If you’ve been away from “home” for a while, a return trip for a graduation party or summer vacation may reveal your neighborhood has changed. The same can be said for the U.S. dairy landscape, where Incremental changes aren’t always noticeable, but snapshots in time might paint a different picture.

USDA’s latest milk production report indicated April 2017 U.S. milk output was up 2 percent compared to April 2016. Nationally, monthly milk production increases compared to a year earlier have been bouncing along at 2 percent or more since August 2016, a period of nine months (February 2017 adjusted for Leap Day).

A deeper dig into those numbers, however, revealed April 2017 milk production increases of 7 percent or more compared to the same month a year earlier in four neighboring states: Colorado, Kansas, New Mexico and Texas.

Among rankings of USDA’s 23 “major” dairy states, Texas (7), New Mexico (9), Colorado (15) and Kansas (16) are in the middle of the pack. As such, percentages relative to actual numbers must be considered. However, growth in those four states is moving the needle on national production and drawing boundaries on an emerging growth neighborhood on the U.S. dairy map. Combined, the geographic neighbors have nearly as many cows and produce almost as much milk as Wisconsin each month.

Cow numbers continue to build

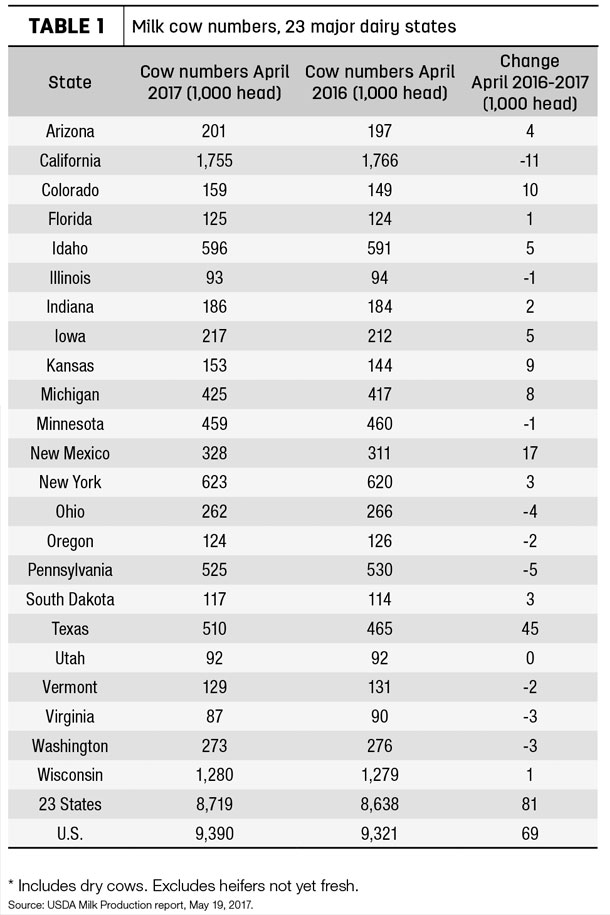

Based on preliminary April 2017 USDA estimates, U.S. dairy cow numbers were up 69,000 head since April 2016. Combined, Texas, New Mexico, Colorado and Kansas surpassed that number, up 81,000 during the same period. The change from 2016 comes with a caveat: A large share of the one-year increases in Texas and New Mexico cow numbers and milk production can be attributed to recovery from Winter Storm Goliath’s devastation early last year.

However, cow numbers in those states have fueled growth in the U.S. herd since 2012. Texas, New Mexico, Colorado and Kansas cow numbers are up 117,000 from April 2012, equal to the growth for the entire U.S. herd.

The numbers are similar for overall milk production. Based on preliminary 2017 USDA estimates, U.S. milk production was up 358 million pounds (2 percent) since April 2016. In Texas, New Mexico, Colorado and Kansas, milk production was up 202 million pounds (9.3 percent).

Longer term, while April 2017 U.S. milk production is up about 6 percent from April 2012, the combined production in Texas, New Mexico, Colorado and Kansas is up 25 percent during the same period. The four states produced about 11 percent of U.S. total milk in April 2012; it’s now nearly 13 percent.

Big kid on the block

The big kid in this block is Texas, fully recovered from Winter Storm Goliath. In March and April 2017, it topped 500,000 cows and 1 billion pounds of milk production per month for the first time ever.

In his organization’s latest newsletter, Joe Osterkamp, board chairman of the Texas Association of Dairymen (TAD) and owner/operator of Stonegate Farms near Muleshoe, Texas, said the growth is being fueled by low interest rates and new milk processing capacity in the region, while milk prices continue bouncing around around break-even.

Osterkamp said he isn’t aware of new dairies under construction. Instead, smaller-scale growth is underway – adding pens and expanding milking parlors – to maximize the capacity of existing facilities.

Lone Star Milk has started processing milk in a new plant near Canyon. Select Milk is in the construction phase of a new Littlefield milk powder/butter plant with capacity to process 4 million pounds of milk per day, due to open in late 2018. In addition to these new plants, Hilmar Cheese Co. has completed an expansion at its Dalhart facility, and Southwest Cheese is expanding capacity in Clovis, New Mexico.

USDA: April recap

Reviewing numbers from USDA’s latest milk production report (April 2017 compared to April 2016):

-

U.S. milk production: 18.31 billion pounds, up 2 percent

-

U.S. cow numbers: 9.39 million, up 69,000 head

-

U.S. average milk per cow per month: 1,949 pounds, up 24 pounds

-

23-state milk production: 17.15 billion pounds, up 2 percent

-

23-state cow numbers: 8.72 million, up 81,000 head

- 23-state average milk per cow per month: 1,967 pounds, up 20 pounds

Texas, New Mexico and Colorado accounted for a vast majority of dairy herd growth compared to a year earlier (Table 1). Kansas (up 9,000) and Michigan (up 8,000) also posted substantial increases. California cow numbers were down 11,000 from a year earlier.

Regional production trends continued; California milk production was down, while milk output per cow was lower in Idaho. Milk production remained strong in the Northeast and Upper Midwest.

Price outlook

April may have been the bottom for milk prices, according to Bob Cropp, dairy economics professor emeritus at University of Wisconsin – Madison.

Cropp estimated the May Class III price, to be announced June 1, should be near $15.60 per hundredweight (cwt), up slightly from April. Chicago Mercantile Exchange (CME) Class III futures inch back into the $16s per cwt in June and the low $17s per cwt in August-November.

In their monthly podcast, both Cropp and Mark Stephenson, director of dairy policy analysis at the University of Wisconsin – Madison, are more optimistic, citing continued good domestic sales and improved dairy exports. A Class III price in the high $17s or even $18 per cwt by October is possible, they said. As a result, 2017 milk prices could average $1.30 to $2 per cwt more than 2016.

Summer weather and its impact on milk production will be a factor as to where milk prices end up, Cropp said. Domestic sales appear to be favorable for butter and cheese. Dairy exports are expected to continue above year-ago levels. Milk production among major dairy exporters has been below year-ago levels in the European Union (EU), New Zealand, Australia and Argentina, but that’s expected to reverse course in the second half of the year in the EU and New Zealand. ![]()

PHOTO: Image by Thinkstock.

Read also: After a weak start, some good news arrives

Dairy Economic Update: Less milk forecast

Independent producers face marketing decisions in Mideast FMMO

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke