You’re busy – milking cows, managing employees and preparing year-end financials. With that in mind, Progressive Dairymanlooks at issues in the news impacting you and your dairy business.

In recognition of your time, we’ll attempt to summarize recent events or actions making dairy headlines and reported in our weekly digital newsletter, Progressive Dairyman Extra. Then, we’ll try to put that news into perspective and briefly describe how it might affect you.

FLUID MILK

What happened?

September 2018 sales of fluid milk faltered badly. At just under 3.8 billion pounds, sales of packaged fluid milk were down 5.6 percent compared to the same month a year earlier. Sales of conventional products were down 5.9 percent; sales of organic products were down 1.2 percent. Only sales of flavored conventional whole milk and organic whole and reduced fat (2 percent) milk were up compared to a year earlier.

Through the first nine months of the year, U.S. fluid milk sales totaled about 34.8 billion pounds, down 2.5 percent compared to the same period a year earlier. Sales of conventional products were down 2.6 percent; sales of organic products were up 0.3 percent.

The U.S. figures represent consumption of fluid milk products in federal milk order marketing areas and California, which account for approximately 92 percent of total fluid milk sales in the U.S.

What’s next?

The USDA is stepping in to buy fluid milk. In November, the USDA’s Agricultural Marketing Service awarded purchase contracts to five companies for a total of about 13.4 million pounds of fluid milk, valued at about $4.86 million. The milk will be distributed for domestic food assistance programs between Dec. 3, 2018 and March 27, 2019.

Companies awarded contracts were:

- Borden Dairy: 6.49 million pounds at a total price of $2.1 million

- Dairy Farmers of America: 34,830 pounds at a total price of $14,628

- Darigold: 2.93 million pounds at a total price of $921,061

- Hollandia Dairy: 2.93 million pounds at a total price of $1.5 million

- Upstate Niagara Co-op: 1.05 million pounds at a total price of $355,109

INTEREST RATES

What happened?

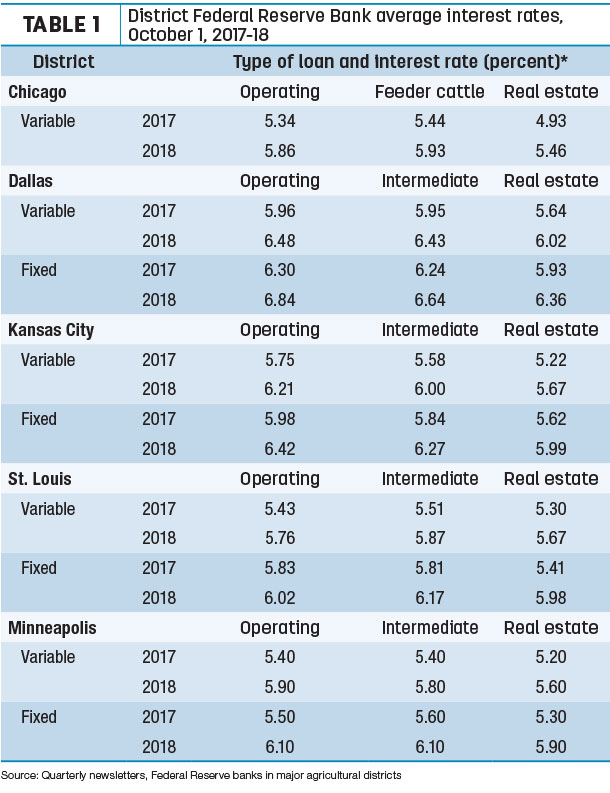

Farm loan interest rates continue to inch higher, in many cases reaching seven-year highs. Based on quarterly surveys of agricultural lenders in several Federal Reserve Bank districts, average interest rates charged are summarized in Table 1.

Meeting on Nov. 8, the Federal Reserve’s Open Market Committee (OMC) voted to leave federal fund interest rates unchanged.

Meeting on Nov. 8, the Federal Reserve’s Open Market Committee (OMC) voted to leave federal fund interest rates unchanged.

What’s next?

The rise in interest expenses has been modest so far, but increasing interest expenses affects farm profitability, especially when combined with rising costs in other areas. Some bankers said the continued upward pressure on financing costs could impact land values.

The Federal Reserve’s OMC is scheduled to meet again Dec. 18-19. In a Professional Dairy Producers of Wisconsin webinar Nov. 21, economist Dan Basse, president of AgResource Company, said he anticipates an interest rate hike coming out of that meeting and another one or two rate increases in 2019. One impact will be further strengthening in the U.S. dollar, which could challenge U.S. ag exports in the first quarter of the year.

Coming up in early 2019, Progressive Dairyman will take a look at how to stress test your operation to examine the impact of rising interest rates.

TAXES ON THE SALE OF ‘BASE’

What happened?

Some cooperatives have implemented “base” programs in an effort to match milk supply with processing and marketing capacity. While not intended to have monetary value, “base” has nonetheless now been bought and sold in a couple of forms:

- Selling base on a per-pound or per-hundredweight basis in a cash transaction

- Selling cows at a higher price, with the base attached to the cow’s milk production

Progressive Dairyman received an email question from a farm tax preparer, wondering how income from the sale of base should be handled for tax purposes.

What’s next?

A milk production “base” is essentially a paper asset, with the value determined between the seller and the buyer. In known cases, the co-op does not set the value of the base. (However, in the situation above, the co-op required a notarized copy of the agreement between the two farmers and switched the base to the new owner.)

“Admittedly, we had not had clients that have been in this situation before, and it was something new to think about for us as well,” said Bryanna Fredericks, a tax manager with Herbein + Company Inc., Reading, Pennsylvania. Herbein + Company specializes in accounting and financial services in the dairy industry, and is a member of Allinial Global, an association of accounting and consulting firms.

After discussing the situation, doing a bit of research and collaborating with a couple of colleagues in the company’s cooperative tax network, Fredericks came to the following conclusion:

“We believe the sale of this intangible asset used in the cooperative member farmer’s business would qualify 100 percent for capital gain treatment. Since the intangible asset is not purchased from the cooperative but, rather, is just an allocation assigned by the cooperative to all its members using average production history, there is no assigned cost basis, and the asset should not qualify for amortization. Therefore, upon sale of the intangible asset, there is no required recapture of ordinary expenses related to any potential amortization, which would be ordinary gain treatment, and instead the farmer should recognize a capital gain for the full amount of the selling price.” ![]()

Editor’s note: Fredricks’ comments regarding “base” programs and taxation are for informational purposes only and an effort to start a discussion on a “new frontier” in taxes related to dairy farming. The comments are not intended for individual tax or legal advice. Consult your own tax preparer or legal advisers for additional advice.