The Rabobank 2016 Global Dairy Top 20 list is out, reflecting a challenging year for the world’s dairy giants. The biggest story isn’t so much the names on the list, but the bottom line on overall dairy sales and its impact.

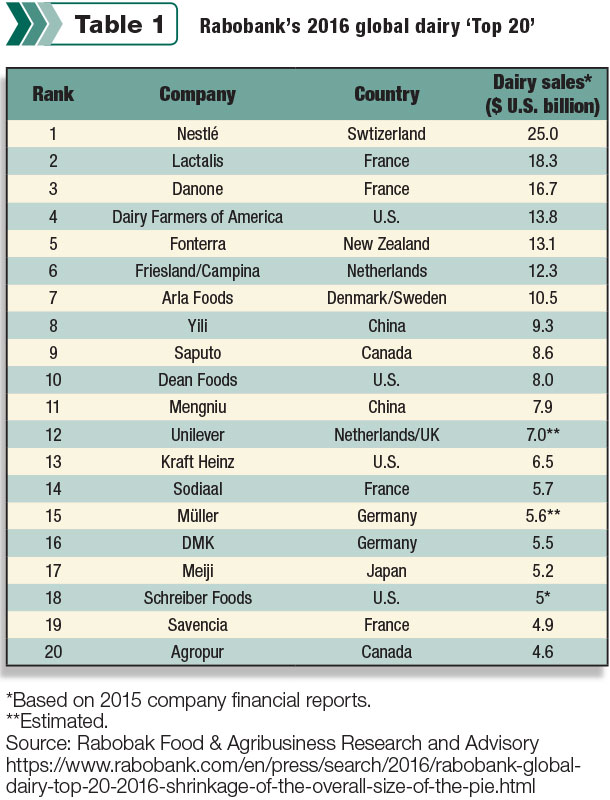

It proved to be a difficult year for most companies, with the strong U.S. dollar and currency volatility, together with low commodity prices, reducing sales values (Table 1). The top 20 posted combined dairy sales of $194 billion ($ U.S.) in 2015, down 13 percent from the year before, according to Rabobank’s global dairy strategist Kevin Bellamy.

“Low dairy commodity prices and currency movements have had a dramatic downward effect on company sales values,” Bellamy said.

With growth slowing in China, the world’s largest dairy companies started to look for new horizons, both within domestic markets and around the world. That included mergers and acquisitions of other companies.

Müller acquired Dairy Crest, leading to the largest climb up the top 20 list, from 20th in 2015 to 15th in 2016. Kraft and Heinz merged, pushing Kraft up three spots. Agropur acquired Davisco, displacing Land O’Lakes on the top 20.

Dairy Farmers of America jumped over Fonterra after taking full control of DairiConcepts, a company they formerly operated in partnership. With its heavy reliance on exports, Fonterra also suffered more than most from declining world commodity prices.

The 2016 ranking does not include pending mergers and acquisitions, including Nestle's joint venture with R&R Ice Cream, Danone’s acquisition of WhiteWave Foods, FrieslandCampina’s ownership stake in Engro Foods and Mengniu’s ownership stake in Burra Foods.

Dairy company business activity in Africa has also put that continent on the dairy map, according to Bellamy. PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke