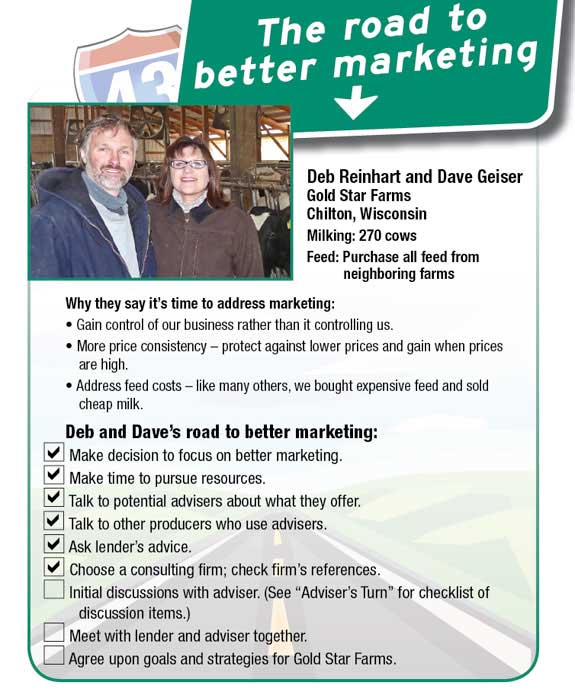

Deb Reinhart and Dave Geiser of Gold Star Farms have been business partners and respected dairy managers for 34 years of their married life together.

“Nothing fancy, but profitable,” they say.

Until they arrived at an unexpected place in 2009. Throughout the challenging year, they found themselves feeding expensive feed and selling cheap milk. And they watched 25 to 30 percent of their equity erode.

“We didn’t expect to be in this situation,” Deb says. “It feels as though our business has been running us instead of the other way around.”

Deb and Dave know what it’s like to feel out of control. In 2000, a tornado took down a freestall barn only a few short years after they had expanded their herd. They managed through the mess and rebuilt, adding a new milking parlor in 2004.

They can accept acts of God. But Deb says “it has been terrible being at the mercy of the market.” If there’s a way to bring some price consistency to the business, Deb and Dave want to find it.

Marketing is a whole new management frontier for these seasoned operators. Dave is the cow man, and Deb handles the business management, human resources and care for youngstock. For the last 10 years, their model of buying all feed from neighboring suppliers allowed them to focus on fine-tuning cows and people management.

It was an excellent business model until 2009, Deb says. The market swings were so significant that Deb, as financial manager, decided now was the time to get serious about milk and feed pricing.

“When I started seeing signs that the milk price might go up, I thought we should be ready.” She admits, “When prices were high, I didn’t see the point in marketing. And when they were low, I didn’t see the point. After 2009, I now see the point. We don’t want to go there again.”

A little marketing experience

Like many producers, Deb and Dave tried some forward contracting milk in the past. “We didn’t have confidence in what we were doing,” Deb recalls. “Many of our fellow producers locked in low prices and were frustrated. We thought it better to do nothing than to do it wrong.”

This fall, she started seeking out marketing resources and attending educational sessions. She talked with other producers through the Professional Dairy Producers of Wisconsin, of which Dave and Deb are long-time, active members.

They also talked with their lender, Steve Schwoerer of Badgerland Financial, who was in favor of a more structured approach to marketing.

“We’re very supportive of any producer who wants to work toward locking in a margin or at least protecting themselves against lower prices,” Schwoerer says. “Especially this past year, the more equity eroded, the higher the operating risk, and the more important it is to lock in prices to protect yourself going forward.”

Locking in a margin sounds good, but Deb wants more than that from her business. She was particularly concerned when she began hearing stories about lenders who encouraged producers to lock in prices in 2009 to stave off any more red ink.

“I understand that lenders want producers to do something – anything. But I want to know what’s best for our business. I know that I want a plan in place to lock in a floor, but I don’t want to lock ourselves out of the upside.”

