USDA’s September World Ag Supply & Demand Estimates (WASDE) and Crop Production reports indicate a slight backslide from improving dairy price and cost trends.

Milk production estimate raised

The WASDE raised both 2016 and 2017 U.S. milk production forecasts, translating into slight weakening in the outlook for milk prices. Anticipated milk production in 2016 was raised about 100 million pounds from last month’s forecast to 212.2 billion pounds. If realized, production would be up about 1.7 percent from 2015. The revised milk production forecast was based on steadying cow numbers in light of improved margins.

Looking ahead to 2017, milk production was raised about 300 million pounds from the previous month’s forecast, to 216.1 billion pounds. If realized, production would be up about 1.8 percent from 2016’s estimate. The production forecast was raised due to a more rapid growth in milk per cow.

On a skim-solids basis, the export forecasts for 2016 and 2017 were raised on higher whole milk powder and whey sales. Both fat and skim-solids basis ending stocks for 2016 are forecast higher as butter and cheese stocks remain high. Fat basis ending stocks were raised for 2017 as well.

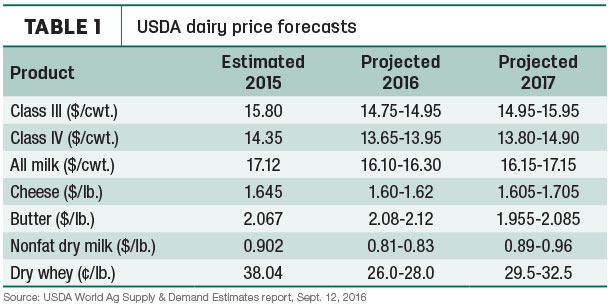

Projected cheese and butter prices were lowered for 2016 and 2017 as supplies remain high. However, prices for nonfat dry milk (NDM) and whey were forecast higher as the global supply tightens and demand strengthens (Table 1).

The 2016 projected Class III price was cut a nickel on both ends of the range, reflecting slightly lower cheese and whey prices. The Class IV price was lowered a dime on each end of the range, with higher NDM prices failing to offset lower butter prices.

For 2017, small declines in projected prices of cheese and butter somewhat offset higher projected NDM and whey prices. Compared to last month’s forecast, the projected Class III price was cut a nickle, while the Class IV price was expected to improve.

All milk prices were forecast at $16.10 to $16.30 per cwt for 2016 and $16.15 to $17.15 per cwt for 2017.

Beef outlook

Impacting cull cow prices, the WASDE report reduced the forecast for 2016 beef production due to lower third-quarter steer and heifer slaughter. However, due to large supplies, projected average 2016 fed cattle prices were reduced to $123 to $125 per cwt; 2017 prices were forecast in a range of $116 to $126 per cwt.

Feed situation outlook mixed, but fairly steady

On the feed side of the equation, both WASDE and Crop Production reports provided mixed news for dairy farmers buying feed.

The Crop Production report estimated 2016 U.S. corn production at 15.1 billion bushels, up 11 percent from last year, but down less than one percent from the August forecast. Area harvested for grain is forecast at 86.6 million acres, unchanged from the August forecast, but up 7 percent from 2015. Based on conditions as of Sept. 1, yields are expected to average 174.4 bushels per acre, down 0.7 bushel from the August forecast but up 6 bushels from 2015. If realized, this will be the highest U.S. yield and production on record for the United States.

U.S. corn supplies for 2016-17 were projected at nearly 16.9 billion bushels, down slightly from last month. As a result, corn ending stocks for 2016-17 were lowered, but would remain the highest since 1987-88.

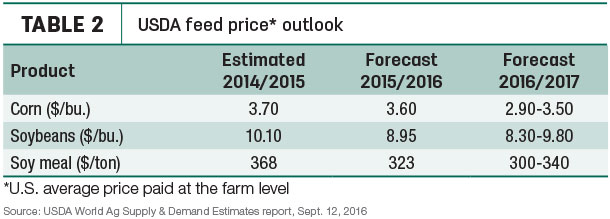

The projected range for the season-average corn price received by producers was raised a nickle on both ends to $2.90-$3.50 per bushel. This would be down 40 cents at the midpoint from the $3.60 per-bushel price expected for 2015-16 (Table 2).

Soybean production is forecast at a record 4.20 billion bushels, up 3 percent from August and up 7 percent from last year. Area for harvest in the United States is forecast at a record 83.0 million acres, unchanged from August but up 1 percent from 2015. Based on Sept. 1 conditions, yields are expected to average a record 50.6 bushels per acre, up 1.7 bushels from last month and up 2.6 bushels from last year.

With higher production, soybean supplies for 2016-17 were projected upward, with ending stocks also higher, pressuring prices somewhat.

The U.S. season-average soybean price for 2016-17 was forecast at $8.30 to $9.80 per bushel, down 5 cents on both ends of the range. Soybean meal prices are forecast at $300 to $340 per ton, down $5 on both ends of the range.

Cottonseed harvest up 27 percent

The cottonseed harvest keeps looking better. The 2016 harvest is expected to total 5.147 million tons, 27 percent more than 2015.

USDA’s September Crop Production report did not update hay harvest estimates.

Download the World Ag Supply & Demand Estimates report

Download the Crop Production report ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke