“It’s better with butter” might be a marketing theme, but it’s also true when it comes to dairy farmer milk checks. Without the strong U.S. butter prices during a recent period of weak world prices, domestic milk prices would have averaged more than $1 per hundredweight lower than they did during the entire 12-month period of August 2015-July 2016.

That would have cost U.S. dairy farmers about $2.2 billion in lost income during that time, according to Peter Vitaliano, vice president of economic policy and market research with the National Milk Producers Federation (NMPF).

Highlighting a new NMPF report commissioned by Dairy Management Inc. (DMI), Vitaliano said the good news related to butter and milkfat may be just getting started for U.S. dairy farmers.

Butter demand is growing, leading some officials to suggest there’s a global shortage. Not only is butter use on a significant uptick, it’s also taking a larger share of total available milkfat, Vitaliano said. Butter’s share of U.S. milkfat use was running about 16 percent in 2000 but has increased to 18 to 19 percent in recent years and is trending higher.

“That’s despite the fact both U.S. milk and milkfat production has been increasing,” Vitaliano said. “Butter consumption is increasing faster than milkfat production.”

Beyond butter

The milkfat story goes beyond butter, said Vitaliano, citing the trend toward increased sales of fluid whole milk. Even though total fluid milk consumption has been on the decline, whole milk, standardized at 3.25 percent milkfat, is increasing in its market share of the fluid category.

Fluid milk sales now consume nearly 2.75 million pounds of milkfat per day, up from about 2.65 million pounds in 2015.

“Fluid milk used to contribute more milkfat back into the system by throwing off cream, but today it is increasing its use of milkfat and tightening the supply-demand balance for fat overall,” Vitaliano said.

Vitaliano said trends away from reduced-fat cheeses, ice cream and yogurt are also increasing the use of milkfat.

Changing butter dynamics

The new demand for milkfat has changed milk and dairy price dynamics on a number of fronts, Vitaliano said.

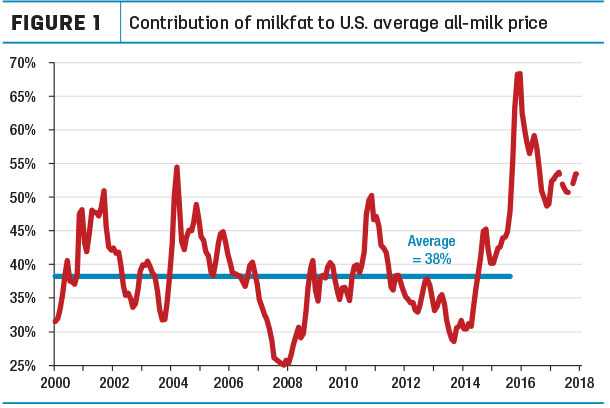

First, the value of milkfat as a share of a farmer’s milk check has grown. Although volatile, milkfat’s contribution to a dairy farmer’s total milk check averaged about 38 percent between 2000 and 2016, occasionally dipping to 25 percent and rarely moving above 50 percent.

As milkfat demand has grown, its share rose to about two-thirds of the total milk check in early 2016. While declining somewhat since then, Vitaliano projects milkfat’s share of the milk check to remain “north of 50 percent” for the foreseeable future.

In July, strong butter and milkfat demand prompted the USDA to raise its 2017-2018 Class IV milk price projections by 35 to 45 cents per hundredweight from earlier forecasts.

A second changing dynamic is the apparent disconnect between U.S. butter inventories and wholesale prices.

As U.S. milk production has grown, so has cheese and butter production and cold storage inventories. Butter inventory levels are highly seasonal, historically building in the first half of the year and peaking in May-August before beginning to draw down and reaching annual lows during the year-end holidays.

While cheese inventories may be holding down prices, the story is different for butter. As of mid-July, Vitaliano estimated existing inventories were “about 10 days” overstocked of current needs, but prices had resisted downward movement.

“Ten years ago, the markets would have reflected that very strongly,” Vitaliano said. “It looks like we have a change in the traditional inventory/milk price relationship, based on strong consumer demand. If the market thinks things are tight, we’re going to see prices react accordingly.”

“It can’t go on forever, but the holiday season and enhanced milkfat and butter demand will be upon us sooner than you think,” he continued. “People aren’t too uncomfortable with these levels of inventories because we’re going to need them at the end of the year.”

Except in periods of extreme surplus, Vitaliano doesn’t foresee butter prices falling far. “There’s a huge pent-up demand that will come out in any time butter prices get close to $2 per pound. This has long-term benefits for dairy farmers,” he said.

A third changing price dynamic is the U.S./world price relationship. Historically, milkfat has been a product in surplus, both domestically and on the world market. As a result, U.S. butter prices have been higher than subsidized world prices.

However, with high global demand for butter, U.S. butter prices have been somewhat lower than Oceania prices through early 2017.

It usually takes several months of persistent gaps between U.S. domestic prices and foreign export prices to impact exports. But with higher domestic demand for milkfat, less U.S. production will be available for export markets, even though U.S. prices are competitive.

“Our exports are down,” he said. “We need that extra milkfat to meet demand in our own market.”

Trends to continue?

Through May (latest estimates available at Progressive Dairyman’s deadline), 2017 U.S. butter production was running about 1.2 percent less than the same period in 2016 and heading into the seasonal-low production period.

California is home to 14 of the 86 butter production facilities in the U.S. and produces about 30 percent of total U.S. butter annually. California actually produces a much larger proportion of butter than cheese relative to the national picture.

Summer heat, causing lower milk production and cow death losses, was especially acute there, according to American Farm Bureau Federation (AFBF) economist Katelyn McCullock. The summer downturn was on top of a 7.5 percent decline in California butter production through the first five months of 2017.

Rabobank Dairy’s Kevin Bellamy forecasts global milk and milkfat production will continue to grow but won’t be enough to keep pace with butter demand. Milkfat production levels are seasonally depressed in the European Union.

Dairy checkoff’s role

Tom Gallagher, chief executive officer of Dairy Management Inc. (DMI), staked a claim for dairy checkoff research and promotion efforts for helping move the needle on milkfat consumption. He said DMI’s business plan had come together in three primary areas:

1. Two decades of checkoff-funded nutrition research bore fruit

“We’ve long believed milkfat had benefits to consumers and the general population that were not reflected in government policy and health professional guidance. We were adamant of what we believed the ‘right’ story was,” Gallagher said. A turning point was when butter was featured on the cover of TIME magazine, validating dairy nutrition research that is now being recognized by government and public health officials.

2. Relationships of state, regional and national checkoff organizations with influential health professionals, such as the American Academy of Pediatrics, American Dietetic and Nutrition Association and other groups

“It’s important those organizations respect the credibility of the National Dairy Council and the science we produce,” Gallagher said. “Without that respect, this story would have been met with much more skepticism because it flies in the face of what the health community traditionally had thought.”

3. Work with industry partners, such as McDonalds

Gallagher said the uptick in milkfat consumption can be traced to a DMI partnership with McDonalds, which convinced and trained the restaurant chain to convert from margarine to butter.

“That triggered a catalytic effect that convinced others within the industry to follow suit,” Gallagher said.

Vitaliano added his support for long-term human nutrition research related to milkfat and believes the payoff to dairy farmers will continue. While efforts to move government policy on milkfat, including school milk program guidelines, will be slow, the good news is: Consumers are rapidly making the switch with their purchases.

“This (milkfat) story has been moving fast in recent months, and it’s a big story,” said Vitaliano. “It’s spreading globally, and it’s affecting the dietary fat story beyond dairy.” ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke