The hurdle of hedging Growing up on dairy farms in both California and Illinois, I saw firsthand the many decisions dairy producers make at every level of their operation to gain strategic advantages.

I believe dairy producers are some of the most adaptive and resourceful people in the economy due to the nature of the work they do. The majority of revenues and costs associated with dairy farming are variable, which makes maintaining a consistent profit margin a difficult task.

Many producers understand the benefits of utilizing the futures markets to mitigate their financial risk, but there still seems to be a hurdle that causes many to shy away. In order to participate in utilizing futures or options to manage their margins, dairy producers must be able to appropriately fund a margin account that guarantees their positions. For many, this capital must be drawn out of pocket or come from an operating line of credit.

In an ideal world, banks would offer a separate hedge line of credit to qualifying dairy producers so they may participate in the futures market. This would allow producers to mitigate risk and, in turn, would reduce the default risk for the existing operating lines extended by the banks. From a broad perspective, this seems like a no-brainer for the banks, but there are several factors in the equation that remain unsettling for regulators at lending institutions.

Realizing the unrealized

The assets each dairy producer has on his or her balance sheet can be valued with a reasonable degree of accuracy. Banks use this valuation, as well as several other financial metrics, to consider a dairy’s operating line of credit securable by banking regulators. Futures positions that hedge or protect future cash positions are much more difficult to value for banking regulators.

Since margin accounts are settled daily at the exchange, unrealized (market-to-market) profits/losses are incurred prior to when the related cash position is taken. Quantifying the fluctuations in that margin account is difficult for banking regulators, but there is one way to use historical data to forecast how much producers may need to meet margin requirements.

Using implied volatilityto value margin risk

When analyzing the volatility of futures contracts, analysts often discuss the topic of “implied volatility.” Implied volatility is essentially a forecast of the volatility remaining in a specific security prior to expiration. Because of how dairy futures contracts settle, the implied volatility generally decreases as contracts approach expiration.

Using historical data, we can take a look at the average volatility in futures contracts to forecast how much fluctuation may be remaining in a contract from the time the position is initiated. This means we can use implied volatility to estimate how much capital may be required to hold a position until the cash position is taken.

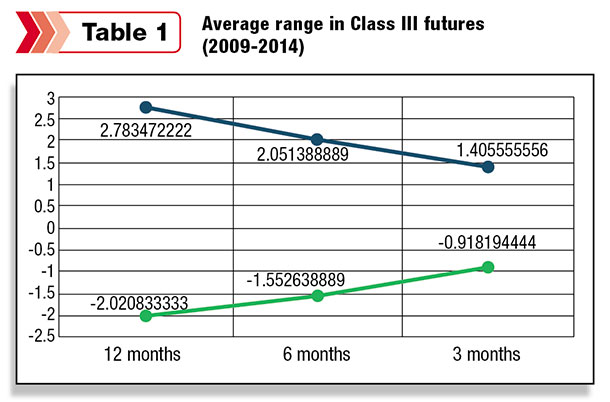

There is a great deal of data available for lending institutions to use as a reference when analyzing how much capital a margin account may need to hold onto a position. For a simplified example, I put together a chart (Table 1) to show the average trading range Class III futures have had in the last 12 months, six months and three months of trading before expiration. As you can see, the trading range gets smaller as expiration approaches.

This means hedges initiated further from expiration are susceptible to larger movements in the market. This means they could potentially be the most beneficial for producers, but they may also require a great deal of capital to meet margin calls if the market moves against the position before the cash position is taken after expiration.

The nuts and bolts

- Let’s say there is a dairy farmer who produces 3 million pounds of milk per month, and about 80 percent of their milk is utilized for Class III.

- This means the producer could hedge up to 12 Class III milk contracts per month.

3,000,000 x 80 percent = 2,400,000

2,400,000 / 200,000 = 12

- In July 2015, the producer decided they would like to hedge 50 percent of their production (1.5 million pounds) for June 2016.

- They sell six June 2016 Class III milk future contracts at $17 per hundredweight.

- Initial margin for June 2016 Class III futures for hedgers is $1,500 per contract.

- In order to initiate the position, the producer must have $9,000 in the margin account.

$1,500 x 6 = $9,000

- If the contract settled higher, and the balance of the margin account falls below $9,000, funds must be deposited to meet the margin call.

- Every $0.01 per hundredweight movement in Class III futures = $20 change per contract

- The maximum profit/loss that can be incurred in one day if the futures contract were to move up the limit (+$0.75 per hundredweight) would be $1,500 per contract.

- Because the position was initiated 12 months prior to expiration, the producer should anticipate larger movements in the price of the contract before expiration.

- If the hedge is accurately placed, the June 2016 milk check the producer receives should either be enhanced by some additional income in the margin account or have the capital to cover the loss incurred in the margin account.

The win/win scenario

Price swings in the futures markets are impossible to calculate with the amount of accuracy the lending institutions are normally comfortable with.

However, the accuracy of cash flows on a dairy operation can be more accurately forecasted if producers are able to fully utilize the markets to mitigate their price risk. This should encourage banks to develop robust risk management programs, not only for their customers but also for their own security. PD

Disclaimer: HighGround Dairy is a division of HighGround Trading LLC, an introducing broker registered under U.S. laws. The risk of loss in trading futures and options can be substantial. Past performance is not indicative of future results.

-

Curtis Bosma

- Account Manager

- HighGround Dairy

- (312) 604-3080

- Email Curtis Bosma