Carpe diem – “seize the day” – is a quote we often hear, but typically not in relation to succession planning. Ordinarily, successful farm succession planning is a process rather than an event. However, in December of 2010, President Obama signed the Tax Relief, Unemployment and Job Creation Act of 2010 (the “Tax Relief Act”), which creates major motivation for families to resolve their issues and accelerate the process to move forward with transferring farm assets through succession planning.

A little background

In the past, a major obstacle to succession planning for dairy farmers has been the sharp increase in the value of land and other farm assets. Transferring these assets, whether during life or at death, often resulted in large estate or gift taxes. Now, with the passage of the Tax Relief Act, a short window of opportunity has been opened to allow transfers of assets without the assessment of transfer taxes.

This window is open until January 1, 2013, and is set to close at that time unless there is intervening tax legislation. As a result, it is incumbent on families considering succession planning issues to seize the opportunity and move forward with the plan.

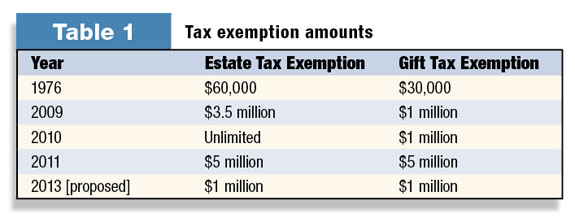

To understand the significance of the change, a little history is necessary. As you can see in Table 1 , the amount of wealth a person could pass tax-free at death (“estate tax exemption”) and the amount of tax a person could gift tax-free during life (“gift tax exemption”) have increased dramatically over time.

The new Act creates an extraordinary opportunity now to move large amounts of assets to succeeding generations in the event the exemptions return to their previous levels in 2013.

It is usually best to use an exemption as soon as it is available to reduce or eliminate estate taxes. When assets are transferred during lifetime, the current value of the asset is removed from your estate as well as all future appreciation of that asset. (As a trade-off for the lifetime gift, the value of assets transferred during lifetime reduces the amount that can pass tax-free at death.

For example, if there is a $5 million estate tax exemption and you gave away $1 million of assets during your lifetime, the amount that can pass tax-free upon your death is reduced to $4 million.)

Looking ahead

In order to take advantage of this opportunity, gifts of assets must be made prior to January 1, 2013. There are some important issues to address in gifting assets:

• It is often difficult to make large gifts because the assets provide needed income to the family. However, these issues can be addressed with other planning opportunities to ensure income needs are met.

• It is difficult to gift portions of land, buildings, equipment and animals. To make gifting easier and to provide a framework for the ownership and management of assets following a gift, the assets are often initially transferred to one or more limited liability companies (LLCs). Since the LLC owns the assets, the gift is actually a portion of the LLC rather than actual assets.

The LLC is governed by a document referred to as an Operating Agreement, which lays out the rules for use and management of the LLC assets. These rules can allow for the involvement of family members not actively involved in the farm or provide a way in which they can exit the farm.

There are two other advantages to utilizing an LLC for the succession plan and transfer of assets:

1. Ownership of the LLC can be divided into voting ownership and non-voting ownership. If the senior generation is not ready to cede control to the succeeding generation, for example, the senior generation may retain the majority of the voting ownership while gifting the non-voting ownership to the succeeding generation. The voting interest controls the management while the bulk of the value could be assigned to the non-voting ownership.

2. The value of the ownership of the LLC can be significantly discounted because the ownership is non-controlling and is not easily sold. Applying these discounts allows for a larger amount of assets to be transferred.

In addition to the use of LLCs, certain trusts can be used to further leverage and protect the gifts made to the succeeding generation. A grantor retained annuity trust (GRAT) or a grantor retained income trust (GRIT) – where the gift goes to a trust – can create large discounts in value.

If there is concern regarding the maturity of a member of a succeeding generation, for example, the gift can be made to a trust to protect the gift from creditors, including a divorcing spouse.

Conclusion

The full Latin phrase for carpe diem is “carpe diem quam minimum credula postero,” which translates to “Seize the day, and put no trust in tomorrow.” This could not be truer for succession planning.

The Tax Reform Act of 2010 has created a major opportunity for the transfer of significant assets without the application of a transfer tax. The estate and gift tax exemptions are at historically high levels until January 1, 2013. My advice? Seize the day! Meet with your advisers to conquer any obstacles and get your succession planning done. PD

Dan Rupar

Attorney

Ruder Ware