consumer product; look at Greek yogurt. With Greek yogurt requiring two to three times as much milk as conventional yogurt, that is extra good news for dairy farmers.

The other good-news products are cheese, butter and cream. Cheese continues to lead the dairy industry with 2013 per-capita consumption almost 2.5 times the amount consumed back in 1980. Cheese consumption should continue to edge up a little each year.

A product that may surprise some is cream. Cream per-capita consumption more than doubled from 1980 to 2013, but down from its peak in 2010. The coffee industry could be one reason for increased cream sales.

Butter is another “good news” product. Butter per-capita consumption has increased each year since 2001. In fact, we have to go back to the 1960s to find butter per-capita consumption higher than the 5.5 pounds in 2013. More butter consumed is one of the reasons for the record butter prices we recently experienced.

Not-so-good news

Fluid milk tops the not-so-good news list. 2013 per-capita consumption declined more than 4.5 pounds from 2012. Attempting to find some good news in fluid milk, per-capita consumption of 2 percent milk did increase in 2013 compared to 2012.

It is difficult to be optimistic that per-capita consumption of gallons of white milk will stop declining. However, it is encouraging to see fluid products with “added protein” hitting the marketplace. Hopefully, these products will boost sales.

In addition, the fluid segment may benefit from export sales of shelf-stable milk. According to the U.S. Dairy Export Council, over 16 million gallons of fluid milk were exported during the first eight months of 2013. Compared to two years ago, this is up almost 70 percent.

The other not-so-good news items are cottage cheese and ice cream. Cottage cheese per-capita consumption has declined by more than one-half in the past 30 years. 2013 consumption was a mere 2.1 pounds per capita. It is likely that yogurt is cannibalizing cottage cheese sales.

Per-capita consumption of the All-American dessert, ice cream, continues to decline each year. 2013 per-capita consumption is 7.5 pounds or 29 percent lower than 1980. Why? My reasons include health concerns, emphasis on reducing fat and sugar intake, the introduction of other frozen desserts such as frozen yogurt and ice cream-type products that cannot be labeled as ice cream.

Another reason is that much ice cream is no longer sold in half-gallon containers, but 48-ounce or 56-ounce containers that look like half-gallon packages. Unit sales may be holding, but less ice cream per unit lowers total volume of ice cream sold.

In summary, per-capita consumption of dairy products has remained at more than 600 pounds for nine consecutive years. However, per-capita consumption is starting to level off. This makes the need for international sales and new dairy product uses even more important.

The bright stars in the dairy industry are yogurt and cheese. Surprisingly, butter per-capita consumption is at its highest level in 45 years. Fluid milk per-capita consumption continues its many decades of decline. PD

Calvin Covington is a retired dairy cooperative CEO and now does some farming, consulting, writing and public speaking.

Calvin Covington

Retired Dairy Cooperative CEO