Still, Schwoerer advises clients to address both the milk and the input side of the business when marketing. Gold Star Farms has priced feed from neighbors based on four different CBOT closing prices for four months out of the year – typically March, May, July and September. The grower and Dave take turns selecting the months. They also locked in soybeans and cottonseed through a local feed mill, but have let those contracts expire, awaiting better prices.

“You can’t protect a margin without locking in your costs,” Schwoerer says. “Feed and interest rates are key inputs that should be examined as part of a big picture.”

Doing due diligence

Deb and Dave ultimately decided to hear a proposal from Stewart-Peterson, a consulting firm that offers a fee-based service for pricing both feed and milk. They reviewed the services offered and checked references, something Deb says she does for every service provider for Gold Star Farms.

They signed on with the firm in November, proceeding more on faith and good references than anything.

“We’re not in a good cash position, so right now the fee is just a big number,” Deb observes. “I’m not completely sure what those dollars will bring back to my business, but I know we need to do something.”

In the early stages of the relationship, Deb and Dave are talking with their adviser several times a week, asking questions and discussing goals. Early on, they intend to meet face-to-face with their adviser and their lender at the same table, discussing the farm’s approach to marketing in 2010.

Schwoerer says a hedge line of credit will be on the agenda for that meeting. Keeping the line of credit separate from the day-to-day checkbook aids marketing decision-making, he says.

Much decision-making awaits Deb and Dave in the months ahead.

“We have to learn and get up to speed quickly,” Deb says. “The rest of our workload hasn’t changed, and we’re adding on a whole new management function here.”

Adviser’s turn

All good business relationships are based on trust. Where markets and financial matters are concerned, trust and communication from the get-go are vitally important.

“In my experience, if we set up the working relationship correctly from the beginning, we have more open and honest communication, and that brings a better chance of success.”

Here are the key areas of the working relationship that the trio discussed on their very first conference call:

1. Communication preferences. It’s important for the client to know that this relationship is more than applying a blanket set of recommendations and without respect to their individual needs. Two-way communication is important. I explain the communication structure we use, which includes:

• Daily and weekly e-mails

• Broadcast alerts when there is a strategy change

• Scheduled phone calls to ensure regular communication

2. Operation profile. We ask questions on both the milk and the feed side, such as:

• Current and expected milk production

• Whether their milk plant offers forward contracting and at what price

• How much of their production they have contracted in the past

• Feed usage numbers, typical purchases, and what current contracts are in place

• Expectations for where the adviser can and can’t help with feed recommendations. Certain products, such as distillers grains, glutens and hay, may have local supply and demand issues that overrule what the markets are doing.

• Business goals, such as break-evens, return on equity goals (especially when multiple business partners are involved), expansion plans, lender or credit concerns and other business issues that could help customize recommendations to their operation’s needs. While these aspects of the business are not necessarily tied to marketing, they play into how and why a client makes decisions.

3. Level of market knowledge.

• We ask questions about the client’s experiences, successes, failures, risk tolerance and comfort level with various positions.

• We go over common terms so we can be sure they understand the language we will be using.

• We talk about their comfort level with setting up a hedge line of credit. We explain the advantages of having one, which include: a) more flexibility for using marketing tools beyond forward contracts, such as futures and options and b) better decision-making because marketing decisions can be made independent of current cash flow. Our clients who use a hedge account tend to net a better price for their milk; however, it is often difficult for a producer to wrap their arms around while getting started. Deb had those same initial concerns.

Willing to learn

Deb and Dave gracefully shrug off any accolades they’ve received for their dairy skills and industry leadership through the years. The two are always willing to help dairy producers learn, which is why they agreed to be profiled in this series.

“No producer wants to look like they do not know something,” Deb says. “Yet there are others in this same boat, and we owe it to each other to teach and learn.” PD

Follow Dave and Deb’s next risk management steps in the March 22 issue of Progressive Dairyman .